If you’re an SSS member and a consistent contributor, you’re in luck! You can now process your loan in the safety of your home through the My.SSS portal. Just provide the necessary documents and make sure to meet the requirements, and you will receive your loan funds in no time.

One of the services the Philippine Social Security System (SSS) offers is the SSS salary loan.

SSS Salary Loan Details

Let us uncover first what is an SSS Salary Loan. This cash loan is available for qualified, employed members for short-term financial needs. SSS loans have low interest rates unlike any other. The amount you can loan will also be based on your existing contributions, which means the funds loaned are partly yours

SSS Loan Eligibility Requirements

SSS members are eligible for the salary loan if they meet the following requirements:

- At least 36 months of consistent contribution;

- Currently employed with the employer for at least a year;

- Monthly contributions must be up-to-date;

- Has not been granted the final benefit such as total permanent disability, retirement, or death;

- Must be under the age of sixty-five (65) at the time of the application; and

- Has not committed fraud against SSS.

A one-month salary loan is equivalent to the average of the borrower’s latest posted 12 Monthly Salary Credits (MSCs) or the amount applied for, whichever is lower. Meanwhile, a two-month salary loan is equivalent to twice the average of the borrower’s latest poster 12 MSCs, rounded to the next higher monthly salary credit, or amount applied for, which is lower. The net amount of the loan shall then be the difference between the approved loan amount and all outstanding balance short-term member loans.

Note: The amount of the loan will be based on the SSS member’s total contribution.

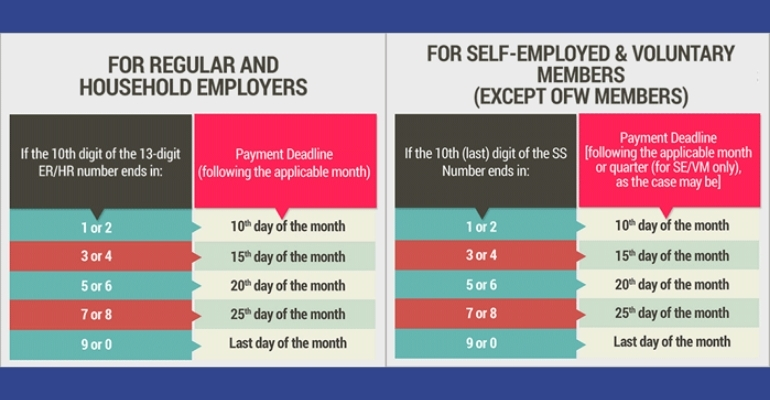

Schedule of Payment

According to SSS, the loan shall be payable within two (2) years in 24 monthly installments. Monthly amortizations will then start on the 2nd month following the date of the loan, which is due on or before the payment deadline. Refer to the image below for an example.

You can make payments at any nearby SSS branch, SSS-accredited bank, or SSS-authorized payment center.

Service Fee

A one percent service fee will be deducted from the loan amount.

Loan Renewal

SSS member-borrower is eligible to renew the loan after payment of at least 50 percent of the original principal amount and at least 50 percent of the term has lapsed. Accordingly, proceeds of the renewal loan are any amount greater than or equal to zero as long as the outstanding balance on the previous loan is deducted.

In case the member-borrower transfers employment, he/she must submit to his/her new employer an updated statement of account of any outstanding loan balance with SSS and allow his employer to deduct from his/her salary, the corresponding amortization due, including any interest,/or penalty for late remittance. (Source)

Continue reading below to learn the step-by-step process of how to apply for an SSS salary loan.

SSS Salary Loan Online Process

The step-by-step guide to applying for an SSS Salary Loan online is as follows:

Step 1: Got to My.SSS Portal via browser

Go to https://www.sss.gov.ph/ and check the box under the “I’m not a robot” pop-up.

Step 2: Select Member’s Log-in

Select the ‘Member’ button to access the member’s login page. Once directed, input your My.SSS User ID and password. Don’t forget to tick the “I’m not a robot” box before hitting the ‘Submit’ button.

- In case you forgot your user ID and/or password, simply select the “Forgot User ID or Password?” link under the ‘Submit’ button. You’ll then be directed to a page where you’ll need to enter your user ID or email address. Click ‘Submit’ and check your email for instructions from SSS about the retrieval or reset of your My.SSS account login information.

