Estimated reading time: 6 minutes

Graduating from college is an exciting milestone, but stepping into the workforce comes with responsibilities including securing your Taxpayer Identification Number (TIN).

If you’re a fresh graduate about to start your first job, here’s everything you need to know about applying for a TIN from the Bureau of Internal Revenue (BIR).

Table of contents

What is a TIN and Why Do You Need It?

The TIN is a unique identifier assigned to individuals and businesses for tax purposes.

If you’re employed, your employer will require your TIN for tax deductions and government contributions.

It’s also necessary for various transactions like opening a bank account, applying for loans, or securing government-issued IDs.

Who Should Apply for a TIN ID?

Fresh graduates entering the workforce for the first time should apply for a TIN. If you’ve never had one before, you’ll need to register as an employee under the correct BIR form.

Steps to Apply for a TIN as a Fresh Graduate

Starting your first job comes with new responsibilities, including getting your Taxpayer Identification Number (TIN).

The BIR offers both online and walk-in application processes, and we’ll walk you through a method that combines both for convenience and efficiency.

This step-by-step guide is based on our personal experience, ensuring you have the most practical approach to securing your TIN hassle-free.

1. Determine Your Employment Status

- If you’re employed, your employer will typically assist in processing your TIN.

- If you’re a freelancer or self-employed, you’ll have to apply as a taxpayer under a different category.

2. Prepare the Required Documents

- BIR Form 1902 – Application for Registration (for employees)

- Valid government-issued ID (e.g., passport, birth certificate, or school ID with a transcript of records)

- A copy of your job contract or employer’s certificate of employment (COE)

- Your employer’s BIR-registered TIN and RDO (Revenue District Office) details

3. Apply for a TIN (Online or In-Person)

- Online Application: If eligible, you can apply via the BIR’s Online Registration and Update System (ORUS). Create an account on the BIR website, fill out the necessary forms, and follow the instructions for submission.

- In-Person Application: Visit the BIR Revenue District Office (RDO) where your employer is registered if online registration is not available for your case.

4. Wait for Your TIN

Once submitted, processing usually takes a few days. Your TIN will be issued, and you’ll receive a TIN card or a printed TIN verification slip. Online applicants may receive their TIN electronically.

5. Use Your TIN Properly

- Provide your TIN for tax-related transactions.

- Do not apply for multiple TINs, as having more than one is illegal and subject to penalties.

Benefits of a BIR Digital TIN ID

- Improved Security: The digital TIN ID reduces fraud and tampering risks with advanced security features.

- Primary ID with QR Code: Each digital TIN ID contains a unique QR code for authenticity verification.

- Portability & Accessibility: Stored on your smartphone or device, eliminating loss or damage.

How to Get a BIR Digital TIN ID

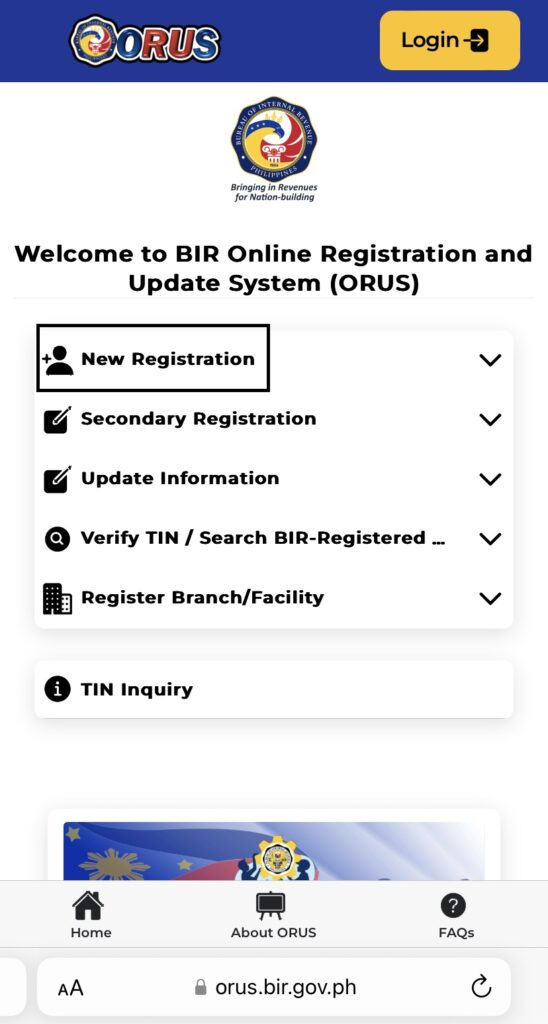

1. Visit the ORUS Website

Go to the BIR’s Online Registration and Update System (ORUS) website.

