Estimated reading time: 7 minutes

Numerous government agencies are now adopting technological advancements and incorporating these to streamline their services. Thus, securing your BIR eAppointment lets you skip the long waiting lines and fill out forms on the day. The bureau offers numerous eAppointment services on its website. With this article’s help, you can focus on the TIN appointment process as seamlessly as possible.

Table of contents

The BIR Online Appointment Process

The Bureau of Internal Revenue (BIR) now has an online portal for individuals to schedule their appointments before they visit the bureau’s offices. Although applicants still need to go to their offices to complete their transactions, they can now cut the long lines and physical forms for more efficient and convenient transactions.

BIR Online Appointment for TIN Process

To apply for a Bureau of Internal Revenue online appointment for a TIN application, follow the steps below:

Visit the BIR Website and Check for Required Documents

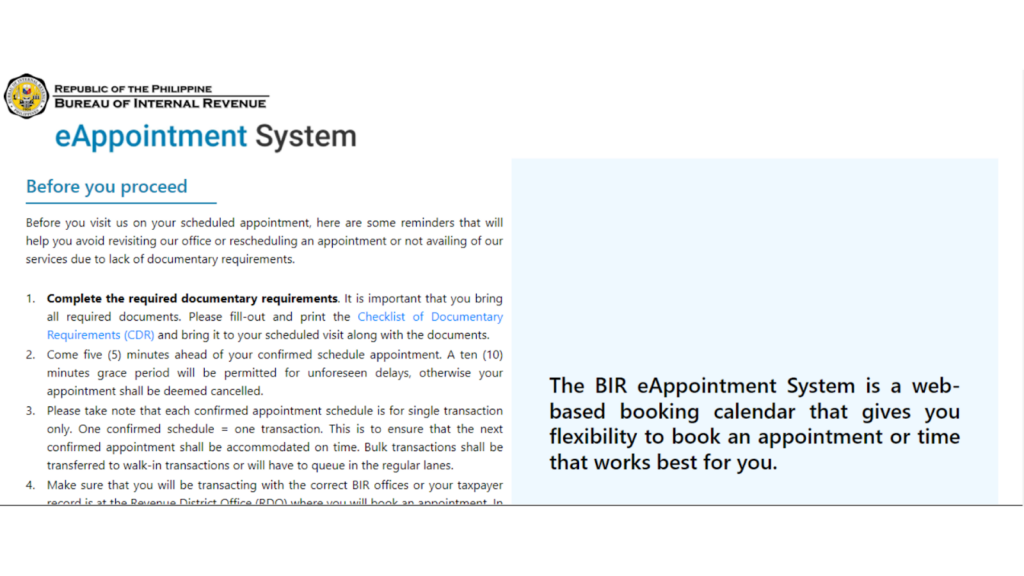

To successfully apply for a TIN, individuals must first know the needed documents to get one. You can visit the BIR website to find the complete list of requirements.

There are various requirements and forms, depending on the application type. For new job applicants, select the option for BIR online registration number for employment. See the images below for the steps mentioned.

