If you’re already employed full-time in the Philippines, you might be familiar with the term “13th month pay.” However, how many of us truly understand what the 13th-month pay is, why it exists, and how to calculate it? Additionally, is there a 13th month pay calculator for the Philippines where we can input data and get an instant computation?

Let’s delve into these questions and provide a more comprehensive understanding of the 13th month pay.

Table of contents

- Understanding 13th-Month Pay in the Philippines

- Who is Eligible for the 13th Month Pay?

- How to Compute for the 13th Month Pay in the Philippines

- Steps to Computing your 13th month pay in the Philippines

- Payment of 13th-Month Pay in the Philippines

- Is 13th Month Pay Taxable in the Philippines?

- 13th-Month Pay vs. Christmas Bonus

- Penalties for Non-Compliance of 13th-Month Pay in the Philippines

- Resignations and Terminations

- 13th Month Pay in the Philippines: FAQs

Understanding 13th-Month Pay in the Philippines

In addition to annual salaries, 13th Month Pay is a mandatory yearly benefit for full-time rank-and-file employees. Established in Presidential Decree (PD) No. 851, this benefit was legalized in 1975 to assist Filipinos during the Christmas season.

So, how much is the 13th month pay? As mandated, it’s equivalent to one-twelfth (1/12th) of an employee’s total basic salary earned within the year. Private sector workers eligible for the 13th Month Pay in the Philippines receive an extra yearly bonus over and above their yearly wage.

Moreover, the Philippine Decree for calculating 13th Month Pay applies to all employers excluding those with significant losses, non-profit institutions with reducing income, the government, those already paying 13-month pay, employers of household helpers and personal service workers, and commission, boundary, or task-based workers. Despite amendments, the core framework of the law remains unaltered.

Who is Eligible for the 13th Month Pay?

According to PD No. 851, the 13th month pay is mandatory for most employees in the Philippines. Here’s a quick look at who is eligible or entitled to receive the 13th month pay:

- Rank and file employees

- Employees who have worked for at least one month

- Employees from the private sectors

For those wondering how many months it takes to get 13th month pay, an employee who has worked a minimum of one month during the year is entitled to the prorated portion of the benefit.

How to Compute for the 13th Month Pay in the Philippines

According to the law, the 13th-month pay equals one-twelfth of an employee’s annual salary earned within the same calendar year.

Steps to Computing your 13th month pay in the Philippines

So, how to compute the 13th month pay in the Philippines? You can use this simple formula to get the amount of your benefit:

(Total basic salary earned during the year) ÷ 12 = 13th Month Pay

Let’s apply this formula with an example. Employee X’s basic salary is ₱12,000. Their monthly earnings are as follows:

| Month | Status | Monthly basic salary |

| January | No absence | ₱12,000.00 |

| February | No absence | ₱12,000.00 |

| March | No absence | ₱12,000.00 |

| April | No absence | ₱12,000.00 |

| May | No absence | ₱12,000.00 |

| June | 5 days leave with pay | ₱12,000.00 |

| July | No absence | ₱12,000.00 |

| August | No absence | ₱12,000.00 |

| September | 2 days leave with pay | ₱12,000.00 |

| October | No absence | ₱12,000.00 |

| November | 1 day leave with pay | ₱12,000.00 |

| December | No absence | ₱12,000.00 |

According to the data above, the total basic salary earned in this calendar year is ₱144,000.00.

Therefore, Employee X’s thirteenth month pay is:

₱144,000.00 ÷ 12 = ₱12,000

How to Compute Prorated 13th Month Pay

If employees haven’t completed a full year of work by the time the 13th month benefit is calculated, only the basic pay for the actual months they’ve worked is considered. This is called a prorated 13th month pay. It ensures that employees who have worked for less than 12 months still receive a fair portion of the benefit.

For instance, Employee Y has worked for a company for 6 months and earns a monthly basic salary of ₱15,000, this is how to compute their 13th month pay:

(Monthly basic salary x 6 months) ÷ 12 = 13th Month Pay

(₱15,000 x 6) ÷ 12 = ₱7,500

How to Compute 13th Month Pay with Absences

As mentioned previously, your 13th month pay is based on the basic salary you received in a year. So, if you have unpaid absences within the year, it will affect the total amount of your 13th month pay because it reduces the annual salary. Here’s how to compute your 13th month pay if you have absences:

(Annual salary – unpaid absences) ÷ 12 = 13th Month Pay

For a clearer picture, we’ll apply this formula to an example. Let’s say Employee Z earns a monthly basic salary of ₱13,000 and has missed working days that resulted in ₱1,000 worth of unpaid absences throughout the year:

