Estimated reading time: 9 minutes

Buying a property is a significant investment, but it doesn’t always have to be expensive. One way to purchase real estate at a lower cost is by buying foreclosed properties. These are properties that have been repossessed by a lender or creditor due to the borrower’s inability to pay the mortgage or loan.

Pag-IBIG is a government agency that provides affordable housing loans to Filipinos. Pag-IBIG also offers foreclosed properties for sale, which can be a great opportunity for those who want to own a property at a lower price. Now, let’s take a look at the process of buying foreclosed properties in Pag-IBIG.

Table of contents

Pag-IBIG Foreclosed Properties

Foreclosed properties are real estate properties that have been repossessed by a lender or creditor due to the borrower’s inability to pay the mortgage or loan. In other words, when a homeowner fails to make their mortgage payments, the lender or creditor can initiate a legal process to take ownership of the property and sell it to recover the unpaid debt. Lenders usually sell foreclosed properties at a discount, making them an attractive option for real estate investors and homebuyers seeking affordable properties.

How to Easily Find Foreclosed Properties for Sale with Pag-IBIG

There are two ways to view Pag-IBIG foreclosed property listings:

Visiting the Pag-IBIG Fund office

To get the list of foreclosed properties in the Pag-IBIG office, go to the second floor of JELP Business Solutions Center, 409 Shaw Blvd., Mandaluyong (for properties in Metro Manila) or the Pag-IBIG regional branch (for properties in the provinces). Coordinate with the Marketing and Sales-Acquired Assets Management Group.

Checking the Government Agency’s Website

Check out the Pag-IBIG website’s Property Finder page to view the list of purchased assets if you’d prefer.

How to find the list of Pag-IBIG acquired assets online:

1. Go to Home Development Mutual Fund (Pag-IBIG) Official Site https://www.pagibigfund.gov.ph/

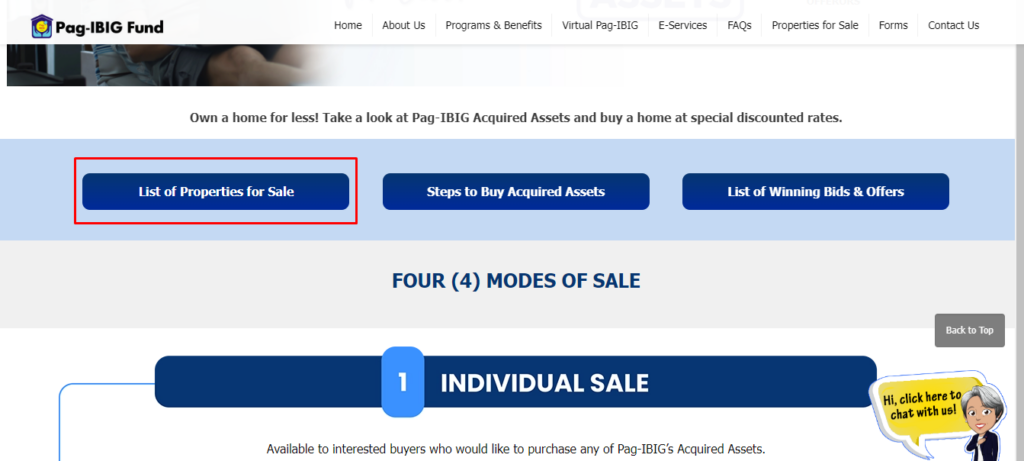

2. On their Homepage, Click “Properties for Sale” located in the upper right.

3. You will be directed to “Properties for Sale (Acquired Assets).” Scroll down and click on the “List for Properties for Sale” button to see the available properties.