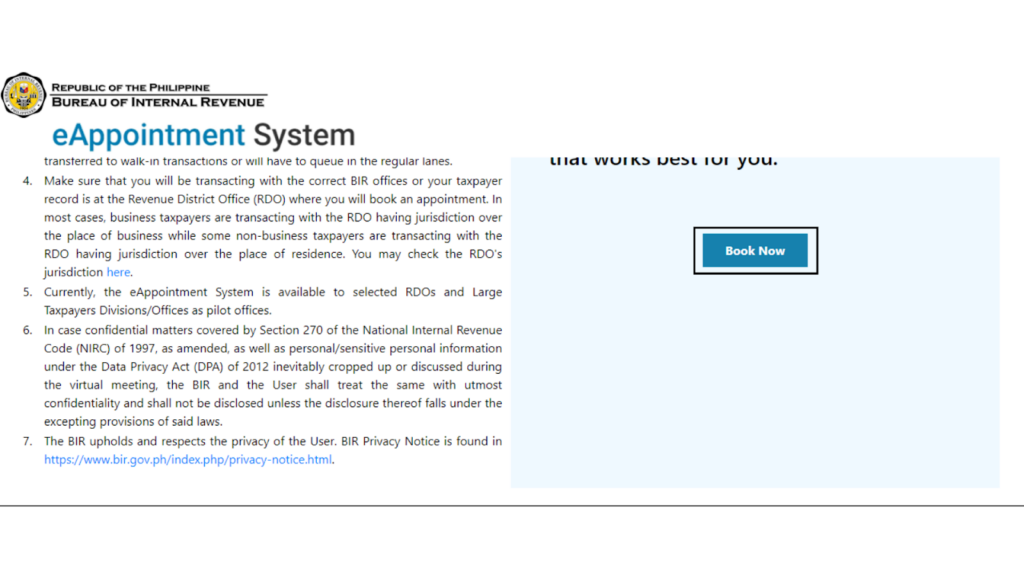

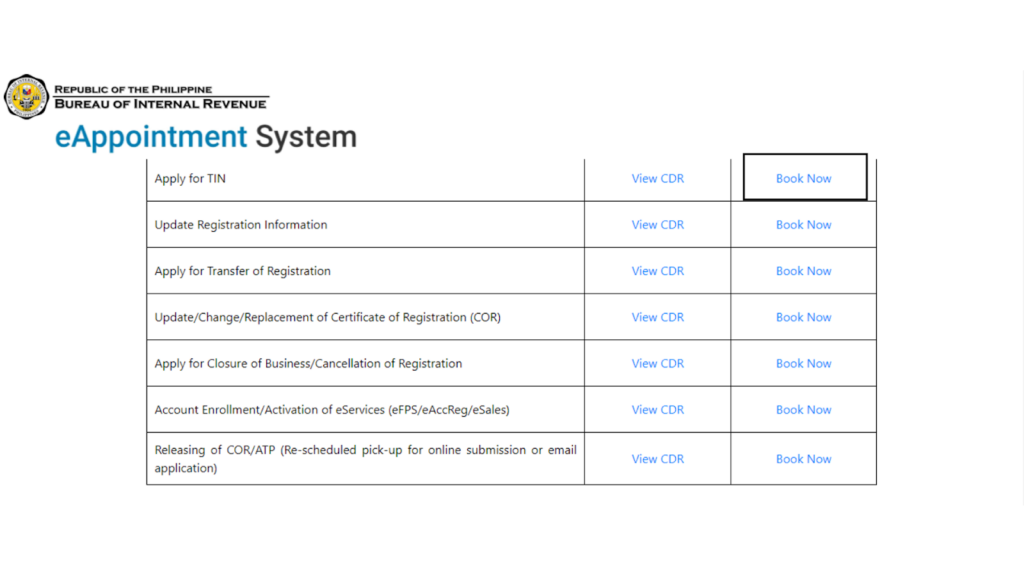

Once you have visited the website, thoroughly read the government agency’s terms and conditions before clicking the ‘Book Now’ option.