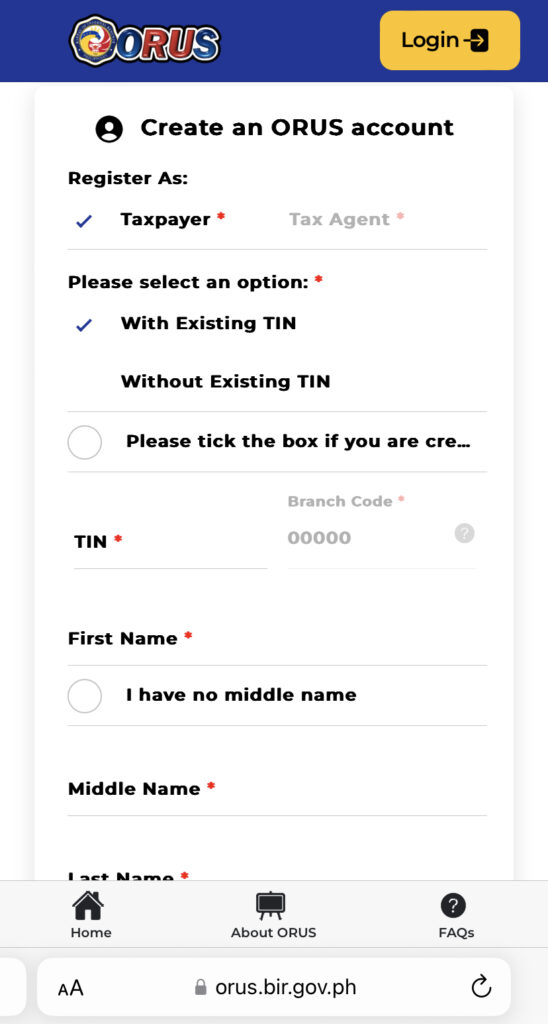

2. Create an ORUS Account

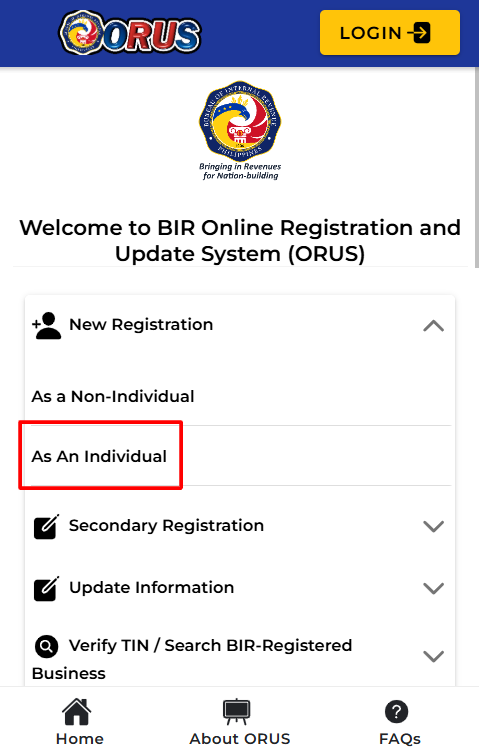

- Click “As an Individual” to begin.

