If you are a taxpayer in the Philippines, you might have heard about the TIN number. TIN stands for Taxpayer Identification Number, which is a unique nine-digit number issued by the Bureau of Internal Revenue (BIR) to identify taxpayers in the country. If you are wondering what are the requirements for a TIN number, this guide will help you with the process.

Table of contents

What is a Tax Identification Number (TIN)?

TIN is the acronym for Taxpayer Identification Number, which is a unique identification number assigned to individuals and businesses by the Bureau of Internal Revenue (BIR) in the Philippines. This nine-digit number identifies taxpayers and keeps track of their tax obligations and transactions.

Anyone who earns income or does business in the country is required to have one. TIN is used for various purposes, such as filing tax returns, transacting with government agencies, and opening a bank account.

Understanding the Tax Identification Number (TIN)

A tax identification number is a special set of numbers that distinguishes people, businesses, and other entities like nonprofits (NPOs). Each person or entity must apply for a TIN. Once approved, the assigning agency assigns the applicant a special number.

The TIN, which is also called a taxpayer identification number, is mandatory for anyone filing annual tax returns with the IRS, which the agency uses to track taxpayers. In tax-related paperwork and when requesting government benefits or services, filers must mention the number.

TINs are also required for other purposes:

- For credit: Banks and other lenders require Social Security numbers on applications for credit. In order to confirm that the correct applicant is submitting the application, this information is then forwarded to the credit bureaus. Credit reporting agencies also use TINs—notably SSNs—to report and track an individual’s credit history.

- To apply for a job: Companies want a TIN from every applicant. Employers check the data with the issuing organization.

Also Read: How to Get BIR Digital TIN ID for Existing TIN Holders

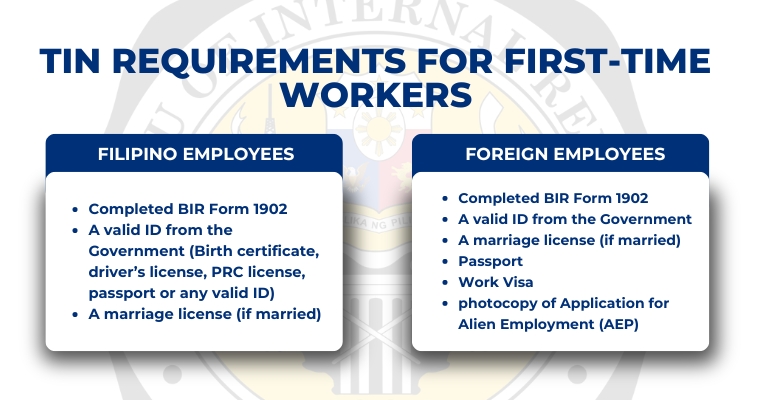

Requirements for First-Time Workers to File a TIN

Now that new hires are aware of how crucial the TIN is, let’s go down the application criteria. The following are things that new Filipino staff should have:

1. Successfully Completed BIR Form 1902

BIR Form 1902 is a prerequisite for new hires who are going to start receiving a salary or other kind of compensation in the Philippines. Many employers manage their workers’ BIR registration. If this applies to your situation, submitting the form and the remaining procedures will suffice to finish your TIN application. Once you’ve properly registered, your employer ought to provide you with your permanent TIN.

2. A valid ID from the Government

For identification verification, any kind of government-issued identification. You can use your birth certificate, driver’s license, PRC license, passport, National ID card, Social Security System (SSS) ID, Unified Multi-Purpose (UMID) card, and clearance from the National Bureau of Investigation (NBI), among other documents.

3. A marriage license (if married)

To apply for a TIN if you are married, you must have a copy of your marriage license.

Requirements for Foreign Employees

Employees from other countries will need to meet extra requirements. They must also produce their passports, a work visa, or a photocopy of a properly received Application for Alien Employment (AEP), which may be obtained from the Department of Labor and Employment, in addition to the completed BIR Form 1902.

2 Ways To Get a TIN Number in the Philippines

Walk-in Registration

- Go to the Revenue District Office (RDO) with jurisdiction over the place where your home, head office, or branch office is located.

- Submit the TIN number requirements to the New Business Registrant Counter (NBRC).

- Pay the following BIR fees:

- Annual registration fee – ₱500

- Documentary stamp tax – ₱30

- BIR-printed receipt/invoice – Available for purchase (If you opt to print your receipt/invoice elsewhere, apply for an Authority to Print.)

