If you’re already employed full-time in the Philippines, you might be familiar with the term “13th month pay.” However, how many of us truly understand what the 13th-month pay is, why it exists, and how to calculate it? Is there a 13th month calculator where we can input data and get an instant computation?

Let’s delve into these questions and provide a more comprehensive understanding of 13th month pay.

Table of contents

Understanding 13th-Month Pay in the Philippines

In addition to annual salaries, 13th Month Pay is a mandatory yearly benefit for full-time rank-and-file employees. Established in Presidential Decree No. 851, this benefit was legalized in 1975 to assist Filipinos during the Christmas season.

Private sector workers who are eligible for the 13th Month Pay in the Philippines receive an extra yearly bonus over and above their yearly wage.

Moreover, the Philippine Decree for calculating 13th Month Pay applies to all employers excluding those with significant losses, non-profit institutions with reducing income, the government, those already paying 13-month pay, employers of household helpers and personal service workers, and commission, boundary, or task-based workers.

The core framework of the law remains unaltered despite amendments.

How to Calculate the 13th Month Pay

According to the law, the 13th-month pay is equivalent to one-twelfth of an employee’s annual salary earned within the same calendar year.

So how to compute 13th Month pay? Below is the calculation for the 13th-month pay:

(Total basic salary earned during the year) ÷ 12 = 13th Month Pay

Let’s apply this formula with an example. Employee Y’s basic salary is Php 12,000. Their monthly earnings are as follows:

| Month | Status | Monthly basic salary |

| January | No absence | ₱12,000.00 |

| February | No absence | ₱12,000.00 |

| March | No absence | ₱12,000.00 |

| April | No absence | ₱12,000.00 |

| May | No absence | ₱12,000.00 |

| June | 5 days leave with pay | ₱12,000.00 |

| July | No absence | ₱12,000.00 |

| August | No absence | ₱12,000.00 |

| September | 2 days leave with pay | ₱12,000.00 |

| October | No absence | ₱12,000.00 |

| November | 1 day leave with pay | ₱12,000.00 |

| December | No absence | ₱12,000.00 |

According to the data above, the total basic salary earned in this calendar year is Php 144,000.00.

Therefore, Employee Y’s thirteenth month pay is Php 144,000.00 ÷ 12 = Php 12,000.

If employees haven’t completed a full year of work by the time the 13th month benefit is calculated, only the basic pay for the actual months they’ve worked is considered. For instance, if an employee has worked for a company for three months, their 13th month pay would be computed as follows:

(Monthly basic salary x 3 months) ÷ 12 = 13th Month Pay

Using a 13th Month Calculator

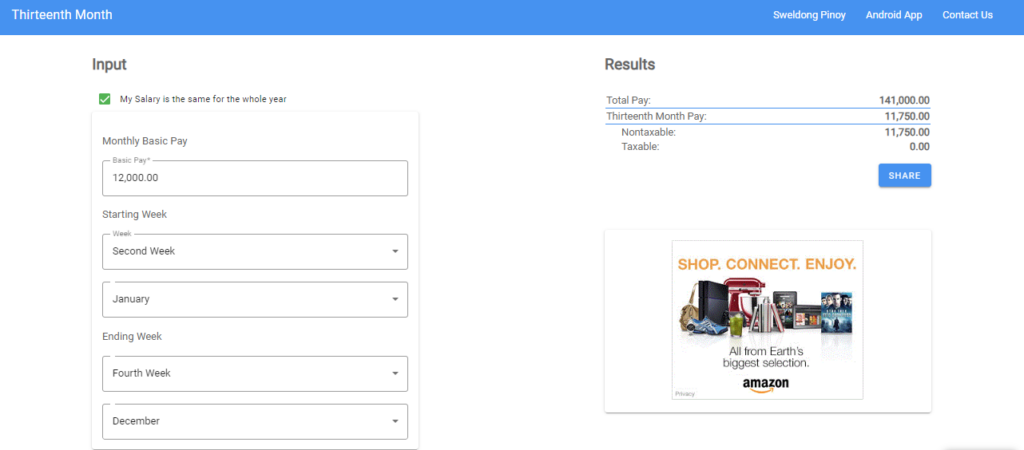

There is an easier way to calculate 13th Month Pay. Sweldong Pinoy offers a 13th month pay computation calculator online.

Here is an example of how to use the 13th month pay computation calculator:

If your salary is not the same for the whole year, you can uncheck the box and enter the data manually for every month.

The 13th Month Pay Computation in the Philippines

The Department of Labour and Employment (DOLE) in the Philippines mandates the provision of the 13th month pay to every private sector rank-and-file employee, regardless of their employment status.

The minimum pay is at least one-twelfth of the basic salary earned by an employee and must be paid by the 24th of December each year. Employers are required to submit a compliance report by the 15th of January of the following year, detailing their adherence to these guidelines.

In the Philippines, all rank-and-file private sector employees, who have worked for at least a month in a calendar year, are entitled to a 13th month pay. This does not apply to managerial employees who have the power to implement strategic and management-level policies.

Employees who have not worked for the full 12 months of the calendar year, as well as those who resign or whose employment is terminated, are also entitled to this benefit. Take note that the calculation of the thirteenth month pay does not incorporate benefits or allowances that are part of the basic salary. The ultimate amount of the thirteenth month pay is influenced by the number of months the employee has worked and any unpaid leaves taken within the same calendar year.

Conclusion

The 13th-month pay is a significant component of the Filipino employment landscape, legislated to provide an extra financial boost during the festive season. Its calculation is a straightforward process, equating to one-twelfth of an employee’s total basic salary earned within a year. Online tools such as the 13th month pay calculator make computations easier and accessible to all.

Remember, all private sector rank-and-file employees who have worked for at least a month in a year are entitled to this benefit, with prorated amounts for those who have not completed the full 12 months. It is not a bonus but rather an essential part of employee rights and benefits in the Philippines.

Read Other Helpful Guides Here: WhatALife-How-To-Guide-Articles

Leave a Reply