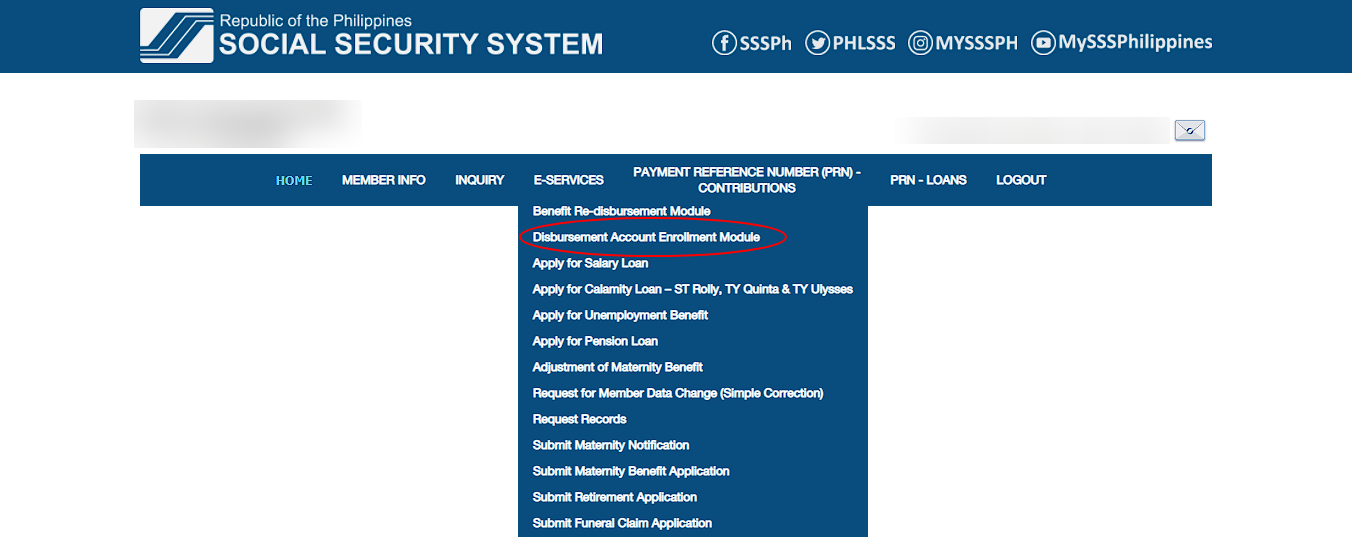

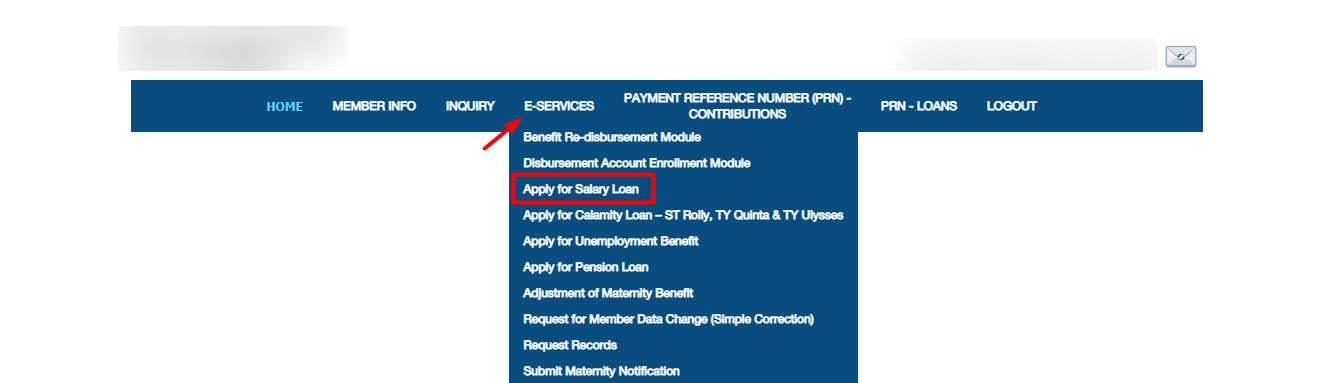

Step 3: Select E-Services

In the menu bar, hover over the E-Services and click the ‘Disbursement Account Enrollment Module’ for those who haven’t submitted any supporting documents and-or bank details. Read and take note of the reminders before proceeding.