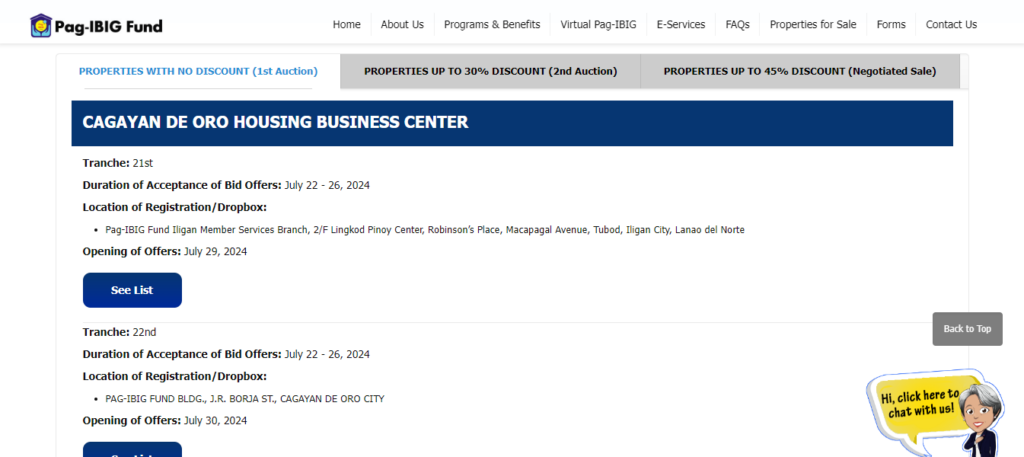

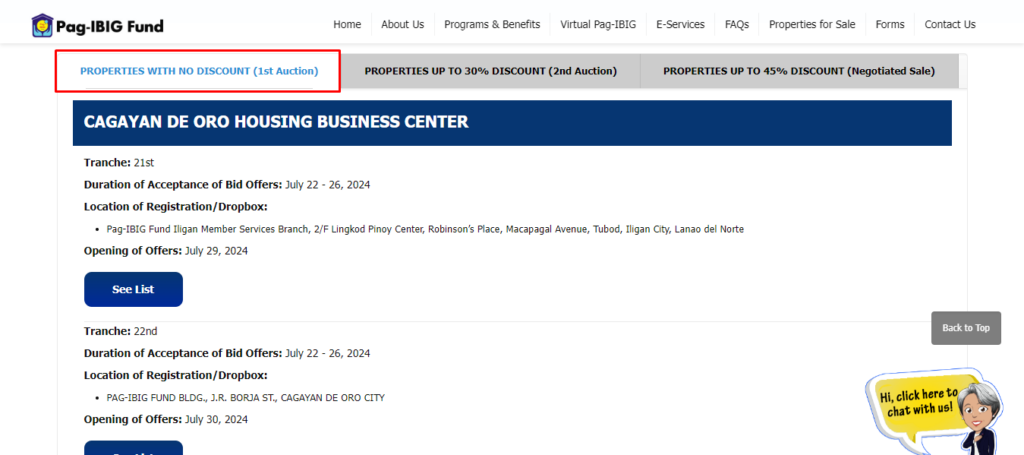

4. At the tab, you can select whether you want to show Properties Under Negotiated Sale, Properties Under Public Auctions (No Discount), and Public Auctions (With Discount).

You can see the complete details of the property when you click the link “Click here to open complete Detail” at the bottom of every property listed.

How to View the List of Acquired Assets for Auction

On the Pag-IBIG website, you may also see the list of repossessed homes that are up for auction if you want to bid for an acquired property as opposed to purchasing one through a negotiated sale.

- Go to the Pag-IBIG Fund Acquired Assets page. (Refer to the above steps ’How to find the list of Pag-IBIG acquired assets online’)

- Scroll down the page. At the tab, you can select whether you want to show Properties Under Negotiated Sale, Properties Under Public Auctions (No Discount), and Public Auctions (With Discount).

- Click on your preferred auctions, then scroll down and click the link “Click here to open complete details” at the bottom of every property listed.

- The property listings are grouped into either the NCR branch or provinces.

- A PDF file will pop up, which contains the bidding guidelines and listing of foreclosed properties up for auction.

- Read the guidelines and scroll further to find the listing. Take note of these details of the foreclosed property you’re considering buying:

– Property number

– Property location

– Type of property

– Transfer Certificate of Title (TCT)

– Lot area

– Floor area

– Minimum bid

– Appraisal date

How to Bid for Pag-IBIG Foreclosed Properties

Considering taking part in a Pag-IBIG auction to purchase a purchased asset? The general guidelines for placing a bid on a foreclosure property are shown below.

1. Prepare the Bidding Requirements

Put all the requirements in a sealed envelope before you take part in the public bidding for Pag-IBIG-acquired assets.

- Completed Offer to Bid form, two copies

- 10% of your recommended bid price for the property you want, paid in cash at a Pag-IBIG office or by a manager’s check made out to the Pag-IBIG Fund.

- Completed Special Power of Attorney and Acknowledgement Form (if you are unable to attend the auction but will have a designated agent bid on your behalf)

2. Check for Any Erratum Posting on the Pag-IBIG Website

Visit the page for Pag-IBIG’s acquired assets five days prior to the planned auction to see if any errata have been placed on the property listing under the auction you’ll be attending.

The list of properties that have recently been taken off the list for public bidding is contained in an erratum. These properties are often not up for bid because a direct bidder had purchased them prior to the auction.

It’s critical to be sure the foreclosure property you wish to purchase is still up for auction.

