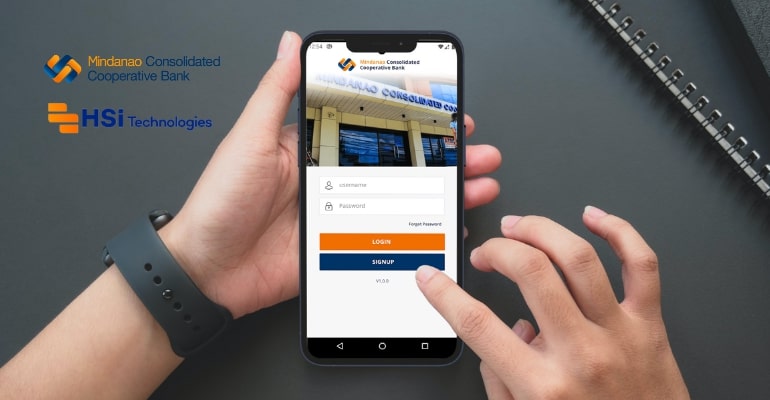

To keep pace with the consumer and market demand, MCCB heavily invested and adapted to technological changes and advancements to improve the bank’s services and allow its clients to have a seamless banking experience. Now, MCCB has integrated e-banking services into its system, including installing automated teller machines (ATMs) in all MCCB branches and developing the MCCB Online mobile app with the help of HSI Technologies.

Mindanao Consolidated Cooperative Bank Goes Digital, Offers Mobile Banking App and Digital Payments for Convenience and Inclusivity

MINDANAO CONSOLIDATED COOPERATIVE BANK (MCCB) operated as a cooperative bank and was formed by consolidating three constituent cooperative banking institutions of Mindanao. MCCB envisions being the bank of choice for cooperatives, farmers, fishermen, small entrepreneurs, and other clients and commits to providing efficient, responsive, and innovative financial services to institutional and individual clients.

MCCB provides financial services such as:

- Deposit (e.g., Passbook Account, ATM Account, Checking Account, and Time Deposit),

- Loan & Credit Services (e.g., Agricultural Loan, SME/Business Loan, Auto Loan/Truck Loan, Consumers Loan, Jewelry Loan, Home Loan, Motorcycle Loan, and Loans Against Deposit), and;

- Investment Stock (e.g., Common stock for registered cooperatives and Preferred Stock for Individual Investment)

The Mindanao-based cooperative bank has been operating profitably and has remained a viable and sustainable institution since the pre-consolidation time in 1979.

Now, MCCB joins BSP’s Digital Payment Transformation through MCCB Online to provide an efficient, inclusive, safe, and secure digital payments ecosystem that supports diverse needs and capabilities. The mobile banking app is where you can do everything online 24/7, such as quick balance inquiries, check transaction history, transfer funds, pay your bills, and buy prepaid loads.

The app was made possible through MCCB’s partner HSI Technologies. With HSI Technologies, MCCB can ensure that its mobile banking app is highly secure, efficient, and user-friendly. This is a major step forward for the cooperative bank, as it is the first in Northern Mindanao to integrate a digital payment system and make banking services more accessible to its clients, regardless of location or schedule.

Mindanao Consolidated Cooperative Bank Continues to Innovate and Expand with the Adoption of Digital Technology and Mobile Banking Services

As mentioned in the previous section, MCCB is the only cooperative bank in Northern Mindanao to develop and inaugurate the mobile banking app and digital payments to its system. It has taken a massive leap in bringing cooperative banking to the next level by adapting to technological changes and allowing its clients and users to bank conveniently. These changes made digital payments in a cooperative bank become more imperative, more common, more accessible, and more affordable to help accelerate the gradual transition to a cash-lite economy.

MCCB continues to serve not only its clients but also the underserved and underprivileged communities, thanks to the trust its clients have placed in the bank.

“Amidst the pandemic, MCCB has remained committed to uplifting the lives of our members. The challenges we have encountered allowed us to discover more opportunities and expand our operations to continue providing above-standard services and assistance to our clients. Moreso, MCCB continues its social responsibility efforts and works towards finding alternative ways of improving the standard of living of the members and the people in the communities we are serving. The social concerns of the bank are carried through our annual social assistance program and our annual charity donation,” said Ms. Myrna A. Sescon, President of the Mindanao Consolidated Cooperative Bank.

The continued faith and confidence of the clients and partner agencies are the strength that keeps MCCB moving forward for better competitiveness. At present, MCCB has a total of 21 offices (19 branches and 2 branch-lite units) all over Mindanao. It continues to aim for expansion to serve the people in the countryside, spur economic development, promote financial inclusivity, and touch lives.

Download the MCCB Online mobile app today via Google Play or App Store, and discover a better way to bank!

Also Read: What Are the Different Types of Cloud ERP, and Which One Should Your Company Use?

Leave a Reply