Managing your finances through GCash has never been more convenient, but hitting your account limit can slow things down. Whether you’re using GCash for everyday transactions or managing larger payments, knowing how to increase your GCash limit to 500k or simply increasing your account limit lets you enjoy smoother, hassle-free operations and greater financial flexibility.

If you’re thinking of increasing your limit, we’ll walk you through the steps so you can maximize the benefits of this popular mobile wallet.

Table of contents

GCash Wallet and Transaction Limits

GCash wallet and transaction limits set how much you can store, send, receive, and transact within your account. These limits ensure secure and seamless GCash use for all your financial needs. Let’s break down what these limits entail and how they apply to your account:

Specific Limits per GCash Profile

Before we dive into the specific details, let’s explain what each GCash limit means:

- Wallet limit. The highest amount of money you can keep in your GCash.

- Incoming Transaction Limit. The maximum amount you can accept in your GCash wallet, including cash-ins and received money.

- Outgoing Transaction Limit. The maximum amount you can transfer from your GCash Wallet, such as sending money, bank transfers, or cashing out.

Now that we’re all on the same page, here are the specific limits of each GCash profile:

| Basic | GCash Jr | Fully Verified | Gcash Plus | GCash Platinum | |

| Profile Overview | For new or non-verified GCash users | For users aged 7-17 years old | For users with a fully verified account | For users with a linked bank account or investment | For users eligible for Globe Platinum |

| Wallet Limit | |||||

| At any given time | ₱10,000 | ₱50,000 | ₱100,000 | ₱500,000 | ₱1,000,000 |

| Incoming Transaction Limit | |||||

| Monthly | ₱5,000 | ₱10,000 | ₱100,000 | ₱500,000 | ₱1,000,000 |

| Outgoing Transaction Limit | |||||

| Daily | None | ₱10,000 | ₱100,000 | ₱100,000 | ₱500,000 |

| Monthly | ₱5,000 | ₱10,000 | None | None | ₱1,000,000 |

Also Read: GUIDE: How to Verify Your GCash Account

Who Qualifies to Increase Their GCash Limit?

Before you can enjoy the perks of increasing your GCash limit, you need to meet certain qualifications, such as:

- You must be 18 years old and above

- Have a Philippine-issued SIM card

How do I increase my GCash wallet and transaction limits?

If you’re looking to raise your GCash wallet and transaction limits, follow the step-by-step guide below:

How to Increase Gcash Limit to 100k

If you’re a Basic user, simply becoming a fully verified user can boost your wallet and transaction limit to ₱100k.

How to Increase Gcash Limit to 500k

After increasing your GCash wallet limit to ₱100k, you can further raise it to ₱500k by completing at least one of the following steps:

Link and Cash In

- Link your BPI, Unionbank, Payoneer, or Paypal account to your GCash wallet

- Cash into GCash with your linked bank account

Create a GSave account with CIMB

- On your GCash app, tap ‘GSave’

- Sign up for a GSave account with CIMB

- Deposit at least ₱1,000

Create a GFunds account and invest in BPI or ATRAM

- Open the GCash app and tap ‘GFunds’

- Create a GFunds account and invest in BPI or ATRAM

- Invest at least ₱100

Once you’ve completed any of the steps above, wait 3-5 days for the new limits to take effect.

For verification, you’ll get an in-app notification from GCash when your wallet and transaction limits are upgraded.

How to Check GCash Cash In Limit

To make sure you’re within the GCash limit, it’s important to check it regularly. Here’s how to check your GCash cash in limit:

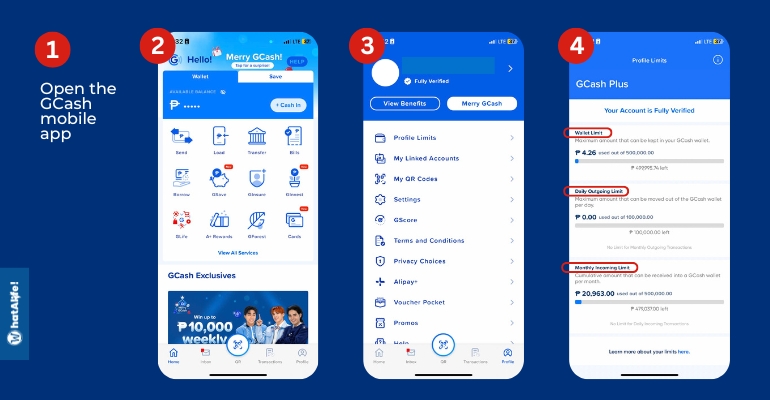

- Open the GCash mobile app

- Tap ‘Profile’ on the lower right corner of the screen

- Then, tap ‘Profile Limits’

- You can then view your Monthly Incoming Limit, along with your Wallet Limit and Daily Outgoing Limit

Here’s an example:

Also Read: Your Ultimate Guide on How to Cash Out in GCash

Is There a Limit When You Transfer from Banks to GCash?

Although GCash has set its own limits for Incoming Transactions, you’ll also need to be aware of each bank’s transfer limits.

For example, the daily transfer limit for UnionBank is set to ₱100,000, which is refreshed every 24 hours. If you want more flexible transactions, BPI lets you customize your limits. So, you can set your daily transfer limit for BPI to e-wallets, like Gcash, for any amount you want. Note that your limit will refresh daily at 10 PM.

Important Reminders for Increasing Your GCash Limit

If you’re wondering how to increase your GCash limit up to even 500k, here are key reminders to keep in mind:

- Complete Full Verification. Ensure your GCash account is fully verified by submitting a valid ID and completing the selfie verification process. Without full verification, your account will remain limited.

- Link Your Bank Account or Debit Card. Linking your GCash account to a bank account or debit card is essential. It shows financial stability and helps increase your account limits.

- Upgrade to GCash Platinum. To enjoy the maximum limit of ₱500k, aim to upgrade to GCash Platinum by completing all requirements.

- Regularly Use Your GCash Account. Maintain consistent usage of your GCash account for transactions like bill payments, online purchases, or remittances. This activity indicates you’re an active user and may qualify for a higher limit.

How to Increase Your Gcash Limit: FAQs

For more information on GCash limits, here are answers to frequently asked questions:

Your daily GCash limit depends your account verification status. You can refer to our table above for complete details of the limits.

If your GCash account exceeds its limit, your transactions will be declined until you’re back within the allowed limit.

The maximum daily limit for GCash outgoing transactions, like transfers, will depend on your account verification status. Please refer to the table above for complete details, including your GCash monthly cash in limit.

You can register up to five different GCash accounts and mobile numbers under your name.

If your account has exceeded its limit, GCash won’t charge you since your transaction will be declined.

You can check your limit by tapping ‘Profile’ on the mobile app before tapping ‘Profile Limits.’ On the page, you’ll see your GCash wallet, daily cash out, and monthly cash in limits.

To cash out a large amount in GCash, make sure to check your limit. GCash has a sufficient cash-out limit, where verified users can withdraw up to ₱100,000 daily and ₱500,000 for Platinum members. For complete details, you can also refer to our table above.

If you have multiple GCash accounts, they’re automatically linked into one main customer profile for easy access.

Gcash recommends waiting 3-5 business days for your new limits to take effect. If there are no changes after the time period, you can submit a ticket through their website or mobile app.

Sources: (1), (2), (3), (4), (5), (6), (7)

Keep Reading: GUIDE: GCash Submit a Ticket, Refund, Report a Problem, Account Recovery

Leave a Reply