Estimated reading time: 5 minutes

Keeping up with your PhilHealth payments is crucial to ensure continuous healthcare coverage and avoid penalties.

Now that you are familiar with the PhilHealth contribution table it’s essential to understand the various payment methods available—including the convenience of the online payment system.

The good news? There are several easy ways to pay!

In this guide, we will walk you through the different payment options and provide step-by-step instructions on how to pay and check your PhilHealth contributions efficiently.

Table of contents

Who Needs to Pay PhilHealth Contributions?

Before we dive into the payment process, it’s important to know who is required to contribute to PhilHealth:

- Employed Individuals – Contributions are automatically deducted from salaries by employers.

- Self-Employed and Voluntary Members – Freelancers, entrepreneurs, and unemployed individuals paying voluntarily.

- OFWs (Overseas Filipino Workers) – Required to remit payments to maintain coverage.

- Senior Citizens – Automatically covered by the government, but may opt for additional contributions.

- Indigent Members – Contributions are subsidized by the government.

Also Read: How PhilHealth Works: A Guide for Fresh Graduates and First-Time Employees

Step-by-Step Guide to Paying Your PhilHealth Contributions

For Employed Members

Your PhilHealth contribution is automatically deducted from your salary, and your employer takes care of sending it to PhilHealth along with their share.

If you want to check your payments, you can ask your HR department or log in to the PhilHealth Member Portal.

For Self-Employed and Voluntary Members:

Option 1: Paying Through PhilHealth Offices

- Visit the nearest PhilHealth Local Health Insurance Office (LHIO).

- Fill out a PhilHealth Premium Payment Slip (PPPS).

- Pay the contribution at the cashier.

- Secure your official receipt for reference.

Option 2: Paying via Accredited Payment Centers

- Go to a PhilHealth-accredited payment partner such as:

- Bayad Center

- SM Bills Payment

- GCash or PayMaya (if available)

- Inform the cashier that you will be paying for your PhilHealth Contribution.

- Provide your PhilHealth Identification Number (PIN) and payment details.

- Keep the payment receipt as proof of transaction.

Option 3: Paying via Online Banking and e-Wallets

- Log in to your online banking or e-wallet account (e.g., GCash, PayMaya, or BPI Online).

- Look for PhilHealth under the billers list.

- Enter your PhilHealth Identification Number (PIN) and the amount to be paid.

- Confirm the payment and keep the confirmation email or receipt for reference.

With the PhilHealth online payment system, voluntary members can easily settle their contributions without visiting a physical office.

Option 4: Paying via Overseas Collection Agents (For OFWs)

- Visit an accredited overseas remittance center or online remittance platform.

- Provide your PhilHealth Identification Number (PIN) and contribution amount.

- Secure the payment receipt for record-keeping.

How Much Should You Pay for Your Contributions?

Your PhilHealth contributions are based on your income bracket, so the amount you need to pay may vary.

To stay updated, you can check out the latest contribution table.

- Employees and Employers – Share the contribution based on the salary bracket.

- Self-Employed and Voluntary Members – Contribution amount depends on declared income.

- OFWs – Fixed contribution amount or based on earnings.

How to Check Your PhilHealth Contributions

To ensure your contributions are properly credited:

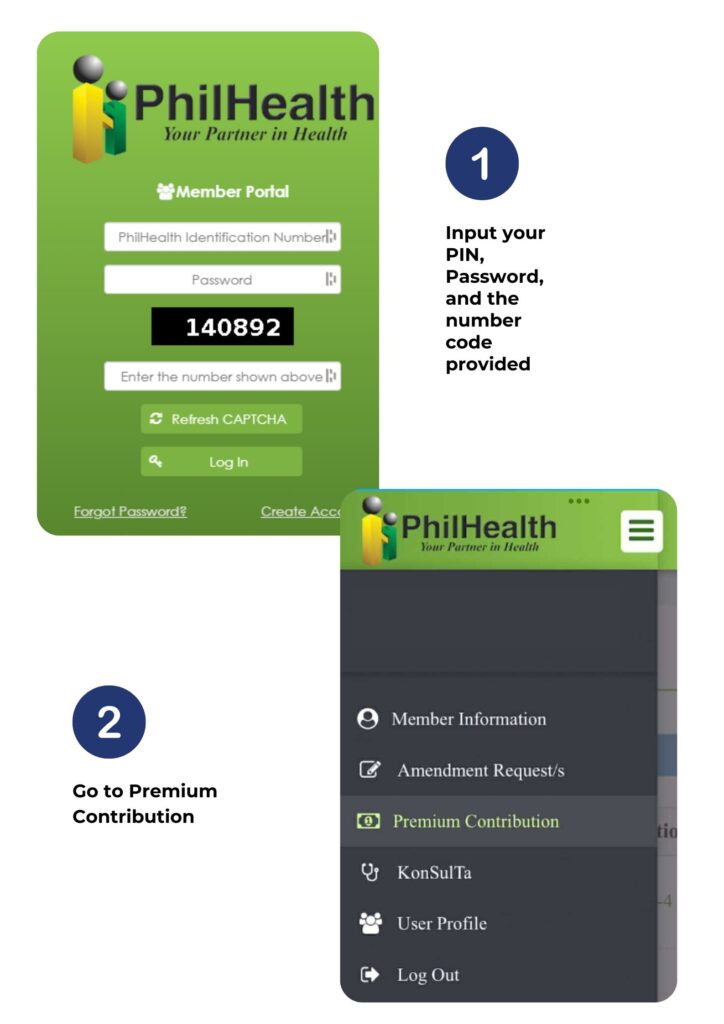

- Log in to the PhilHealth Member Portal.