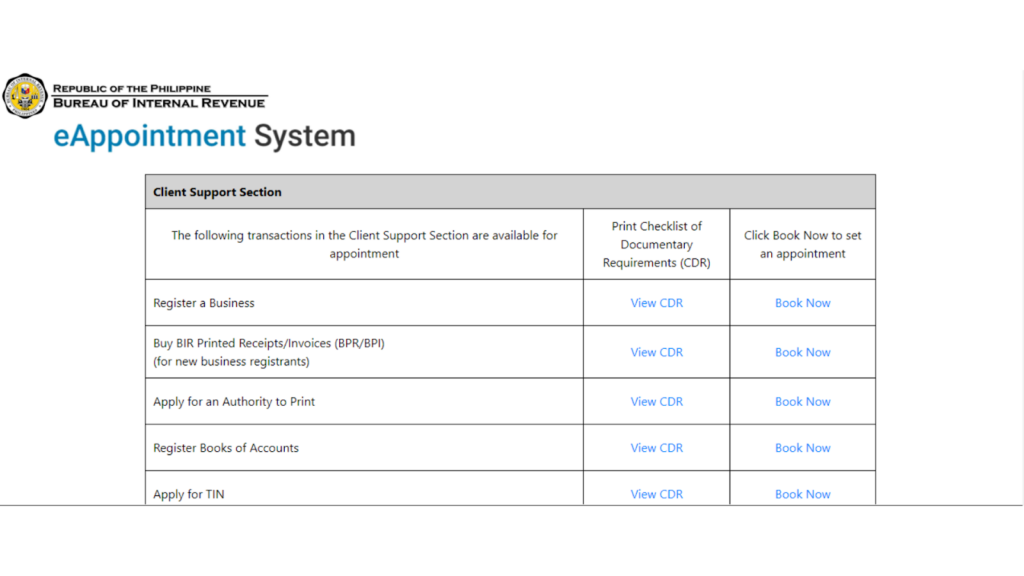

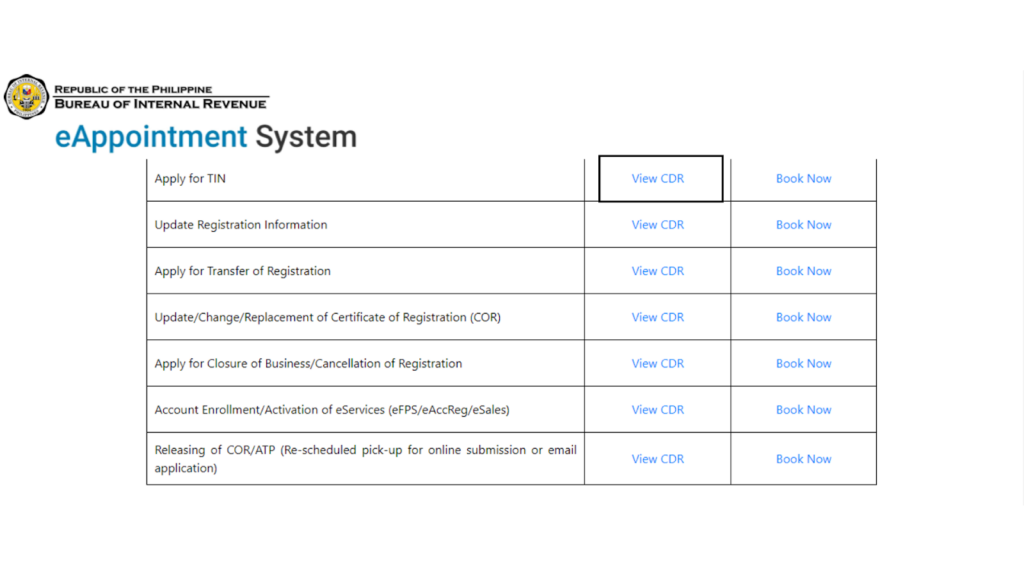

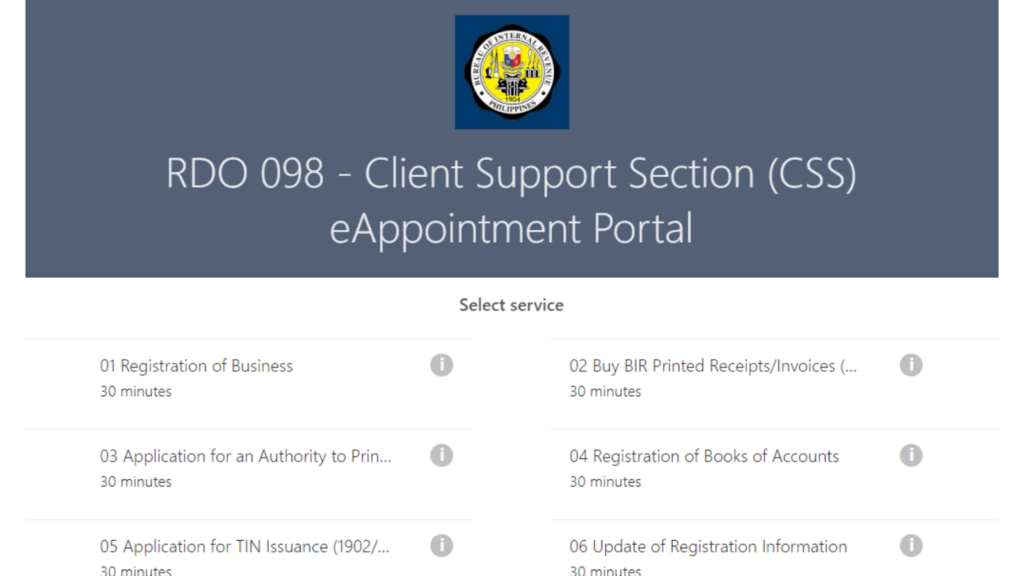

You will be directed to a list of Bureau of Internal Revenue branches. Choose the one closest to you to proceed. After that, you’ll find a list of services to apply for.

Scroll for the TIN option, look for ‘Apply for TIN,’ and click ‘View to CDR for the list of requirements.

Gather All Your Required Documents

Before booking your appointment, you must have all the requirements for your Tax Identification Number (TIN) application. By this, you are ensured that once you get to your selected office, your documents are complete and ready for verification.

Book Your Appointment

Once your documents are complete, return to the Bureau of Internal Revenue portal to book your BIR eAppointment for employment. You just need to follow the steps mentioned above.

