Estimated reading time: 6 minutes

Maternity is undoubtedly one of the most critical and exciting phases of a woman’s life. However, it is also a time when a woman’s healthcare and financial needs increase, creating significant stress and pressure. In the Philippines, it is essential for pregnant women to understand the Philhealth maternity benefits and how to avail them. These benefits are specifically designed to provide women with financial support for their medical needs related to childbirth, such as prenatal care, delivery, and post-natal care. This blog will detail the Philhealth maternity benefits that women can avail of, including requirements and processes.

Table of contents

What are Philhealth Maternity Benefits?

Paid Maternity Leave

Under the Expanded Maternity Leave Law (Republic Act 11210), the SSS pays qualified SSS members a cash benefit equivalent to 100% of their average daily salary credit.

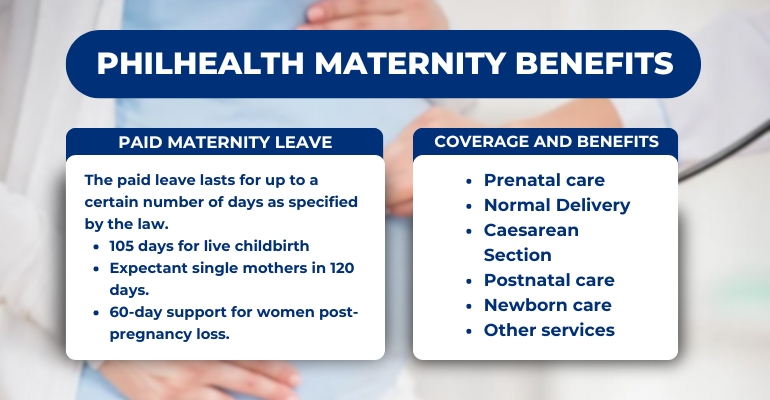

The paid leave lasts for up to a certain number of days as specified by the law:

- 105 days for live childbirth, regardless if it’s a normal or cesarean delivery

- 120 days for single mothers who are giving birth (105 days plus an additional 15 days)

- 60 days for women who had a miscarriage or emergency termination of pregnancy

Eligibility Requirements

- The woman must have made at least three months of contributions within the six-month period preceding her delivery if she is an employed member.

- If the woman is a voluntary member, she must have made at least nine months of contributions within the twelve-month period preceding her delivery.

- Contributions must be updated and paid on time to qualify for the benefits.

- The woman must be registered as a Philhealth member.

- The woman must have a valid Philhealth ID or Member Data Record (MDR).

Also Read: GUIDE: PhilHealth Hospitalization Coverage and Benefits

Coverage and Benefits

- Prenatal care – Philhealth covers the cost of prenatal checkups, laboratory tests, and medicines related to pregnancy.

- Normal Delivery – Philhealth covers the cost of normal delivery, including professional fees, room and board, and necessary medical supplies.

- Cesarean Section – Philhealth covers the cost of cesarean section delivery, including professional fees, room and board, and necessary medical supplies.

- Postnatal care – Philhealth covers the cost of postnatal care, including necessary follow-up checkups, laboratory tests, and medicines.

- Newborn care – Philhealth also covers the cost of essential newborn care such as newborn screening tests, immunization, and hospitalization for up to seven days after delivery.

- Other services – Philhealth also provides benefits for other necessary services related to maternity, such as emergency services, blood transfusions, and anesthesia.

How to Avail Philhealth Maternity Benefits

Requirements

To avail of Philhealth maternity benefits, a pregnant woman must submit the following requirements to the hospital or clinic where she will give birth:

- Philhealth Member Data Record (MDR)

- Philhealth Claim Form 1 (CF1)

- Valid ID and Philhealth ID

- Medical certificate indicating the expected delivery date

- Any other necessary medical documents

The hospital or clinic will then submit the Philhealth claim on behalf of the patient. The claiming process usually takes two to four weeks, depending on the completeness of the requirements and the efficiency of the hospital or clinic.

Common Problems and How to Address Them

Here are some of the common issues that women encounter and how to address them:

Incomplete Documents

One of the most common problems is incomplete documents. To address this, ensure that all necessary documents are complete and accurate before submitting them to the healthcare provider.

Unaccredited Healthcare Provider

Some healthcare providers may not be accredited by Philhealth, resulting in the denial of benefits. To avoid this, check if the healthcare provider is accredited by Philhealth before availing their services.

Exceeded Benefit Limit

Philhealth maternity benefits have a set limit. If the cost of medical expenses exceeds the benefit limit, the patient may need to pay for the excess amount. To avoid this, check with the healthcare provider or Philhealth beforehand to know the specific coverage and limit of the benefits.

Late Philhealth Contributions

If the woman’s Philhealth contributions are not updated and paid on time, she may not be eligible for maternity benefits. To avoid this, ensure that contributions are updated and paid regularly.

Denied Claim

If the Philhealth claim is denied, the patient or healthcare provider may file an appeal or request for a reconsideration of the claim. The appeal or reconsideration must be filed within 60 days from the receipt of the denial notice.

Also Read: PhilHealth Online Registration: 3 Easy Steps to Follow

Claiming Process and Timelines

Claim Submission

The healthcare provider will submit a claim for Philhealth benefits on behalf of the patient after childbirth. The claim should be submitted within 60 days from the date of discharge from the hospital.

Benefit Processing

Philhealth will process the claim and credit the benefit amount to the healthcare provider’s account or directly to the patient’s account, depending on the agreement between the healthcare provider and the patient.

Payment Timeline

The payment of benefits may take up to 60 days from the date of claim submission. However, Philhealth aims to process and release the benefits as soon as possible.

Reconsideration Process

If the claim is denied, the patient or healthcare provider may file for an appeal or reconsideration of the claim within 60 days from the receipt of the denial notice.

Other Tips and Reminders

Preparation Before Giving Birth

- Verify Philhealth membership

- Choose a Philhealth-accredited healthcare provider

- Know the benefit coverage

- Complete necessary documents

- Attend prenatal checkups

Private Health Insurance Options

Before choosing a plan, it is important to compare benefits, coverage, and costs from various providers and read the policy terms carefully. Some private health insurance providers in the Philippines that offer maternity coverage include Maxicare, Pacific Cross, and Pru Life UK.

Philhealth maternity benefits and maternity leave benefits are essential for pregnant women in the Philippines. These benefits can help cover the costs of prenatal care, delivery, and hospitalization expenses and provide financial support during and after childbirth. However, to fully avail of these benefits, it is important to be aware of the eligibility requirements, procedures, and timelines involved in the claiming process.

Final Thoughts

It is recommended that pregnant women start preparing for their maternity benefits and leave as early as possible to avoid any delays or complications in the claiming process. Overall, by availing of Philhealth maternity benefits and maternity leave benefits, pregnant women can focus on their health and the well-being of their newborns without worrying about the financial burden of childbirth. –WhatALife!/Jayve

Leave a Reply