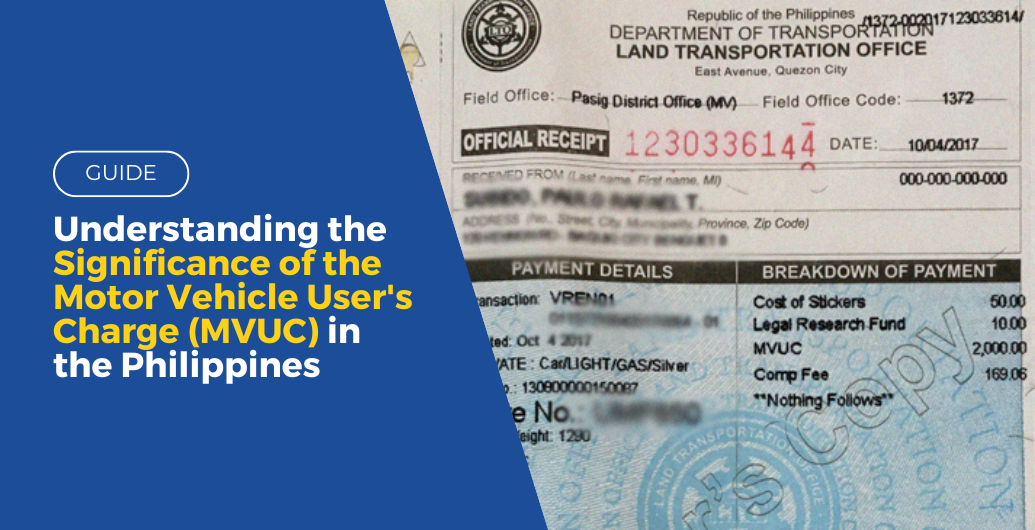

In the Philippines, vehicle owners are required to register their vehicles after purchase. However, the process doesn’t conclude there, as citizens must also fulfill specific fees, including the one we’ll discuss here: the Motor Vehicle User’s Charge (MVUC) collected by the Land Transportation Office (LTO).

If you’ve recently acquired a vehicle, it’s crucial to comprehend the significance and operation of these fees. Owning a car in the Philippines entails several mandatory fees, and the MVUC is one of the significant charges you’ll encounter. This article aims to offer readers a concise overview of the MVUC.

Table of Contents

What is the meaning of LTO MVUC?

MVUC, which stands for the Land Transportation Office Motor Vehicle User’s Charge, is commonly referred to as the road users’ tax. This charge is levied during vehicle registration and primarily serves the purpose of financing the upkeep of national and provincial roads, as well as mitigating the environmental impact of vehicle-related air pollution.

However, the MVUC varies depending on numerous factors. These factors include vehicle type, gross vehicle weight (GVW), and year model, among others. While the likelihood of citizens making incorrect payments at the LTO is minimal, it’s always advantageous to have prior knowledge of the MVUC and other LTO fees you’ll be required to pay when you visit the agency to register your vehicle.

Also Read: GUIDE: LTO Car Registration Renewal

List of LTO MVUC and Other LTO Fees

Now that you’ve understood the function and the meaning of MVUC, we’ll be discussing the rates and other LTO fees you’ll most likely encounter along the process as soon as you reach the LTO office for your vehicle registration transactions.

MVUC Fee for Private and Government Car Registration or Renewal

- Car Type and Weight: Motorcycle without sidecar

- MVUC: PHP 240.00

- Car Type and Weight: Motorcycle with sidecar

- MVUC: PHP 300.00

- Car Type and Weight: Light passenger cars (Up to 1,600 kg)

- MVUC: PHP 1,600.00

- Car Type and Weight: Medium passenger cars (1,601 kg to 2,300 kg)

- MVUC: PHP 3,600.00

- Car Type and Weight: Heavy passenger cars (2,301 kg and above)

- MVUC: PHP 8,000.00

- Car Type and Weight: Utility vehicles (Up to 2,700 kg)

- MVUC: PHP 2,000.00

- Car Type and Weight: Utility vehicles (2,701 kg to 4,500 kg)