- Attend the scheduled initial briefing for new business registrations in the RDO.

- Receive the following (All documents contain your TIN.):

- Certificate of Registration (BIR Form 2303)

- Notice to Issue Receipt/Invoice

- BIR-printed receipts/invoices or Authority to Print, whichever is applicable

- Received copy of BIR Form 1901

- Proof of payments

Online Registration

TIN issuance, payment of the registration fee, and the issue of the Certificate of Registration are only a few of the taxpayer registration services provided by the eREG System online application system, which is used for taxpayer registration.

Additionally, corporate or Non-Individual Taxpayer-Employers can make it easier for their employees to obtain a Taxpayer Identification Number (TIN). In order to issue new workers’ TINs without using current TINs, corporate or non-individual employers registered with the Bureau must enlist an approved user.

Part I: Creating a BIR eReg Account

- Visit the BIR eRegistration website.

- Click on Create Employer User Account on the User Menu on the left part of the page.

- Read the User Agreement. Click the Agree button.

- Enter your email address, complete name, employer TIN, and employer branch code (the last three digits of your employer TIN—not the RDO code).

- Type the captcha code and hit Submit. Upon clicking the Submit button, you will be directed to the eReg Login page, wherein you can see a message confirming that your account has been successfully created.

- Wait for an email notification from BIR containing your account username. Once you have received your username, you can now get TINs for your employees

Part 2: Get TIN for Employees Through the BIR eReg System

Employers may now log in to issue Taxpayer Identification Numbers (TINs) for their workers after setting up their BIR eReg accounts.

- Visit the BIR eRegistration website.

- Input your registered username (i.e., the one sent to you via email) and your email address. If the username and email address match, you will receive an email containing your password. Check your spam folder if you cannot see the email in your inbox.

- Fill out the Basic Taxpayer Data Form with the required information, which includes the name of the employee, birthdate, name extension, email address, civil status, and gender. Important Note: Taxpayers with no middle name must get their TINs manually at the concerned Revenue District Office (RDO).

Importance of Having a TIN number

Having a Taxpayer Identification Number (TIN) is important for several reasons:

Legal Requirement: In many countries, individuals and businesses must have a TIN to pay taxes and comply with tax laws. Failure to obtain a TIN can result in penalties, fines, and legal action.

Tax Compliance: TINs help tax authorities keep track of taxpayers’ income, deductions, and tax payments. With a TIN, taxpayers can file their tax returns accurately and timely and avoid any penalties for non-compliance.

Financial Transactions: Many financial transactions, such as opening a bank account, buying a property, or applying for a loan, require a TIN. It is a way for financial institutions to verify the identity of the taxpayer and ensure compliance with tax regulations.

Government Services: TINs are also used to access government services and benefits such as healthcare, social security, and education. Without a TIN, it may be difficult for individuals to avail of these services.

International Transactions: In today’s global economy, businesses often need to engage in international transactions. Having a TIN is important to comply with the tax regulations of other countries and to avoid double taxation.

Also Read: Guide: How to Verify your BIR TIN

Tips To Keep in Mind

When applying for a Taxpayer Identification Number (TIN), it’s important to understand the requirements and the type of taxpayer you are. You should gather all the required documents, apply early, provide accurate information, keep your TIN safe, update your information when necessary, and seek professional advice if needed. Obtaining a Taxpayer Identification Number (TIN) is a crucial step for individuals and businesses to comply with tax laws and regulations. Having a TIN enables individuals and businesses to access financial services and government benefits, engage in international transactions, and avoid penalties and fines for non-compliance.

Final Thoughts

Whether you’re an individual taxpayer or a business owner, having a TIN is important for compliance and financial transactions. Following the outlined guide above can help individuals complete the registration process smoothly. As a result, they can avoid potential penalties and enjoy the benefits of being a compliant taxpayer.

Frequently Asked Questions (FAQs)

To help streamline the TIN registration process, here are additional information applicants can keep in mind:

Can I get a TIN number without a job?

Yes. Filipino citizens are free to get a TIN even if they’re currently unemployed.

Is a TIN number a valid ID?

Taxpayers can use their TIN ID as a valid form of identification in the Philippines.

Can I apply for TIN number online?

Absolutely. Just visit the BIR eRegistration website and fill in the necessary information in the application form. – WhatALife!/Jayve

Keep Reading: GUIDE: 2023 Updated Income Tax Table in the Philippines

Leave a Reply