Here are some important reminders to keep in mind:

A. Bank account details and mobile numbers should be valid and active and should not be among the following:

- Closed account;

- Dormant account;

- Account name differs from the member name;

- Dollar account;

- Frozen account;

- Incorrect bank account;

- Invalid mobile number;

- Joint account;

- Not an existing account;

- Different disbursing banks;

- Prepaid account;

- Time deposit account;

- An account with restrictions; or

- Duplicate accounts/numbers.

Accounts that meet the following will be automatically rejected.

B. Make sure that you triple-check the information you submit and that you have filled out all fields required with the correct information;

C. Disbursement of loan proceeds shall be through PESONet participating banks;

D. In case of errors in encoded/provided details or invalid or closed disbursement accounts, the re-disbursement or re-crediting of your benefit may take at least thirty (30) days of the process;

E. Last but not least, upload proof of disbursement account is required. Only verified/approved accounts shall be used for disbursement of loan/benefit proceeds by the SSS.

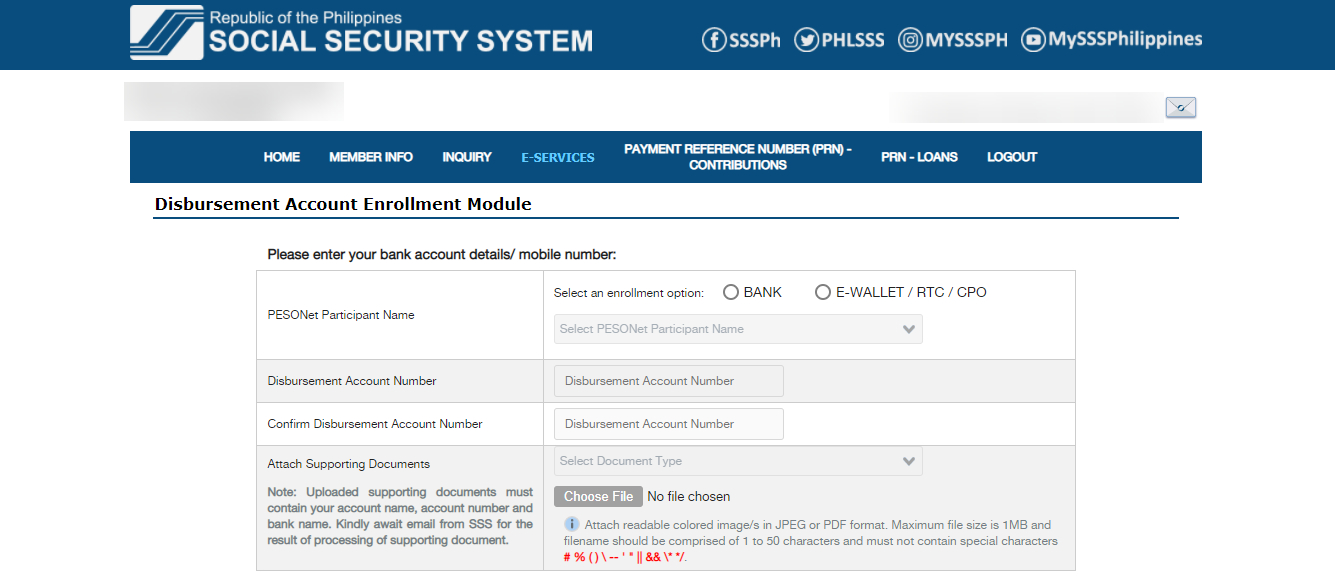

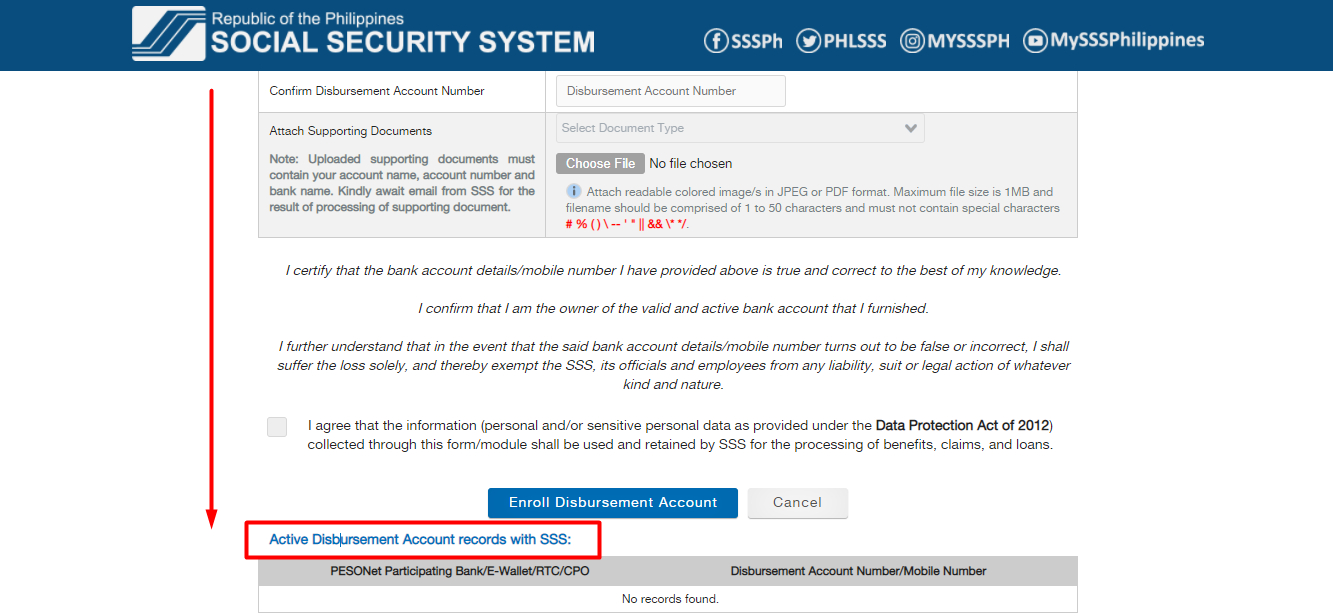

Step 4: Provide Bank Details

Provide the bank account details and-or mobile number for the E-wallet where you want to receive your money. Note: Attached documents must not exceed 1MB, so make sure to compress documents and resize images using apps found on mobile app stores or desktop software (.zip)

Step 5: Wait for SSS approval

Wait for a couple of days for the SSS approval of your preferred bank and-or E-wallet. Once approved, you may now proceed with your SSS salary loan application.

Step 6: Select Apply for Salary Loan