Annual salary: ₱13,000 x 12 = ₱156,000

13th month pay: (₱156,000 – ₱1,000) ÷ 12 = ₱12,916

How to Compute the 13th Month Pay Using a 13th Month Calculator

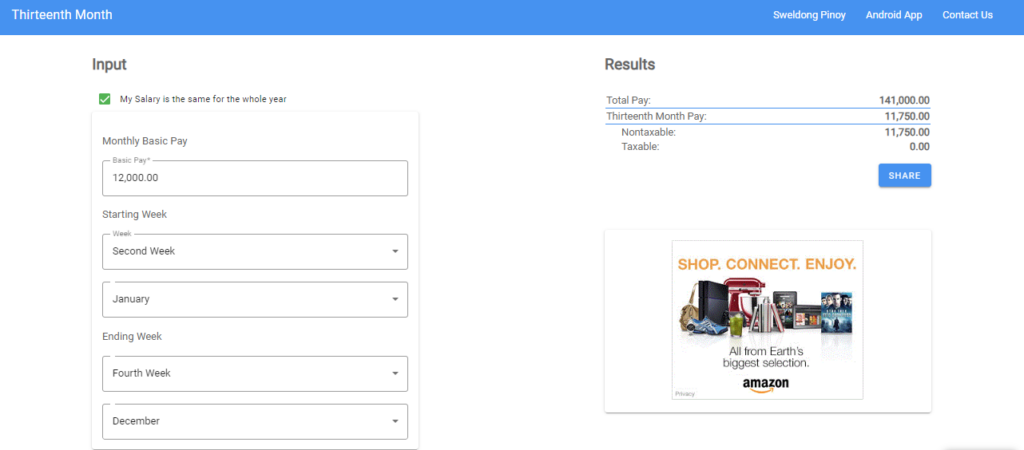

There is an easier way to calculate 13th Month Pay in the Philippines, Sweldong Pinoy offers a 13th month pay computation calculator online.

Here is an example of how to use the 13th month pay computation calculator:

If your salary is not the same for the whole year, you can uncheck the box and manually enter the data for every month.

Payment of 13th-Month Pay in the Philippines

So when is 13 the month pay given in the Philippines? As mandated by PD No. 851, the 13th month pay is given on or before December 24.

Some companies split the 13th month pay into two installments, giving half in the middle of the year (typically in June) and the remaining half in December. However, employers should pay the full amount by December 24 to avoid penalties from the Department of Labor and Employment (DOLE).

If, for some reason, you can’t personally claim your 13th month, you can have a representative get it for you. Depending on your company’s policy, they might need to present an authorization letter signed by you, allowing the representative to claim your 13th month pay. Sometimes, employers may require them to present a valid ID from you and your representative for verification.

Is 13th Month Pay Taxable in the Philippines?

In the Philippines, 13th month pay is non-taxable to a certain limit. Per the country’s tax laws, 13th month pay and other bonuses are tax-exempt up to ₱90,000. This means that if an employee’s 13th month pay doesn’t exceed ₱90,000, it’s not subject to income tax.

However, any amount exceeding the ₱90,000 threshold will be subject to the standard income tax rate based on the employee’s tax bracket.

13th-Month Pay vs. Christmas Bonus

Although employees receive the 13th month pay and Christmas bonus around the same time of the year, these are two different forms of compensation.

The main difference is that employers are required by law to pay the 13th month, while they’re not required to provide a Christmas bonus. Bonuses are often given at the employer’s discretion as a gesture of goodwill or as part of the company’s policy. The amount can vary and isn’t calculated like the 13th month pay.

Penalties for Non-Compliance of 13th-Month Pay in the Philippines

As mentioned, 13th month pay is mandatory for all employers in the Philippines. Failure to comply with this requirement can lead to penalties imposed by DOLE. This may include fines for non-compliance or failure to report the non-payment of the 13th month pay.

In addition, employees who didn’t receive their 13th month pay can file a report with DOLE or pursue a case in court. If the case is proven, employers could be liable for additional costs and legal fees.

Resignations and Terminations

In the Philippines, resigned employees are still entitled to receive their 13th month pay, even if they leave the company before the end of the year. Even after resignation, their prorated 13th month pay will be released within the same timeline as other employees – which is on or before December 24.

According to DOLE, employees who have gone Absent Without Official Leave (AWOL) are entitled for the 13th month pay. The amount will be based on the months they worked within the company during that year. However, If their AWOL status leads to termination, they’ll no longer be eligible for the benefit after their termination date.

13th Month Pay in the Philippines: FAQs

If you have more questions about the 13th month pay in the Philippines, here is additional information:

Are government employees entitled to 13th month pay?

No, government employees are not eligible to receive a 13th-month pay increase. They’re covered by the Salary Standardization Law, so they receive different benefits, such as a mid-year bonus and other incentives.

Are contractual employees entitled to 13th month pay in the Philippines?

Yes, contractual employees are eligible to receive 13th month pay in the Philippines, as long as they worked within the company for at least one month during the calendar year.

Is maternity leave included in the 13th month pay?

No, maternity leaves are not included in the 13th month pay computation. If an employee were on maternity leave within the year, they’d only receive the prorated amount of their 13th month pay.

How much is the 13th month pay of SSS Pensioners?

SSS Pensioners are entitled to receive a 13th-month pension amounting to ₱1,000. This is an additional benefit on top of their monthly pension.

Is overtime included in 13th month pay?

Overtime is not included in the 13th month pay computation. The benefit only counts an employee’s monthly basic salary.

Is holiday pay included in 13th month pay?

Extra compensation from holiday pay is not included in the 13th month pay calculation because it’s not included in an employee’s base salary.

Are probationary employees entitled to 13th month pay?

Yes, probationary employees are entitled to 13th month pay as long as they have worked for at least one month. They will receive a prorated amount of their 13th month pay depending on the number of months they’ve been working within the company.

Sources: (1), (2), (3), (4), (5), (6)

Keep Reading: WhatALife-How-To-Guide-Articles

Leave a Reply