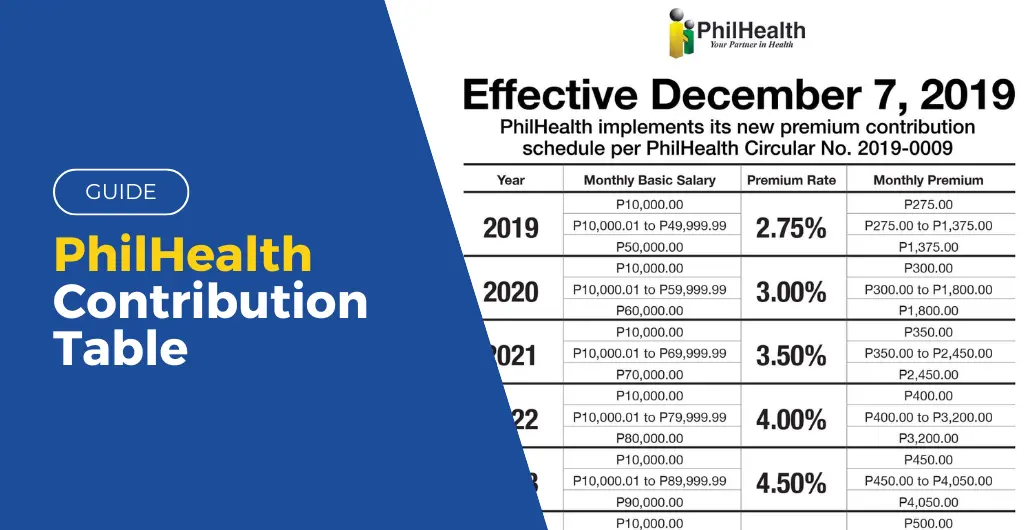

PhilHealth is the nation’s leading Health Insurance Program, providing quality health insurance backed by the government. As mandated by the Universal Health Care Act, prices for premium contributors will increase yearly until 2025. Here is the updated Philhealth Contribution table for 2023.

Table of contents

PhilHealth Updated Contribution Fees

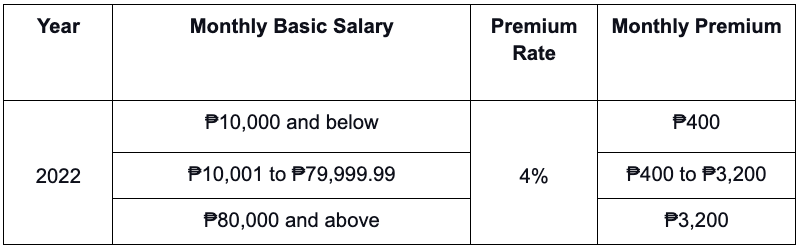

As of January 2, 2023, President Ferdiand Marcos Jr. suspended the increase of the new premium rate. Therefore, you can still refer to the 2022 premium rate, which is 4% of the Monthly Basic Salary of the member. With this, the new premium rates are as follows:

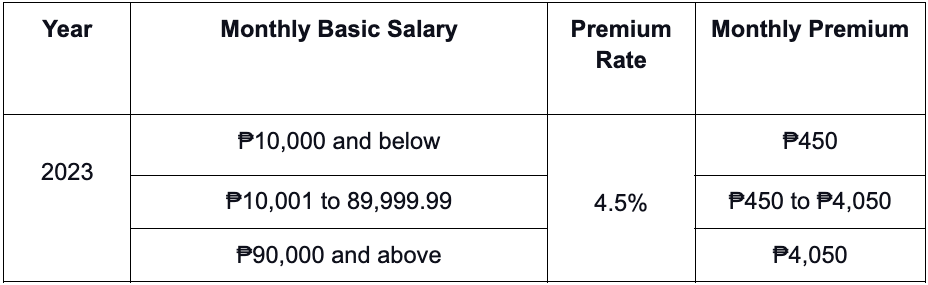

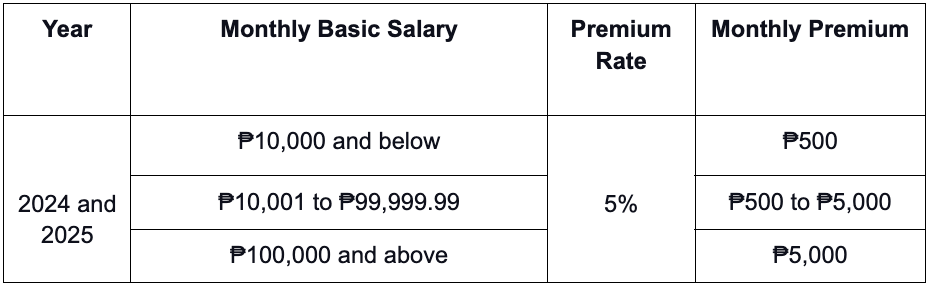

Subsequently, the premium rate will increase again in the following years, with an increase seen in the following tables.

