The Philippine Social Security System (SSS) grants cash aid to its deceased members’ beneficiaries. This is done through monthly pensions or lump sums paid under the agency’s SSS Death Benefit program.

Want to claim the benefit of a recently deceased loved one who is a member of SSS? Check out the eligibility, requirements, and process for the claim below.

Table of contents

Eligibility and Beneficiaries

Primary beneficiary/ies:

- Dependent spouse until they remarry;

- Dependent legitimate, legitimated, or legally adopted and illegitimate children below 21 years old, not gainfully employed, not married.

Secondary beneficiary/ies:

- Dependent parents

Primary beneficiaries will receive a monthly death pension for the deceased member who made at least 36 monthly contributions before the semester of passing.

Meanwhile, if the deceased member had paid less than 36 monthly contributions before the semester of death, its primary beneficiaries would receive a lump sum.

Without the primary or secondary beneficiaries, a designated or legal heir will receive the benefit instead.

Note: Death benefit has no expiration. As long as the listed eligible beneficiaries are present, they may claim the benefit.

Amount of Benefit

The eligible primary beneficiary of the deceased member will receive a monthly death pension. Additionally, they will get a 13th-month pension every December.

If the member has dependent minor children, they are given a Dependent’s Pension equivalent to ten percent (10%) of the member’s monthly pension, or Php 250, whichever is higher. Moreover, only five (5) minor children, beginning from the youngest, may claim this benefit. Note: No substitution is allowed.

The minimum monthly Death Pension is Php 1,000 if the member had less than ten (10) Credit Years of Service (CYS); Php 1,200 if with at least ten CYS; and Php 2,400 if at least 20 CYS plus a Php 1,00 additional benefit effective January 2017.

Also Read: How to Register to My.SSS Online: Your Ultimate Guide 2021

Required Documents

See below for the documents required to claim the benefit.

SSS Application Forms

- Death Claim Application (part 1 & 2)

- Sinumpaang Salaysay

- Affidavit (SSS Form CLD – 1.3 A) for primary and secondary beneficiary claimants

- Affidavit (SSS Form CLD – 1.3) for designated and legal heir claimants

Supporting documents for Primary Beneficiaries:

- Death Certificate of Deceased Member

- Marriage Certificate of Deceased Member

- Birth/Baptismal Certificate of Dependent Children

- Single Savings Account (Passbook or ATM)

Supporting Documents for Secondary Beneficiaries:

- Death Certificate of Deceased Member

- Marriage Certificate of Parents of the Deceased Member

- Birth certificate of Deceased Member

- CENOMAR of Member

Supporting Documents for Designated Beneficiaries:

- Birth Certificate of the claimant (plus marriage certificate) if the payee is a married female (PSA copy or certified true copy issued by LCR)

- Birth certificate and CENOMAR of deceased member (if single)

- Death Certificate of member’s spouse (if the member is a widow/widower)

- Death Certificate of member’s parents (if single)

Supporting Documents for Legal Heirs Beneficiaries:

- Birth Certificate of the claimant (plus marriage certificate) if the payee is a married female (PSA copy or certified true copy issued by LCR)

- Birth certificate and CENOMAR of deceased member (if single)

- Death Certificate of member’s spouse (if the member is a widow/widower)

- Death Certificate of member’s parents (if single)

- Death Certificate of other deceased legal heirs (to equally divide benefits to living heirs only)

Also Read: Self-Employed? How to Pay SSS, Pag-IBIG, and PhilHealth Contributions

Death Claim Application Submission Guide

Unfortunately, the My.SSS portal does not yet allow you to claim the deceased member’s death benefit. You should apply in person at any SSS branch or representative office near you.

However, you may set an appointment for a visit via the online portal.

