Estimated reading time: 5 minutes

The Bureau of Internal Revenue (BIR) in the Philippines recently launched the digital TIN ID in the previous quarter. A memorandum circular dated November 29, 2023, stating that there is no longer a need to get in line in revenue district offices (RDO) since there is now a BIR digitized TIN ID. This article will guide you on how to get one if you are an existing holder.

Table of contents

The New BIR Digital TIN ID

In its implementation, the Bureau of Internal Revenue stated that the digital ID can be used as a valid government-issued ID for any transaction. ID holders do not need a physical copy. BIR Commissioner Romeo Lumagui stated, “With this system, we can eliminate the practice of fixers and scammers selling TIN online while giving taxpayers a convenient alternative in getting a TIN instead of lining up at our Revenue District Offices.”

Also Read: How to Get Taxpayer Identification Number (TIN) Online

Steps on How to Get a BIR Digital TIN ID

Applying for a digital tax identification number ID for existing TIN holders is very straightforward. Simply follow the steps below:

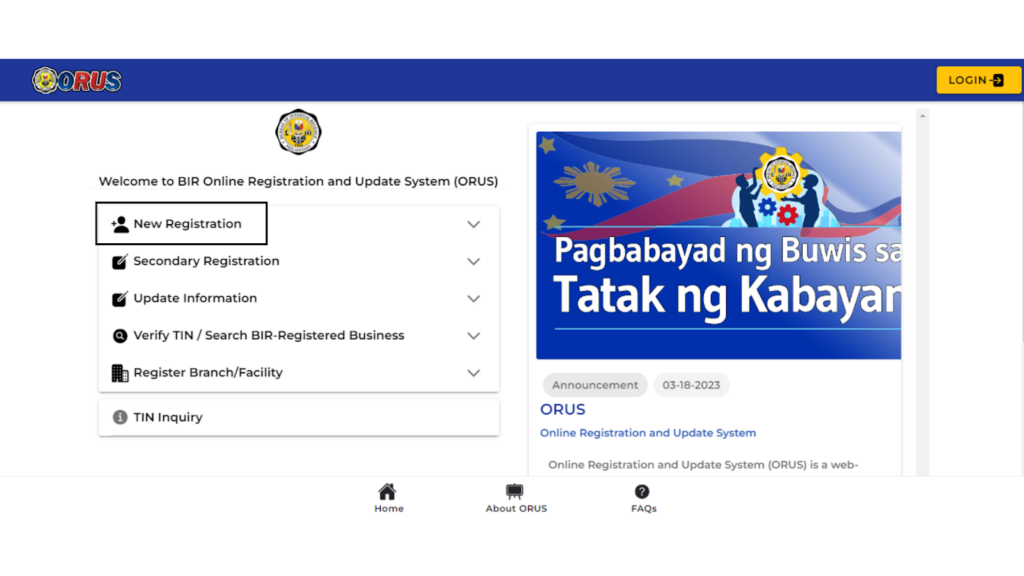

Step 1: Visit the ORUS Website

To apply, taxpayers must first visit the bureau’s Online Registration and Updated System (ORUS) website. However, individuals with no ORUS account yet must create one first.

Step 2: Create an ORUS Account

Click on “As an Individual” to begin the application process, and make sure to thoroughly read the text before clicking on “Create an Account.”

After clicking on “Create an Account,” read the terms and conditions before proceeding to agree to go to the next step of the process.

Click on register as a “Taxpayer” and “With Existing TIN” and select the type of transaction.

After selecting the type of transaction as fit, input all necessary information for the bureau’s verification.

Once done inputting all relevant data, scroll down to click on “Register.” Make sure to check the captcha before registering.

Step 3: Confirm Your Registration Via Email

After you input the necessary information to create an account, the system will send an automated verification message to your registered email.

Also Read: Guide: How to Verify your BIR TIN

Step 4: Log in with Your New ORUS Account

Once your account has been verified, log in to your new ORUS account with your registered credentials. Don’t forget to check the CAPTCHA before logging in.

Step 5: Select ‘Get Your Digital TIN ID’

When you have successfully logged into your ORUS account, click on ‘Get Your Digital TIN ID,’ and then an option to view your digital ID shall appear. Click on that as well.

Step 6: Read Digital TIN ID Instructions and Upload Photo

Before viewing your completed BIR digitized TIN ID, you must upload a recent one-by-one photo of yourself. To complete this, you must first read the instructions set by the Bureau of Internal Revenue (BIR) for photos for the ID.

- Read all the information before proceeding to the next step.

- View your Digital Tin ID by clicking the button below.

- Click “Generate Digital Tin ID” to proceed.

- Read the guidelines before proceeding to the next step.

- Click proceed for you to be redirected to the confirmation stage.

- Click the box to confirm that all the information that you’ve provided is correct and updated.

- After clicking on confirm, you will be issued your BIR digitized TIN ID, which is also available to download.

Final Thoughts

The BIR digital TIN ID offers a seamless process for new applicants and individuals with existing tax identification numbers. The digital version offers taxpayers a more convenient and efficient way to get their TINs. Moreover, you can immediately receive the copy without waiting in long lines at their offices, making the process timely and hassle-free.

Frequently Asked Questions (FAQs)

There are numerous clarifications regarding the overall tax identification number process due to the number of individuals applying for jobs and the requirement to submit a TIN during the job application process. Below are the questions that most individuals ask.

How Can I Get My BIR TIN Online?

As mentioned in the steps above, all taxpayers must do to get their online BIR TIN ID is create an ORUS account and follow the process previously discussed in this article. However, there is a different process for new tax identification number applicants.

How can I verify my TIN ID with a QR Code?

Since the digital tax identification number does not require a signature, unlike the physical copy, its authenticity can be verified by scanning the QR code. All verifying individuals have to do is scan the QR code on the ID by using a smartphone’s camera.

Is TIN ID Available Now?

Individuals can apply for a tax identification number with the Bureau of Internal Revenue. However, there is no physical copy available at all times. Applicants are seldom given a softcopy of their tax identification number via email. The advantage of the BIR digitized TIN ID is that it immediately gives everyone a copy of their IDs without long waits and lines.

What Happens When Someone Falsely Uploads their Photo on their Digital IDs?

The BIR has already stated that using another image for your digital TIN ID is not allowed. Individuals uploading unrelated images like animals, artists, cartoons, or another individual’s photo are subject to the correlating repercussions.

How Much is the Digital TIN ID?

The Bureau of Internal Revenue has already stated that these digital IDs are free and not for sale. Taxpayers should be wary of online sellers’ marketing services for digital TIN IDs since they are free and might be issued with a fake tax identification number and ID. These false tax identification numbers and IDs may lead to future issues with the bureau.

Does the Digital TIN ID Have an Expiry?

The digital TIN ID is a permanent document for identification. Both digital and physical copies are permanent documents and valid all throughout.

Do Taxpayers Still Need a Physical ID Even with a Digital Copy?

Taxpayers no longer need a copy of both IDs; either should suffice. However, the digital copy offers a more convenient and efficient process.

Keep Reading: GUIDE: Undergoing NBI Clearance Renewal Online in the Philippines

Leave a Reply