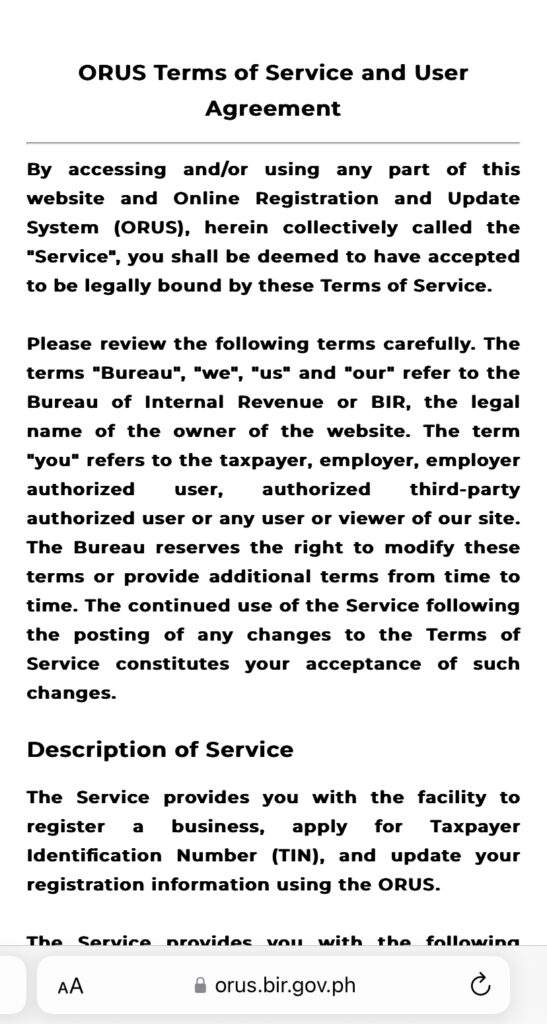

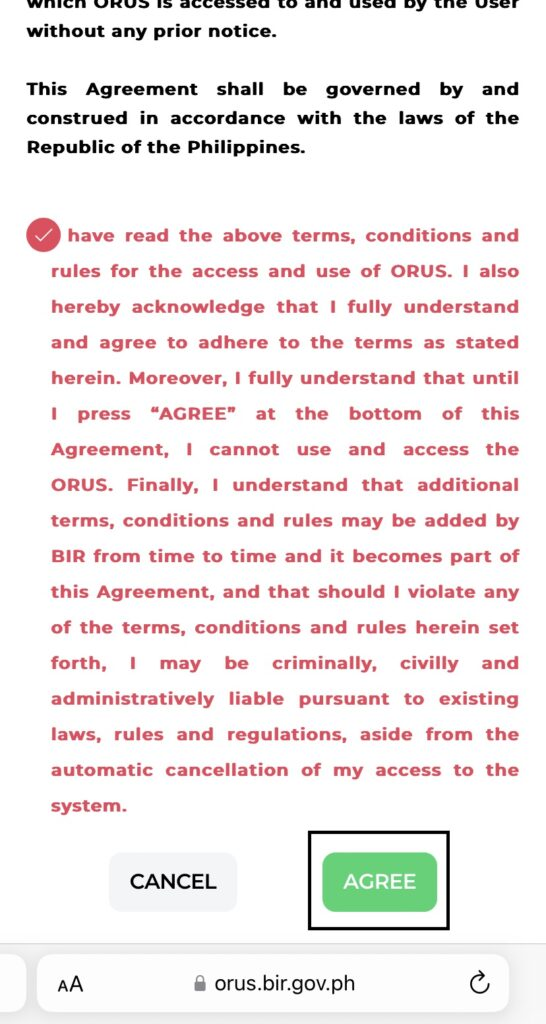

- Read the terms and conditions, then proceed.

- Register as a “Taxpayer” and select “With Existing TIN.”

