Estimated reading time: 4 minutes

Each year, the Social Security System (SSS) publishes an updated contribution table, which serves as the basis for calculating the contributions of its members. The SSS contribution table is important for the agency and its members, as it ensures necessary funds are met to provide the necessary benefits. Thus, knowing your contributions, deadlines and online payments is a must.

Table of contents

Responsibilities and Contribution to SSS

Any employers within the Philippines should be responsible in paying contributions to the Social Security System on their employees’ behalf, as part of their working benefit. Additionally, this ensures complete SSS postings and securing entitlements the necessary benefits for employees at a specific time it is needed.

The SSS established payment deadlines for these contributions based on a member’s SSS number. However, in 2023, the agency will now encourage any member to submit payments on the last day of the month or quarter.

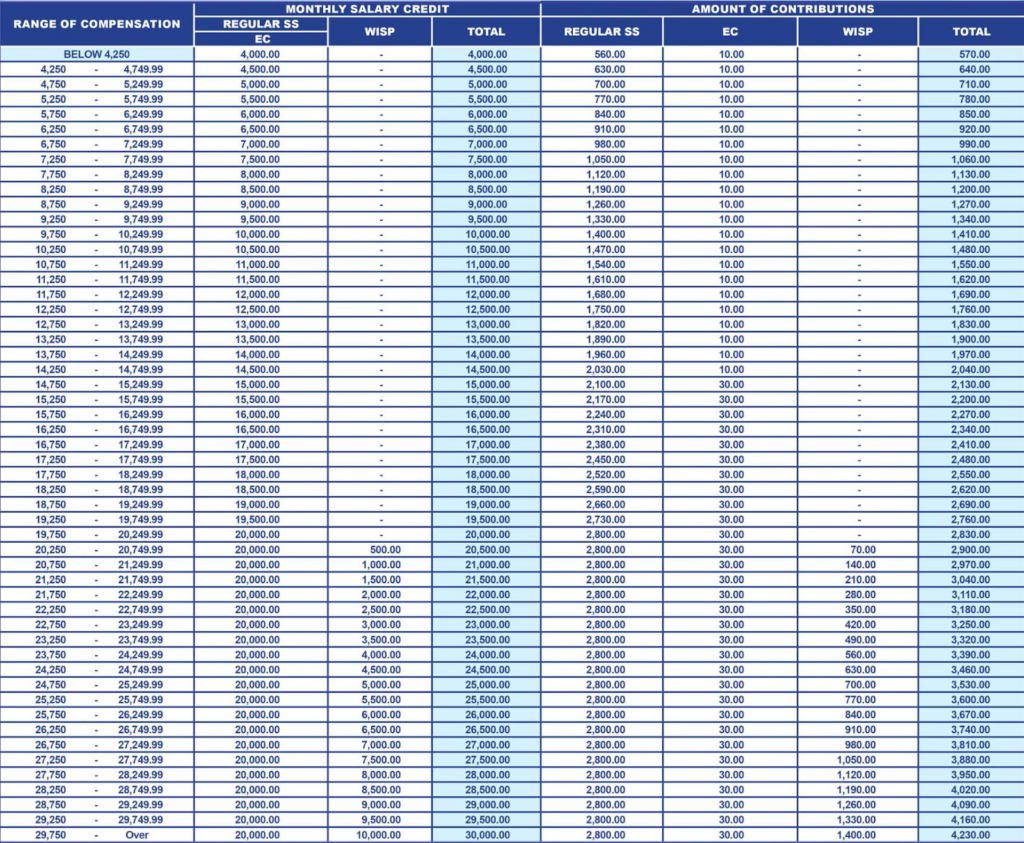

2024 SSS Contribution Table For Self-Employed Members

The 2024 SSS contribution table below is for individuals who are self-employed professionals or freelancers. This table helps these specific members understand their obligations to the Social Security System. Like members employed in organizations, self-employed individuals must also pay monthly contributions based on their income.

Any freelancers or self-employed individuals within the country can use the table below to determine how much their contribution is. Thus, understanding the fine details of the information is crucial in meeting obligations as an SSS member.

