Estimated reading time: 6 minutes

As a member of the Social Security System (SSS) in the Philippines, you have access to a range of benefits, including the SSS Salary Loan. This loan provides financial assistance to SSS members who need it the most. One of the most convenient ways to apply for an SSS Salary Loan is through the SSS online portal.

Table of contents

Understanding SSS Salary Loan

The SSS Salary Loan is a type of loan provided by the Social Security System (SSS) in the Philippines. It is designed to provide financial assistance to SSS members who are currently employed or have a steady source of income.

To be eligible for an SSS Salary Loan, an SSS member must have made at least 36 months of contributions, with six of those contributions made within the past 12 months. Additionally, the member must not be more than 65 years old at the time of application and must not have been granted a final benefit, such as retirement or total disability.

The amount that an SSS member can borrow through the Salary Loan is up to one month’s worth of their salary, with a minimum amount of PHP 2,000 and a maximum amount of PHP 32,000. The loan has an interest rate of 10% per annum and a repayment period of 24 months, with a grace period of two months.

SSS Salary Loan Benefits

The SSS Salary Loan provides several benefits to SSS members who need financial assistance.

- Low-interest rate: The SSS Salary Loan has a low-interest rate of 10% per annum, making it an affordable option for SSS members who need financial assistance.

- Flexible repayment terms: The loan has a repayment period of 24 months, with a grace period of two months. This means that you have enough time to pay off the loan without incurring any penalties.

- No collateral required: The SSS Salary Loan is an unsecured loan, which means that you don’t need to provide collateral to secure the loan.

Eligibility Criteria for SSS Salary Loan

Before applying for an SSS Salary Loan online, make sure you meet the eligibility criteria. The basic requirements are as follows:

- Must be an active SSS member

- Must have at least 36 months of posted contributions

- Must have made six contributions in the last 12 months prior to loan application

- Must not be more than 65 years old at the time of application

- Must not have been granted a final benefit, such as retirement or total disability

Benefits of Applying for an SSS Salary Loan Online

Applying for an SSS Salary Loan online offers several benefits, such as:

- The convenient and easy application process

- Fast approval and disbursement of funds

- 24/7 accessibility to the SSS online portal

- Safe and secure online transaction

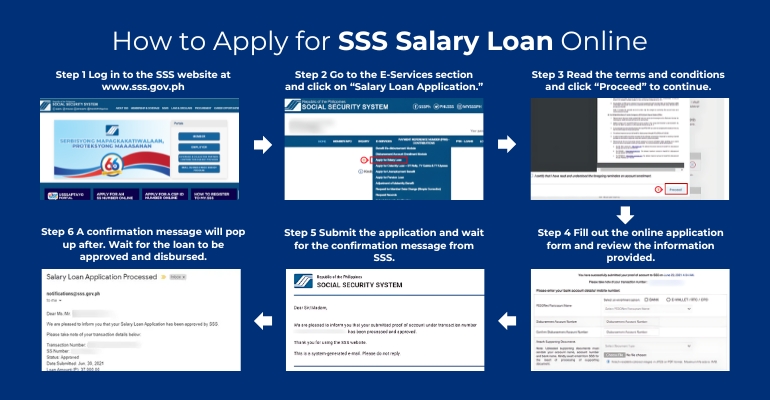

Step-by-Step Guide to Apply for SSS Salary Loan Online

Follow these steps to apply for an SSS Salary Loan online:

- Log in to the SSS website at www.sss.gov.ph

- Go to the E-Services section and click on “Salary Loan Application.”

- Read the terms and conditions and click “Proceed” to continue.

- Fill out the online application form and review the information provided.

- Submit the application and wait for the confirmation message from SSS.

- A confirmation message will pop up after. For future reference, you can either copy the transaction number or go back to the email that’ll be sent to you, including more details.

- Wait for the loan to be approved and disbursed. You’ll be receiving notifications on these as well.

Required Documents for SSS Salary Loan Application

Before applying for an SSS Salary Loan online, make sure you have the following documents on hand:

- SSS ID or two valid IDs, both with a photo and signature

- Photocopy of your latest payslip or any proof of income

- Bank account information for loan disbursement purposes

Loan Repayment and Interest Rates

The SSS Salary Loan has an interest rate of 10% per annum and a repayment period of 24 months, with a grace period of two months. Loan payments can be made through the following channels:

- SSS Payment Counters

- Partner banks and payment centers

- Bayad Center, SM Business Center, and other accredited payment centers

Frequently Asked Questions (FAQs) about SSS Salary Loan

The amount you can borrow through the SSS salary loan depends on your salary and monthly contributions to SSS. For a one-month salary loan, the amount is equivalent to the average of your latest posted 12 Monthly Salary Credits (MSCs) or the amount applied for, whichever is lower. For a two-month salary loan, it’s equivalent to twice the average of your latest posted 12 MSCs, rounded to the next higher monthly salary credit or amount applied for, whichever is lower. The maximum loanable amount for a one-month salary loan is Php 25,000, and for a two-month salary loan, it’s Php 50,000.

Yes, you can apply for a new loan even if you have an existing loan with SSS, as long as your account is updated and has no outstanding balance.

Once you hit the submit button, your employer has three business days to verify your loan application. Once it has been approved (you can check this via your SSS portal, or a text message will also be sent to you), it would take around 2-3 working days to be disbursed into your chosen account.

Final Thoughts

Applying for an SSS Salary Loan online is convenient and hassle-free. With the SSS online portal, you can apply for a loan, check your loan status, update your information, and make payments anytime you want.

However, it’s essential to keep in mind that before you apply for the loan, make sure that you have a sure plan to pay it back within the repayment period to avoid penalties and interest charges. Moreover, borrowing money is a serious financial decision, and it’s crucial to evaluate your financial situation carefully before applying for a loan.

If you’re confident that you can meet the eligibility criteria and repayment terms, the SSS Salary Loan can be an excellent option to meet your financial needs. –WhatALife!/Jayve

Leave a Reply