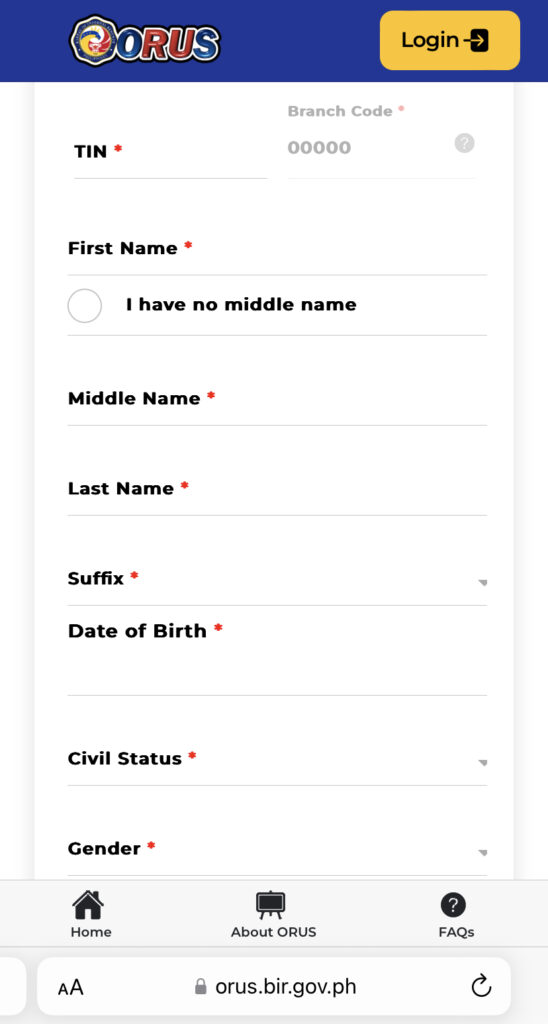

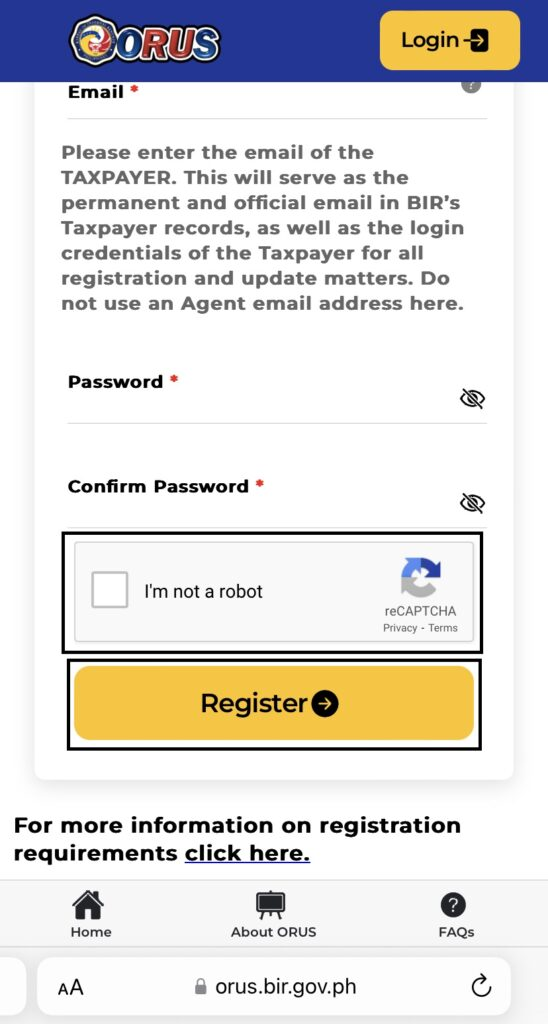

- Input necessary details and complete verification.

Also Read: Guide: How to Verify your BIR TIN

3. Confirm Your Registration Via Email

After inputting the required information, the system will send a verification message to your registered email.

4. Log in with Your New ORUS Account

Once verified, log in using your credentials and complete the CAPTCHA.

5. Select ‘Get Your Digital TIN ID’

Once logged in, click ‘Get Your Digital TIN ID’ to view and download your ID.

6. Read the Instructions and Upload Photo

Upload a recent 1×1 photo following BIR’s instructions, then confirm details.

7. Download Your Digital TIN ID

Once processed, download your digital ID for use in various transactions.

Important Reminders for Using Your Digital TIN ID

- Keep your digital ID secure – Store it safely and avoid sharing it unnecessarily.

- Only use it for authorized transactions – Government, employment, and financial institutions require it.

- Verify before sharing – Confirm the legitimacy of any entity requesting your ID.

- Report loss or compromise immediately – Contact BIR for security concerns

Conclusion

Getting your TIN is an important step toward starting your career.

While it may seem like just another requirement, securing it early ensures you can smoothly transition into the workforce without any tax-related issues.

If in doubt, seek guidance from your employer or visit the official BIR website for updates.

Now that you’re equipped with this knowledge, you’re one step closer to becoming an adult!

How to Get a Digital TIN ID: FAQs

Yes, the digital TIN ID is accepted as a valid government-issued ID.

It is applicable for employment requirements, banking, government transactions, and more.

Scan the QR code on your ID using your smartphone to verify authenticity.

Yes, but physical copies may not always be available. The digital version is more accessible.

It is free. Avoid fixers who charge for it.

No, it is a permanent government-issued ID.

Yes, you can download and print your digital TIN ID for transactions requiring a hard copy.

Sources: (1), (2), (3), (4), (5), (6), (7)

Keep Reading: Your Ultimate Guide to Getting a BIR TIN Online & In-Person!

Leave a Reply