- Enter your PhilHealth ID and password.

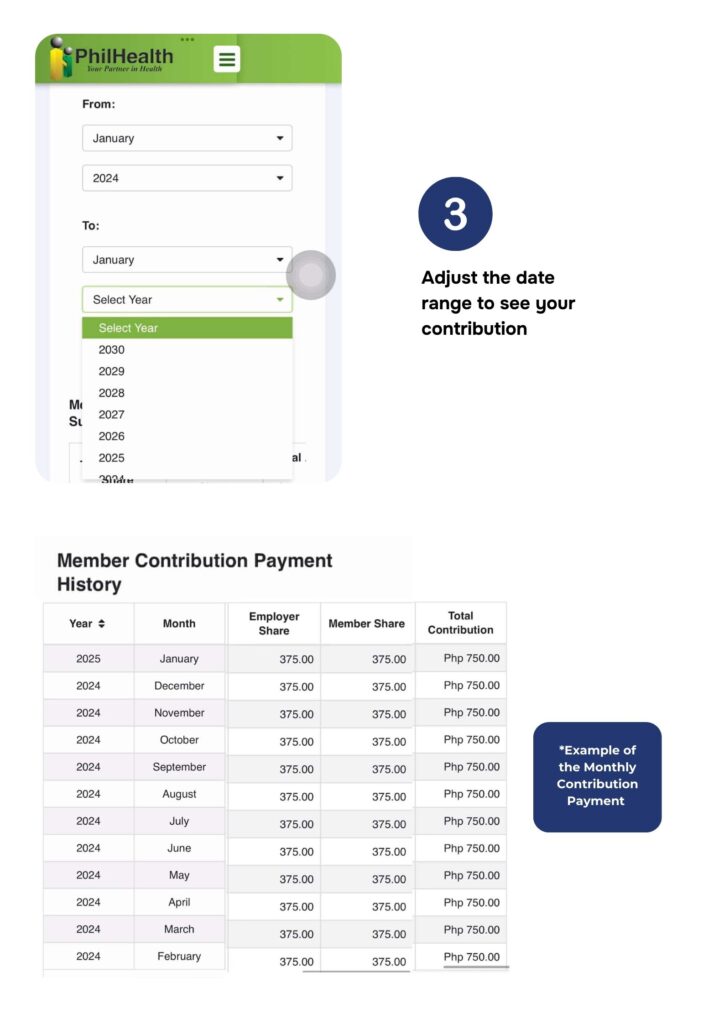

- Navigate to the Premium Contribution History section.

- Specify the date range you want to check.

- Check your posted payments and verify if all contributions are updated.

Importance of Checking Your PhilHealth Contribution Regularly

Understanding how to check PhilHealth contributions is crucial for every member.

Regularly verifying your contributions helps you avoid issues such as:

- Missed payments – Ensuring there are no gaps in your records.

- Incorrect postings – Checking for errors in the contribution amount.

- Claiming benefits without issues – Ensuring seamless access to PhilHealth benefits when needed.

To avoid penalties and coverage interruptions, make it a habit to check your contribution status through the PhilHealth Member Portal.

Benefits of Using PhilHealth Online Payment

With the rise of digital transactions, PhilHealth provides an online payment system for several advantages:

- Convenience – No need to visit a PhilHealth office or payment center.

- Security – Online payments are recorded digitally, minimizing risks of lost receipts.

- Efficiency – Transactions are completed in just a few clicks.

By utilizing this online payment system, self-employed members and OFWs can settle their contributions from anywhere in the world.

Bottom Line

Staying on top of your PhilHealth contributions is key to ensuring continuous access to healthcare benefits when you need them most.

Whether your payments are automatically deducted as an employee, manually settled as a self-employed member, or processed from overseas, knowing your payment options makes the process easier and hassle-free.

By regularly checking your contributions through your HR department or the PhilHealth Member Portal, you can avoid issues like missed payments or delays in claiming benefits.

Remember, timely payments not only secure your coverage but also help you avoid penalties.

For the latest updates on contribution rates, payment methods, and benefits, visit the official PhilHealth website or drop by the nearest PhilHealth office.

Stay informed and stay covered!

Yes, you can pay your PhilHealth contributions via GCash by selecting PhilHealth under the billers list and entering your PIN and payment details.

It is recommended to check your contribution status every few months to ensure all payments are correctly posted.

If your payments are not reflected, contact PhilHealth customer service or visit the nearest LHIO with your proof of payment.

Sources: (1), (2), (3), (4), (5), (6), (7), (8), (9)

Keep Reading: How PhilHealth Works: A Guide for Fresh Graduates and First-Time Employees

Leave a Reply