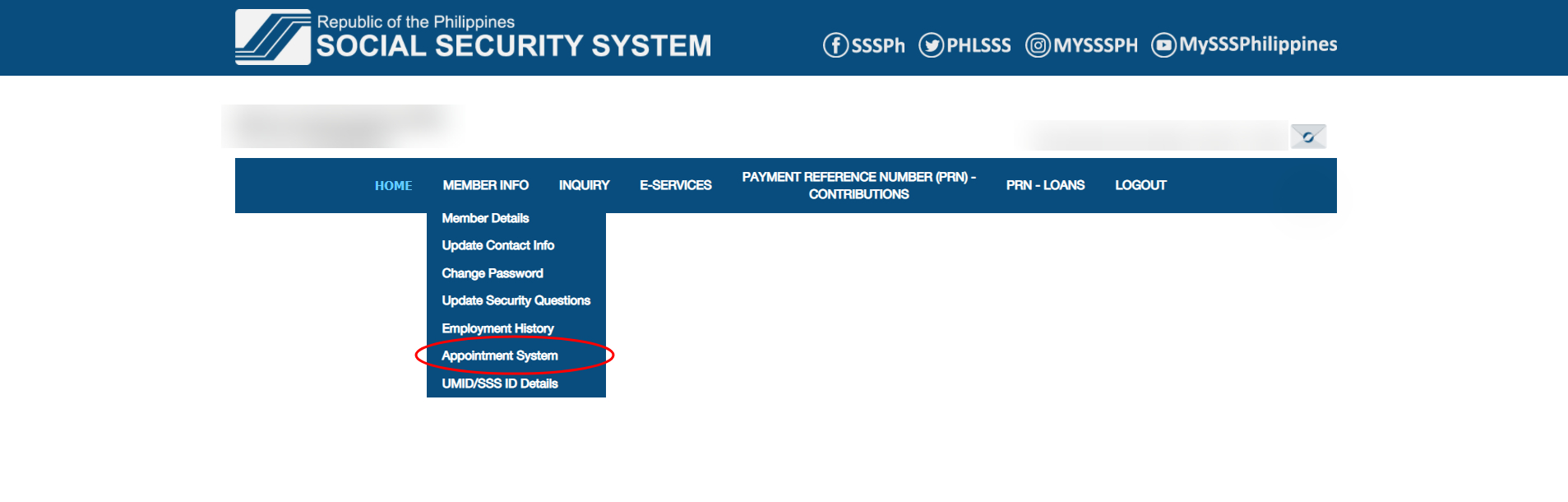

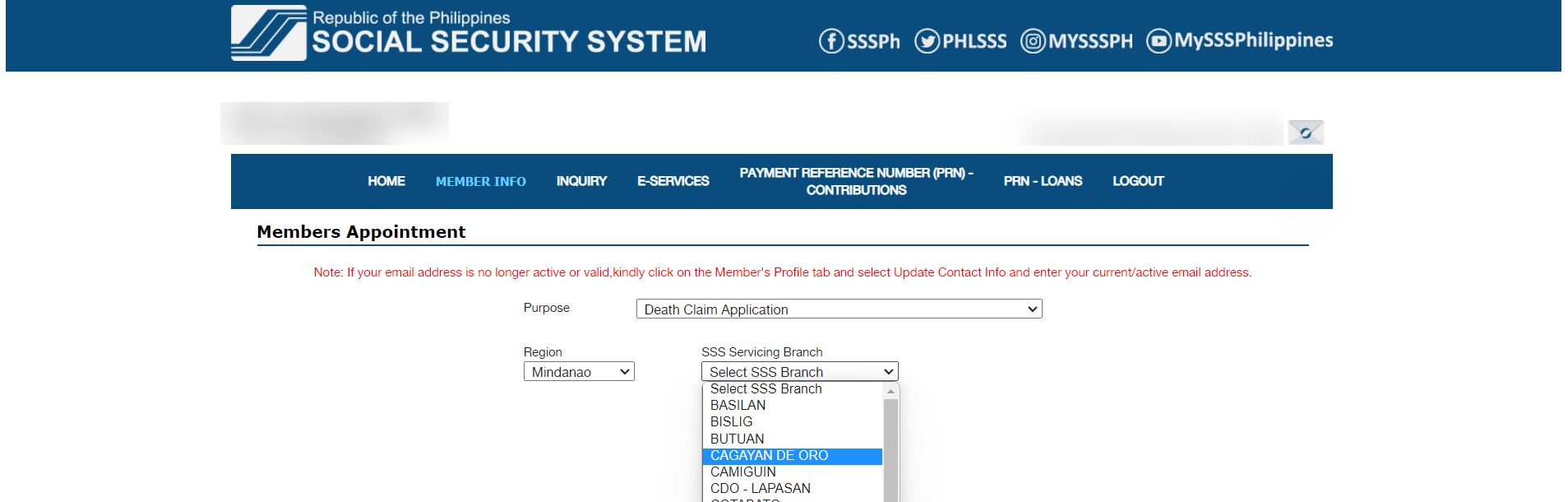

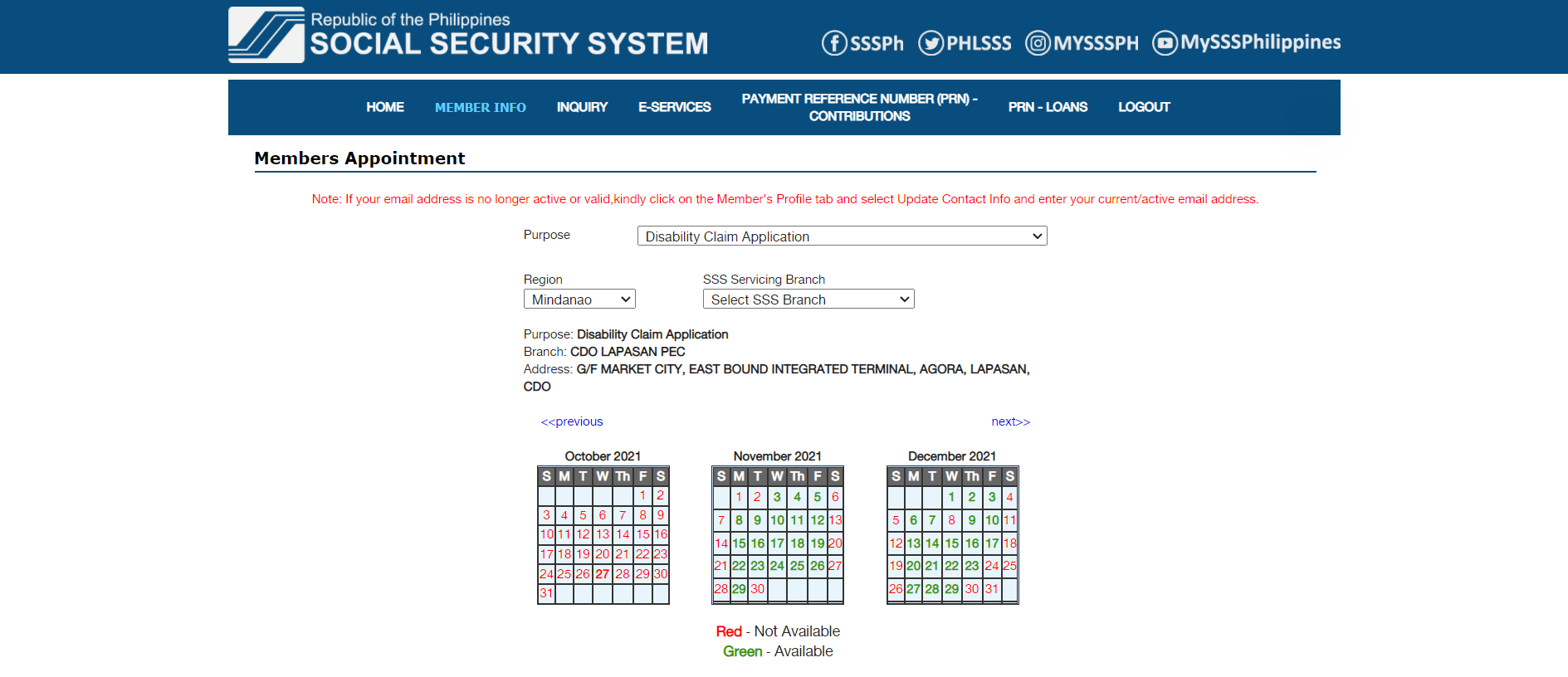

To do this, log in to your My.SSS portal (or through the account of the deceased if credentials are available). Hover over the main menu Member Info > select Appointment System > choose Death Claim Application and the location of the nearby SSS branch.

Once done booking, make sure to take note of the date, time, and schedule ticket, and show this when visiting the branch to avoid inconvenience.

According to SSS terms and conditions, Death Benefits, along with the SPF Retirement and Total Disability, should be credited to the bank account of the eligible member’s beneficiary within three (3) working days from approval of said benefit claim.

Final Thoughts

While death is an unfortunate incident, the government has processes in place to make these a bit easier for bereaved ones. These processes include the SSS death claim benefits. For further assistance and inquiries, contact the SSS Hotline: 1455 / Toll-Free No.: 1-800-10-2255777 / email at member_relations@sss.gov.ph – WhatALife.ph

Keep Reading: How to apply for SSS Salary Loan Online 2021

Leave a Reply