Also Read: SSS CONTRIBUTION TABLE 2024 MONTHLY

PhilHealth Member Classification

There are two types of PhilHealth Members, Direct and Indirect Members. The members also have qualifying dependents, which are:

- Legal spouse/s that are non-members

- Unmarried and unemployed children, whether legitimate or illegitimate

- Legally fostered children and step-children under the age of 21

- Parents aged 60 and above who are non-members

Direct members and their dependents are those with premium contributions. They can pay for their membership and have a stable source of income. These include:

- Members with formal employment

- Domestic Workers, also known as Kasambahays

- Professional Practitioners

- Self-Employed Individuals

- OFWs

- Filipinos Living Abroad

- Lifetime Members (A former member at the age of retirement and has paid at least 120 monthly contributions)

- All Filipinos aged 21 and above with the capacity to pay premium contributions

Indirect Members and their dependents are those who are unable to pay the monthly premium, which includes:

- Indigents identified by DSWD

- Beneficiaries of 4Ps (Pantawid Pamilyang Pilipino Program)

- Persons with Disability

- Sangguniang Kabataan Officials

- All Filipinos aged 21 without the capacity to pay premium contributions

- Those previously identified at point-of-service during registration cannot pay the premium.

Philhealth Contribution For Members

PhilHealth members have different economic capabilities. Here’s a summarized breakdown for Employers, Employees, Self-employed, OFWs, and Kasambahays.

- Employed members will have their contribution divided 50-50 between the employee and employer.

- Kasambahay members with a monthly salary of less than Php 5,000 will have the employer solely pay their contribution.

- Self-employed members with a monthly income of Php 25,000 below will pay Php 2,400 annually for their contribution. Meanwhile, those with a monthly revenue of Php 25,000 and higher will pay Php 3,600 annually.

Land-based OFWs will pay an annual contribution of Php 2,400, and advance payments can be made for up to 5 years. On the other hand, Sea-based OFWs will contribute the same as employed members, with 50-50 between them and their employers.

Why was Philhealth established?

PhilHealth was established to administer Republic Act 7875, also known as the “National Health Insurance Act of 1995.”

The general objective is to promote and accelerate healthcare services and provide quality healthcare to Filipino Citizens without burdening them with its expenses, especially for those who can’t afford them.

What are the benefits of being a PhilHealth Member?

The benefits for PhilHealth Members and their dependents are the following:

In-patient hospital care and Out-patient care, specifically:

- Room and Board (for In-patients)

- Health Care Professional Services

- Laboratory, Diagnostic, and Other Medical Fees

- Usage of Medical or Surgical Equipment and Facilities

- Personal Preventive Services (for outpatients)

- Prescription Drugs and Biologicals

- Health Education and Seminar Packages

- Emergency and Transfer Services

- Other healthcare services that the corporation determines to be appropriate and cost-effective.

Also Read: GUIDE: PhilHealth Hospitalization Coverage and Benefits

Z Benefit Packages

As part of its mandate, PhilHealth also has a financial security program that helps outpatients with specific medical conditions. These medical conditions are animal bites, malaria, tuberculosis, HIV-AIDS, and Voluntary Surgical Contraception.

Malaria Z Benefit

Malaria outpatients will receive a Php 600 benefit, including diagnostic malaria smears, laboratory procedures, drugs and medicine, and consultation services. Members who have been diagnosed with malaria will be able to claim this benefit.

Voluntary Surgical Contraception Z Benefit

Members who wish to do voluntary surgical contraception will have a Php 4,000 benefit covering the surgery’s medical expenses and family planning.

Animal Bite Z Benefit

Animal bite outpatients will receive a Php 3,000 treatment package with rabies vaccines, rabies immune globulin, local wound care, anti-tetanus, and antibiotics. In addition, the package will cover the medical costs for rabies exposure, animal bites, and post-exposure prophylaxis.

Tuberculosis Z Benefit

For members diagnosed with Tuberculosis, PhilHealth will give a benefits package of Php 4,000 for their diagnostic exams, consultation, medicine, and counseling.

HIV-AIDS Z Benefit

Members diagnosed with HIV-AIDS will receive Php 30,000 annually for their medical expenses related to HIV-AIDS.

Final Thoughts

Regularly contributing to PhilHealth gives contributors access to various medical benefits and services. Thus, it ensures they are protected when it comes to medical needs. So, it’s good to stay informed about the latest contribution rates and requirements so they can continue enjoying the benefits of health insurance. Remember, investing in one’s health is one of the most important investments one can make for a secure future.

Frequently Asked Questions (FAQs)

Here is additional information on PhilHealth’s contribution fees:

How much is PhilHealth monthly contribution?

The PhilHealth monthly contribution for 2023 remains at 4% of the member’s basic monthly salary. But for 2024, the rate has gone up to 5%.

How much is PhilHealth contribution for voluntary in 2024?

The Philhealth monthly contribution for voluntary members in 2024 is 3% for individuals with a basic monthly salary below PHP25,000. Meanwhile, members with monthly salaries of PHP25,000 and above are required to pay 5%.

Can I view my PhilHealth contribution online?

Yes. Members can view their contributions online by visiting www.philhealth.gov.ph. Create an account or log in to the PhilHealth Member Portal. Then, go to the Member Information page, and click ‘Premium Contributions.’ –WhatALife!/Vaughn

Source: (PHILHEALTH)

Keep Reading: GUIDE: SSS Contribution Table 2023

Leave a Reply