- MVUC: PHP 2,000.00 + 0.40 x gross vehicle weight (GVW) in excess of 2,700 kg

- Car Type and Weight: SUVs (1991 models and above) (Up to 2,700 kg)

- MVUC: PHP 2,300.00

- Car Type and Weight: SUVs (1991 models and above) (2,701 kg to 4,500 kg)

- MVUC: PHP 2,300.00 + 0.46 x GVW in excess of 2,700 kg

- Car Type and Weight: Trucks and truck buses (4,501 kg and above)

- MVUC: PHP 1,800.00 + 0.24 x GVW in excess of 2,700 kg

- Car Type and Weight: Trailers (4,501 kg and above)

- MVUC: PHP 0.24 x GVW

LTO MVUC Fee For Aged Private Vehicles

- Car Type and Weight: Light cars (models from 1995 to 2000) (Maximum of 1,600 kg)

- MVUC: PHP 2,000.00

- Car Type and Weight: Light cars (models from 1994 and older) (Maximum of 1,600 kg)

- MVUC: PHP 1,400.00

- Car Type and Weight: Medium cars (models from 1997 to 2000) (1,601 kg to 2,300 kg)

- MVUC: PHP 6,000.00

- Car Type and Weight: Medium cars (models from 1995 and 1996) (1,601 kg to 2,300 kg)

- MVUC: PHP 4,800.00

- Car Type and Weight: Medium cars (models from 1994 and older) (1,601 kg to 2,300 kg)

- MVUC: PHP 2,400.00

- Car Type and Weight: Heavy cars (models from 1994 and older) (2,301 kg and above)

- MVUC: PHP 12,000.00

- Car Type and Weight: Heavy cars (models from 1994 and older (2,301 kg and above)

- MVUC: PHP 5,600.00

MVUC Fee For Hire Vehicles

- Car Type and Weight: Motorcycles/Tricycles

- MVUC: PHP 300.00

- Car Type and Weight: Light passenger cars (Up to 1,600 kg)

- MVUC: PHP 900.00

- Car Type and Weight: Medium passenger cars (1,601 kg to 2,300 kg)

- MVUC: PHP 1,800.00

- Car Type and Weight: Heavy passenger cars (2,301 kg and above)

- MVUC: PHP 5,000.00

- Car Type and Weight: Utility vehicles (Up to 4,500 kg)

- MVUC: PHP 0.30 x GVW

- Car Type and Weight: Sport Utility Vehicles (SUVs) (Up to 2,700 kg)

- MVUC: PHP 2,300.00

- Car Type and Weight: Sport Utility Vehicles (SUVs) (2,701 kg to 4,500 kg)

- MVUC: PHP 2,300.00 + 0.46 x GVW in excess of 2,700 kg

- Car Type and Weight: Truck buses (4,501 kg and above)

- MVUC: PHP 0.30 x GVW

- Car Type and Weight: Trailers (4,501 kg and above)

- MVUC: PHP 0.24 x GVW

Penalties, Charges, and Other Fees Related to MVUC

- For vehicles beyond the registration week – PHP 200.00

- Beyond the registration month but not over 12 months – 50% of the MVUC rate

- Over 12 months beyond the registration week but without apprehension for violation of the LTO laws, rules, and regulations during the period of delinquency – 50% of the MVUC rate + renewal

- More than 12 months beyond the registration week but with apprehension for violation of LTO laws, rules, and regulations during the period of delinquency (Circular No. 83C-DIR-20) – 50% of the MVUC rate + renewal for every year of delinquency

- Overloading provided that no axle exceeds 13,500 kg – 25% of the MVUC at the time of infringement for trucks and trailers with a load exceeding more than 5% of registered GVW

Other LTO Fees and Charges

Accreditation fee for manufacturers, assemblers, importers, rebuilders, and dealers (MAIRD)

- Application Fee – PHP 500.00

- Accreditation Fee – PHP 3,000.00/classification

- Renewal Fee – PHP 1,000.00/classification, 100% of renewal fee/classification/year (penalty for late renewal)