Also Read: GUIDE: How to Check Your SSS Contribution

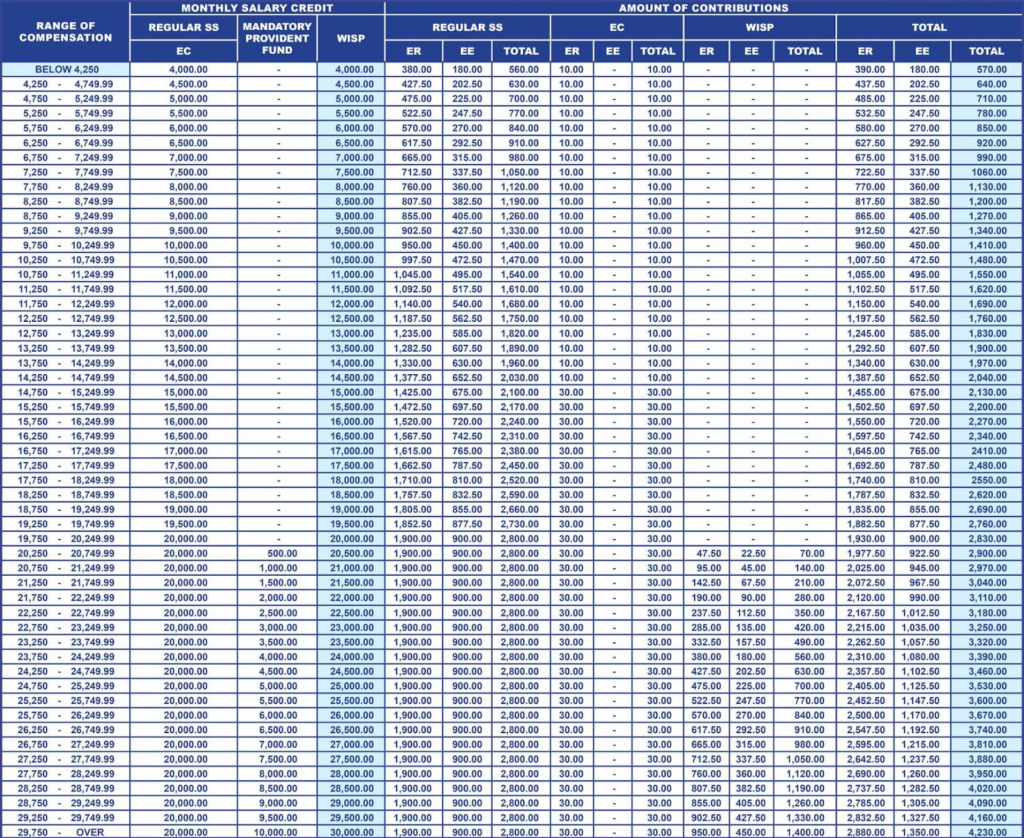

2024 SSS Contribution Table For Employers and Employees

The SSS Contribution for employees and employers can change drastically due to the influence of taxes and the competitive landscape. By the SSS Circular No. 2022-033, a new schedule of SSS contributions will be implemented effectively in January 2024.

The contribution rate for SSS will increase to 14%. The minimum Monthly Salary Credit will be set to PHP 4,000, and the maximum will be PHP 30,000. The updated table is listed as follows:

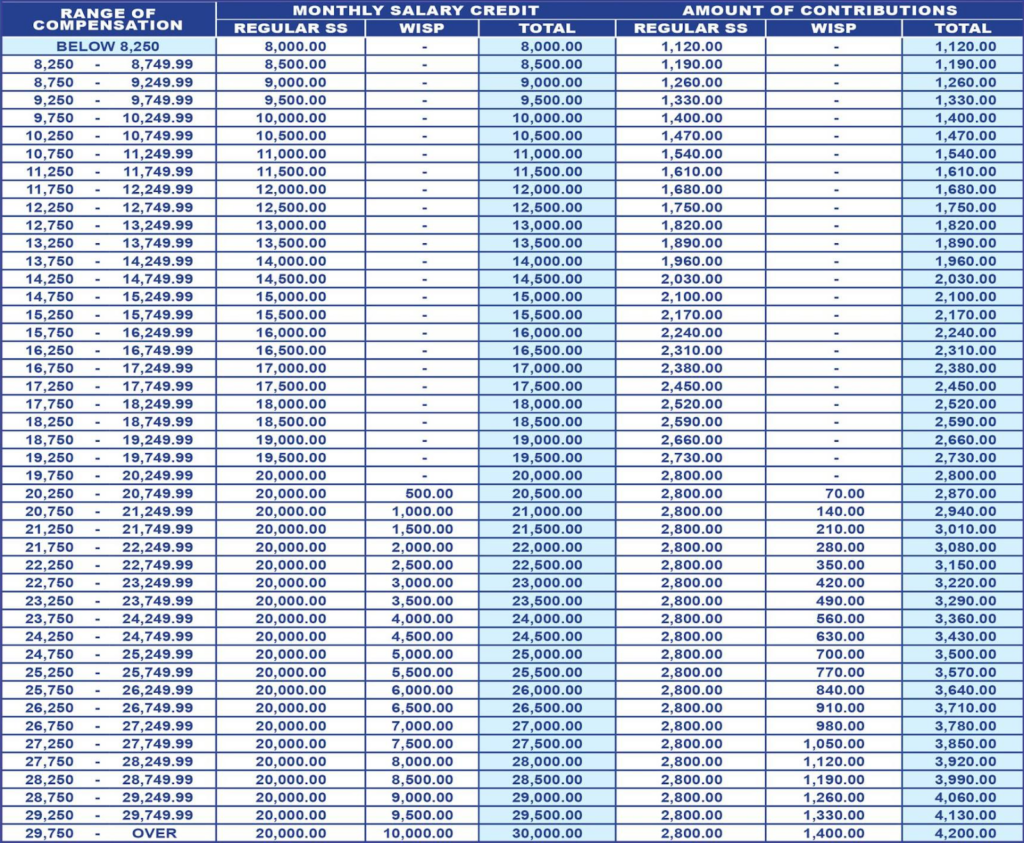

2024 SSS Contribution Table For OFW Members

Overseas Filipino Workers who are based in other countries are still required to pay contributions to the Social Security System at any other member. The monthly contributions are required to be eligible for the organization’s benefits and services. The updated table for OFW Members is as follows:

Also Read: LIST: SSS Contribution Payment Options

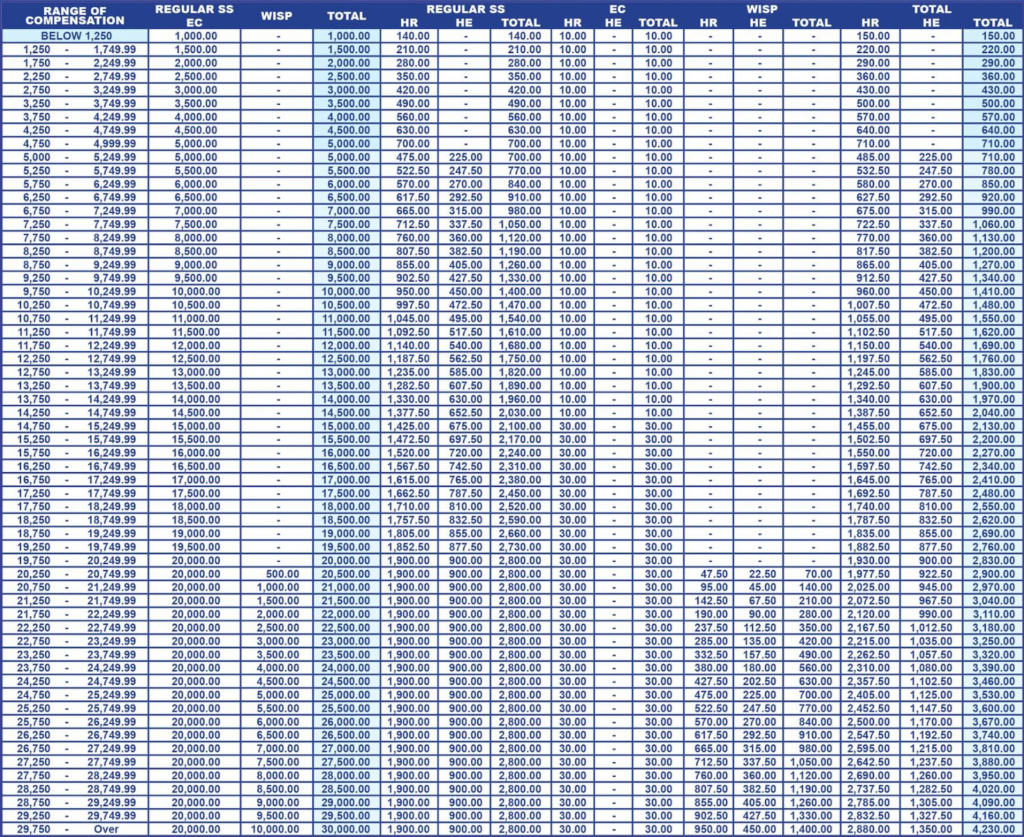

2024 SSS Contribution Table For Household Employers and Kasambahay Members

Household employers and kasambahays can contribute to the SSS with their qualifications and requirements. In addition, the SSS mandates that the household employer of the members should register them with the SSS for social security benefits and protection. The updated contribution table is provided below:

What Changed

As the new year begins, employees and employers look into the factors that lead to the changes in the SSS contribution rate, especially about members’ payment contribution deadlines. In 2023, the SSS implemented a 1% increase in the contribution rate, with the minimum monthly salary credit being adjusted from PHP 3,000 to PHP 4,000. Here are the recent changes for the SSS Contribution in 2024:

- Recent updates indicate stability with no expected change to the 14 percent contribution rate.

- Employers will continue to contribute 9.5% and retain a 4.5% share.

- The impending increase will most likely occur in the year 2025.

The SSS Contribution of 2024 has recently shown little change compared to 2023. The contribution aims to keep the long-term viability of the agency and provides members with a list of benefits.

Final Thoughts

The SSS Contribution table facilitates employers in easily calculating their contributions without experiencing confusion or getting lost. It ensures they receive the right amount and contribute the same amount and benefits through visiting the office or checking your contribution online. In addition, employers can ensure they provide the right benefits to their employees at a specific time and condition of events.

Also Read: Pag-IBIG announces significant increase in contributions

Leave a Reply