3. Attend the Scheduled Bidding

To register and submit your sealed offer, go to the secretariat or technical working group at the venue’s entrance.

The sealed bids will be opened following the bid deadline. The winning bidder will be declared to be the highest.

Your bidder’s bond (10% of the winning bid price) will serve as your down payment for the foreclosed property if you win the auction. The remaining 90% of the winning offer can be paid in full, in installments, or with a Pag-IBIG housing loan.

Also Read: What you need to know about Pag-IBIG Multi-Purpose Loan Application

How to Buy Pag-IBIG Acquired Assets Under Negotiated Sale

1. Reserve the Foreclosed Property

Present the following documentation to the Pag-IBIG office in charge of the sale of the acquired asset in order to make a reservation:

Valid ID (any of the following):

- Company ID

- Passport

- UMID

- Driver’s license

- PRC ID

- Voter’s ID

- Postal ID

- HDMF-Pag-IBIG Overseas Program (POP) ID

- Overseas Workers Welfare Administration (OWWA) ID

- Armed Forces of the Philippines (AFP) ID

- Integrated Bar of the Philippines (IBP) ID

- Senior citizen ID

Proof of income:

- Local employees: Latest one-month payslip

- Self-employed: Income tax return (ITR) / Barangay Permit / Business Permit

- OFWs: Active employment contract / Certificate of employment and compensation

Fill out the Reservation Form and Offer to Purchase Form with your preferred method of payment listed to reserve the property of your choice. You have the option of paying in whole, making payments, or applying for a Pag-IBIG housing loan. Different discount percentages and payment conditions apply to certain payment methods.

Note: You’ll also need to pay a PHP 1,000 non-refundable reservation fee.

2. Submit the Requirements for Purchase (For Housing Loan Only)

This is an additional step for purchasers who plan to use a Pag-IBIG housing loan to acquire a repossessed home.

After paying your reservation fee, you have 30 days to turn in all necessary paperwork to the Pag-IBIG office.

Basic Requirements

- Two copies of the accomplished Buyer’s Information Sheet with a 1×1 ID photo attached to each form

- Photocopy (front and back) of valid ID of principal buyer and spouse, co-buyer and spouse, if applicable

- Proof of income (any of the following):

– Local employees: Notarized certificate of employment and compensation / Latest one-month payslip / Latest ITR

– Self-employed: ITR, audited financial statements, and official receipt of tax payment / Commission vouchers / Bank statements or passbook for the last 12 months / Lease contract and tax declaration / Certified true copy of Transport Franchise / Certificate of engagement

– OFWs: Employment contract / Certificate of employment and compensation / ITR filed with host country/government - Also, pay the PHP 2,000 processing fee and PHP 100 documentary stamp tax.

3. Receive the Notice of Approval of Loan

If your housing loan is granted, you will receive a Notice of Approval and a Disclosure Statement for the loan transaction. Pay the one-year advance insurance premiums within 30 days of receiving these documents.

4. Sign and Submit Mortgage Documents

Submit a signed and notarized Deed of Conditional Sale along with other mortgage documents that confirm your Pag-IBIG Fund housing loan.

5. Make Your Payment

Cash purchase: Pay the property’s net selling price in full within 30 calendar days from your reservation date.

Installment purchase: Pay the net selling price in 12 monthly installments.

Purchase through housing loan: After 30 days from the loan takeout date, you can begin making your monthly amortization payments. You can calculate your monthly amortization using the Pag-IBIG home loan calculator.

Also Read: How to create Virtual Pag-IBIG account: Step-by-step Guide

Reminders from Pag-IBIG

- Brokers and agents cannot accept or collect any payments for the reservation or down payment on Pag-IBIG-acquired assets.

- Make all payments directly to the Pag-IBIG FUND Office only.

- The original borrower/registered owner, CTS/DCS buyer, and third-party occupant may purchase the acquired assets they presently occupied under the repurchase or direct purchase option.

- The selling price of the subject-acquired asset shall be based on its appraisal value.

- Buyers should inspect the property before making any reservations or purchases.

- Contact the corresponding number indicated on the lists/inventory for more details regarding the property.

- For NCR-Branch Accounts, the list is updated every Tuesday and Friday.

- For Provincial Accounts, lists are updated every Friday.

Final Thoughts

Real estate investors and homebuyers in the Philippines might consider investing in Pag-IBIG’s purchased assets. As long as you understand each step involved in placing a bid on or buying a Pag-IBIG repossessed property, you can find the perfect place for yourself. – WhatALife!/Jayve

Keep Reading: GUIDE: PAG-IBIG Online Registration 2023

Leave a Reply