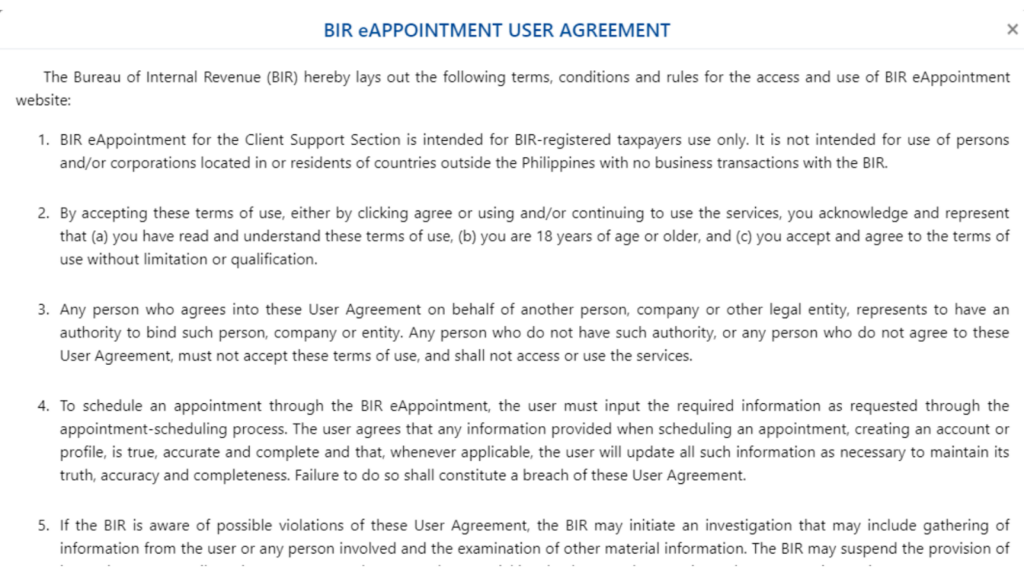

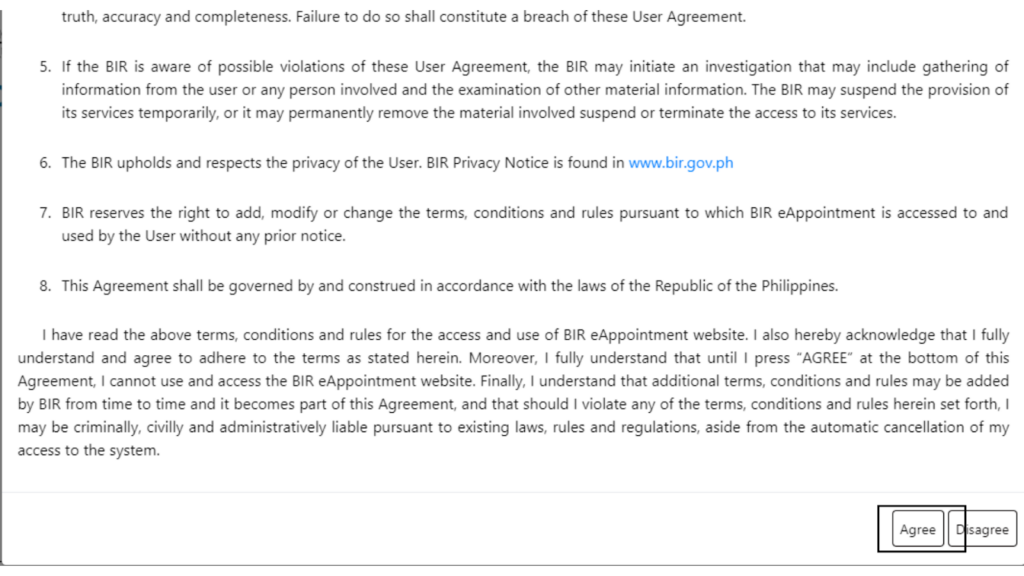

Click on ‘Agree’ on the Portal’s User Agreement

The BIR eAppointment Number portal will then present applicants with a user agreement that elaborates on the essential terms of the online application process. To proceed, carefully read the terms thoroughly and click ‘Agree.’

Click on ‘Application for TIN Issuance’

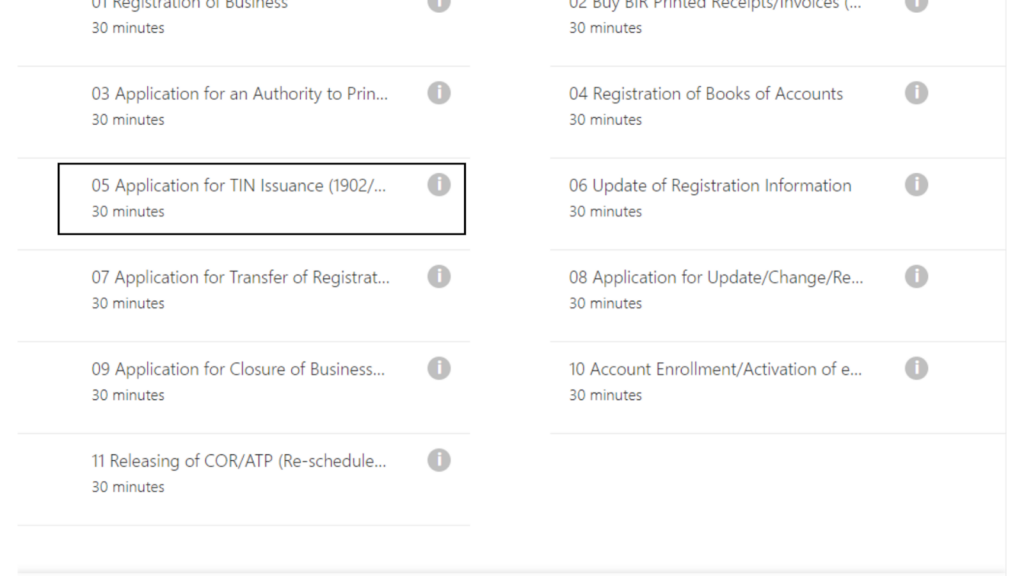

After agreeing to the user agreement, applicants will be forwarded to the Client Support Section (CSS) eAppointment Portal to select the needed service. For TIN applicants, click on ‘Application for TIN Issuance’.