Also Read: GUIDE: LTO Car Registration Renewal

Storage fee

- Fee: PHP 45.00

Administrative fine for the accreditation fees above

- First offense – PHP 100,000.00

- Second offense – PHP 500,000 and a suspension of not more than six months

- Third offense – Cancellation of Certificate of Accreditation

Transfer of MV ownership

- PHP 50.00/transfer

Accreditation fees for other entities

- PHP 1,000.00 (Certificate Fee for both individual and no dollar importation)

- Tax-exempt – PHP 100.00

Top load fee

- PHP 150.00 (buses)

- PHP 100.00 (cars and utility vehicles)

Certification of Data on MV stock report

- PHP 30.00

MVIC emission test fee

- PHP 40.00 (MC/TC)

- PHP 90.00 (UV)

- PHP 115.00 (trucks/buses)

Special Permit Fee

- PHP 20.00/day (not to exceed 7 days)

MVIC inspection fee

- PHP 50.00 (MC/TC)

- PHP 50.00 (UV)

- PHP 75.00 (trucks/buses)

Certificate of Tax Payment per Motor Vehicle

- PHP 30.00

District Office Inspection fee for the use of another District Office

- PHP 30.00

Annotation of Mortgage

- PHP 100.00

New/initial registration regular motor vehicle plate

- PHP 450.00

Change classification

- PHP 30.00

New/initial registration MC/TC plate

- PHP 120.00 (per piece)

Change chassis

- PHP 30.00

New/initial registration trailer plate

- PHP 225.00

Change color

- PHP 225.00

Validation and plate year tags

- PHP 50.00

Change denomination

- PHP 30.00

Replacement of validation stickers

- PHP 200.00

Change engine

- PHP 30.00

Duplicate and replacement of plates

- PHP 450.00 (MV plate)

- PHP 120.00 (MC/TC plate)

- PHP 225.00 (trailer plate)

- PHP 450.00 (regular placement plate)

Change of tire size

- PHP 30.00

Vanity plates

- For auction (limited edition)

- PHP 15,000 (premium edition)

- PHP 10,000 (select edition)

Change of venue of MV registration

- PHP 100.00

Special plates

- PHP 25,000 (GMA-01; AAA-07; ARL-77), PHP 15,000 (DPJ-100; (JPG-100; MMN-100)

- PHP 15,000 (MCM-707; DML 168; MTS-808)

Confirmation/Certification/Verification/Clearance Fee

- PHP 30.00

Deed of assignment fee

- PHP 100.00

Duplicate/replacement of OR/CR

- PHP 30.00

Penalty for late transfer

- PHP 150.00/transfer

Change body design

- PHP 100.00

Carrying capacity

- PHP 100.00

Reactivation fee

- PHP 30.00

Recording fee

- PHP 500.00

Revision of gross weight vehicle

- PHP 30.00

Revision of record

- PHP 30.00

Conclusion

By following the LTO’s rules and regulations, you can easily avoid various fees. When you have knowledge about these charges, it facilitates a smooth registration process and ensures compliance with legal requirements.

In addition, it’s important to note that the LTO Motor Vehicle User’s Charge (MVUC) is mandatory and must be addressed at the time of purchasing a car.

If you’re seeking more valuable insights to enrich your everyday experiences, feel free to delve into WhatALife’s guide articles here!

Frequently Asked Questions (FAQs)

If you want to learn more about LTO’s MVUC, here are answers to frequently asked questions:

What is the MVUC charge from LTO?

The MVUC is the road user’s tax that’s collected during vehicle registration. The government uses it to help fund national and provincial road maintenance. As well as to address the air pollution caused by motor vehicles in the country.

Which vehicles are covered by MVUC?

All motor vehicles are covered by the MVUC, whether they’re for hire, private, or government use.

What is the MVUC rate charge from LTO?

The MVUC rate charges depend on the cart type and weight. you can refer above for the complete list.

Keep Reading: GUIDE: Deed of Sale of Motor Vehicles

Leave a Reply