As the financial landscape in the Philippines continues to evolve, one key element that remains vital for savers and investors is the bank interest rate. Find out the current bank interest rates in the Philippines this 2023 in this blog to help you make informed decisions about your finances.

What is a Bank Interest Rate?

A bank interest rate is the amount that a bank pays to customers for depositing their money into an account. It is also the amount of interest that the bank charges for lending money to its customers. Interest rates are determined by several factors, including inflation, the supply and demand for credit, and government policies. When the central bank raises interest rates, banks charge higher interest rates on loans and offer higher interest rates on savings accounts.

Types of Interest Rates

The nominal interest rate, the effective rate, and the real interest rate are the fundamentally three different categories of interest rates.

- Nominal Interest Rate – The declared rate on which interest payments are computed is known as the nominal interest on an investment or loan. In essence, this is the rate at which interest is earned on savings over time. An investment of 10,000 pesos at a nominal interest rate of 5% over a year, for instance, would return 500 pesos to the investor.

- Effective Rate – Throughout the course of the investment’s whole term, compounding is taken into account. It is frequently used to compare yearly interest rates with various periods for compounding (daily, monthly, annually, etc.). Hence, a nominal interest rate of 5% compounded quarterly would translate into an effective rate of 5.095%, 5.116% compounded on a monthly basis, and 5.127% compounded on a daily basis.

- Real Interest Rate – For analyzing how inflation affects nominal interest rates, the real interest rate is helpful. In essence, the nominal interest rate is subtracted from the real interest rate to account for inflation. This implies that the real interest rate is practically zero if the nominal interest rate is 5% and the inflation rate is also 5%.

Current Bank Interest Rate in the Philippines in 2023

During its meeting in March 2023, the Philippines’ central bank increased its overnight borrowing rate by 25 basis points to 6.25%, confirming market forecasts and driving borrowing costs to their highest level since 2007. That was the second increase in a row this year despite ongoingly high inflation, which was 8.6% in February and was just shy of the 14.2-year high of 8.7% set the month before. The current inflation rate was still much higher than the 2%–4% objective set by authorities. In the meanwhile, the inflation predictions for 2023 and 2024 were both reduced, with an average of 6% (down from 6.1% earlier) and 2.9% (down from 3.1%), respectively.

The below table shows the Bank Interest Rate in the Philippines from Apr 2022 – Apr 2023

Best High-Interest Savings Accounts in the Philippines

Here are the top 10 high-yield savings accounts in the Philippines with the latest interest rates ranked from highest to lowest.

| NAME | INTEREST | AFTER 1 YEAR |

| ING Savings Account | 2.5% | 2,500.00 |

| GSave by CIMB Philippines | 2.6% | 2,600.00 |

| Citibank Peso Bonus Saver Account | 1.66% | 1,660.00 |

| BDO Optimum Savings Account | 1.25% | 1,250.00 |

| Security Bank eSecure Savings Account | 0.70% | 700.00 |

| BPI Family Savings Bank Advance Savings Account with Passbook | 0.625% | 625.00 |

| Security Bank Premium Build Up Savings Account | 0.074% | 74.50 |

| Sterling Bank of Asia Bayani OFW Savings Account | 1.00% | 1000 .00 |

| Citibank e-Savings Account | 0.75% | 750.00 |

| BPI Advance Savings account with Passbook | 0.0625% | 62.50 |

| Citibank Peso High Rate Saver | 0.70% | 700.00 |

| Equicom ATM Savings Account | 0.125% | 125.00 |

As you can see, it’s obvious that how much money you’ll make in a year or ten years depends significantly on the interest rates that banks provide. The highest GSave by GSave offers P2,600 after a year, compared to the lowest P74.50. It is a difference of nearly 40 times.

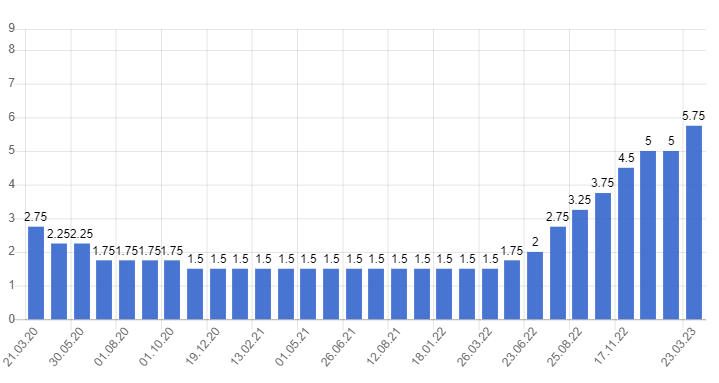

Latest Data on Deposit Interest Rate in the Philippines from 2020 – 2023

Bank Deposit Interest Rate in the Philippines increased to 5.75 % in March 2023. The maximum rate was 4.25 % and minimum was 1.5 %.

Factors Affecting Bank Interest Rates

A. Inflation Rates

Inflation is one of the main factors that affect bank interest rates. Inflation is the rate at which prices for goods and services rise over time. When inflation increases, it reduces the purchasing power of money, which means that the same amount of money will be able to buy fewer goods and services than before. To keep up with inflation, banks need to offer higher interest rates to attract depositors and maintain the value of their money.

B. Economic Conditions

Economic conditions such as the GDP growth rate, unemployment rate, and the level of economic activity in the country can also impact bank interest rates. In a growing economy, banks may increase interest rates to attract more deposits, while in a slow economy, banks may lower interest rates to encourage borrowing and stimulate economic activity.

C. Central Bank Policies

Central banks play a significant role in determining bank interest rates. The central bank sets the benchmark interest rate, which is the rate at which banks can borrow money from the central bank. When the benchmark interest rate is high, banks may increase their interest rates to maintain their profitability, and when the benchmark interest rate is low, banks may lower their interest rates to remain competitive.

The current bank interest rates in the Philippines are subject to change due to various economic and policy factors. As of the latest data available, the top banks in the Philippines offer competitive rates for savings accounts, time deposits, and loan interest rates.

Consumers should regularly monitor the current bank interest rates to ensure that they are getting the best deal on their financial products. When choosing a bank or account type, it is important to compare interest rates and terms among different institutions. By keeping track of the latest interest rates and making informed decisions, consumers can maximize their savings and reach their financial goals. – WhatALife!/Jayve

Sources: (1), (2), (3), (4), (5)

Also read: GUIDE: How to Get a BIR Permit?

Leave a Reply