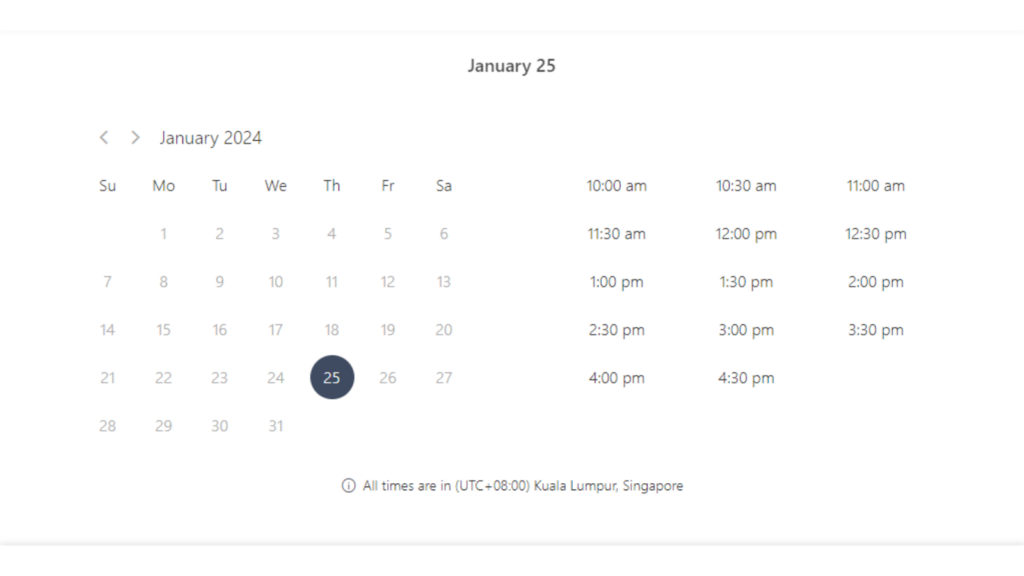

Select Your Appointment Date and Time

After selecting your desired service, applicants can see the vacant dates and times based on their selected location and available appointment slots.