On your menu bar, hover over E-Services and select Apply for Salary Loan (or other types of loan of your choice) to get started.

You will see your Loanable amount available, under which you select your preferred bank. Scroll down and read the member’s reminders before ticking the “I agree to the Terms and Conditions box.” Click ‘Proceed’. Take note of the monthly payment terms and due dates.

Step 7: Review your Application

Review your application before hitting the Submit button. Take note of your transaction number for future inquiries.

After 2-3 days, you will receive your Salary Loan funds via your preferred bank.

Frequent Questions and Answers

Here are some of the common inquiries SSS members made in regard to the loans and the following processes:

How will I know if my SSS loan is approved?

You can visit your SSS account online and click on “Inquiry” and then “Loan Info” afterward. You’ll be able to see your loan status and other necessary details.

How many days will it take before my SSS loan is released?

Your SSS loan will be available within 3-5 working days upon the approval date. You will be able to see it under your account.

How much is the first loan in SSS?

Your loan is equivalent to one month’s worth of your work salary. Conditions include you having completed at least 36 months of total contributions, 6 months months which have been posted in the last 12 months.

Closing Thoughts

Going through the guide, you will easily navigate and apply for your SSS salary loan. This loan is a quick answer to making necessary purchases with little hassle. For any concerns and inquiries, contact the SSS hotline at 1455 / Toll-Free No. 1-800-10-2255777 / SSS email at member_relations@sss.gov.ph – WhatALife.ph

Keep Reading: How to Register to My.SSS Online: Your Ultimate Guide 2021

Leave a Reply