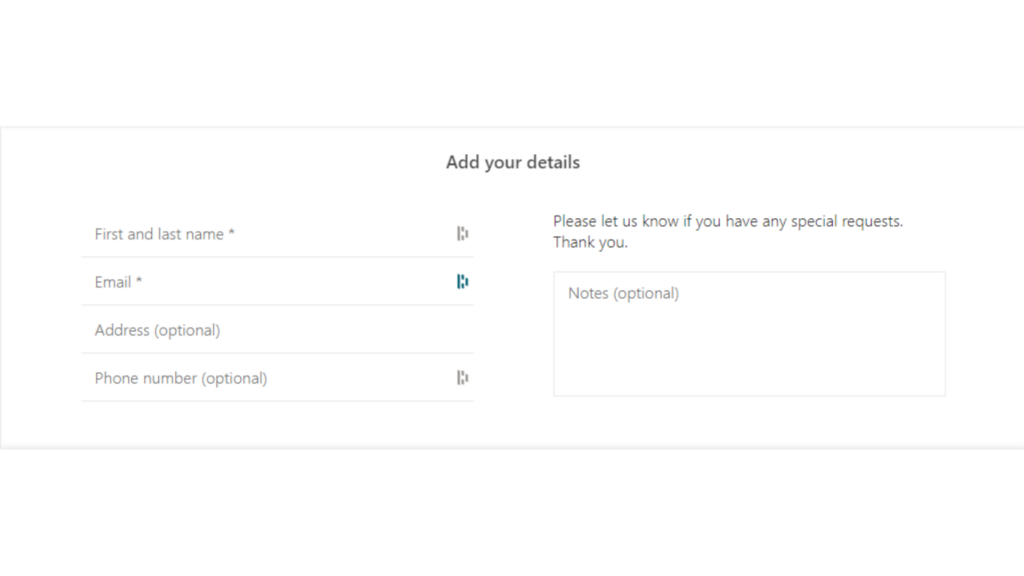

Input the Necessary Information

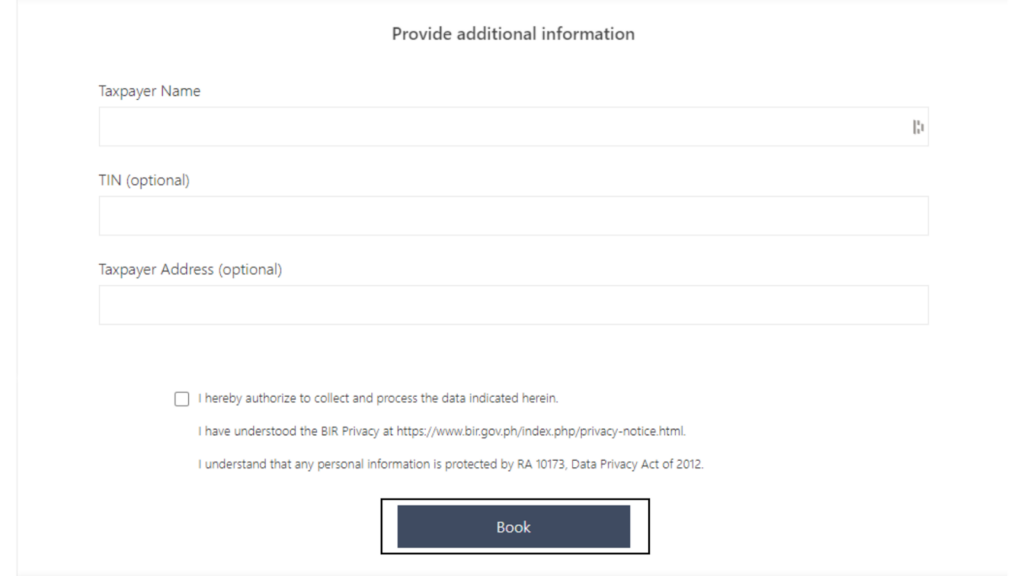

After selecting your chosen time slot, you will be presented with a page that needs to be filled out with your necessary information. Complete this step to finish booking your appointment online.

Final Thoughts

The BIR online appointment for the TIN process offers taxpayers numerous benefits like convenience and efficiency. All applicants must follow the steps discussed in this article to ensure a seamless process when the appointment date arrives. The TIN application is not the only service that offers an online appointment; other BIR services do have it, too. For more details, visit the BIR website.

Frequently Asked Questions (FAQs)

With numerous Filipinos graduating every year, there are numerous questions surrounding the BIR online appointment for the TIN process for their job application. Several professional settings require a tax identification number for applicants to complete their job application successfully.

Is There an Online Appointment for BIR?

Yes. As discussed, there are online appointments for numerous Bureau of Internal Revenue applications. However, most of these applications still require taxpayers to show up in their chosen locations to complete the transaction.

Can I Apply for a TIN Number Online?

Applicants can schedule their TIN application appointments online but must present themselves at their chosen Bureau of Internal Revenue locations to get a number. The online application only simplifies the process with fewer forms to fill out on the day. Moreover, it also provides applicants with a list of their requirements to prevent them from returning if they go to the offices and lack the necessary documents.

How Much is the Annual Registration Fee for BIR 2024?

For business taxpayers, the Bureau of Internal Revenue will no longer be collecting the Annual Registration Fee (ARF) effective on January 22, 2024, in compliance with the Republic Act No. 11976 or the “Ease of Paying Taxes Act.” It centers around enterprise owners who are exempted from filing the BIT Form No. 0605 and paying an amount of five hundred Philippine pesos every year before the end of January.

Can I Update my BIR Information Online?

Yes, taxpayers can now update their existing Bureau of Internal Revenue information online. It can be updated through the Online Registration and Update System (ORUS), which offers an end-to-end process for updating registration information.

Also Read: GUIDE: Business Permit Renewal 2024 (Requirements, Fees, and More!)

Leave a Reply