If you’re looking for an easy way to invest in Pag-IBIG MP2, using GCash is one of the most convenient options.

No more lining up at payment centers—just a few taps on your phone, and your savings are good to go!

If you’re new to MP2 or want a hassle-free way to grow your money, here’s everything you need to know.

What is MP2 Pag-IBIG?

The Pag-IBIG MP2 Savings Program is a voluntary savings scheme that allows Pag-IBIG members to save and earn higher dividends compared to the regular Pag-IBIG savings.

This program is open to all active Pag-IBIG members, including retirees and even former members who still want to invest.

Many Filipinos choose MP2 savings because it offers competitive returns while being a safe and government-backed investment.

Plus, after five years, you can choose to withdraw your MP2 savings along with the dividends you’ve earned.

Pag-IBIG MP2 Requirements

Before you start saving, make sure you meet these basic Pag-IBIG MP2 requirements:

- You must be an active Pag-IBIG member or a former member with at least 24 months of contributions.

- You need a Pag-IBIG MP2 account number, which you can get by registering online via the Virtual Pag-IBIG portal or by visiting a Pag-IBIG branch.

- The minimum contribution is ₱500, but you can save as much as you want!

Also read: Understanding Pag-IBIG: A Guide for New Jobseekers and Fresh Grads

Why Pay MP2 Using GCash?

If you’re wondering how to invest in Pag-IBIG MP2 the easy way, GCash is the answer!

Here’s why:

- Super Convenient – No need to visit a Pag-IBIG branch or payment center. You can pay from anywhere, anytime!

- Fast & Easy – Takes less than 5 minutes to complete the payment.

- Safe & Secure – GCash uses security measures to protect your transactions.

Step-by-Step Guide to Paying MP2 via GCash

STEP 1: Open GCash

Launch the GCash app and enter your 4-digit MPIN to log in.

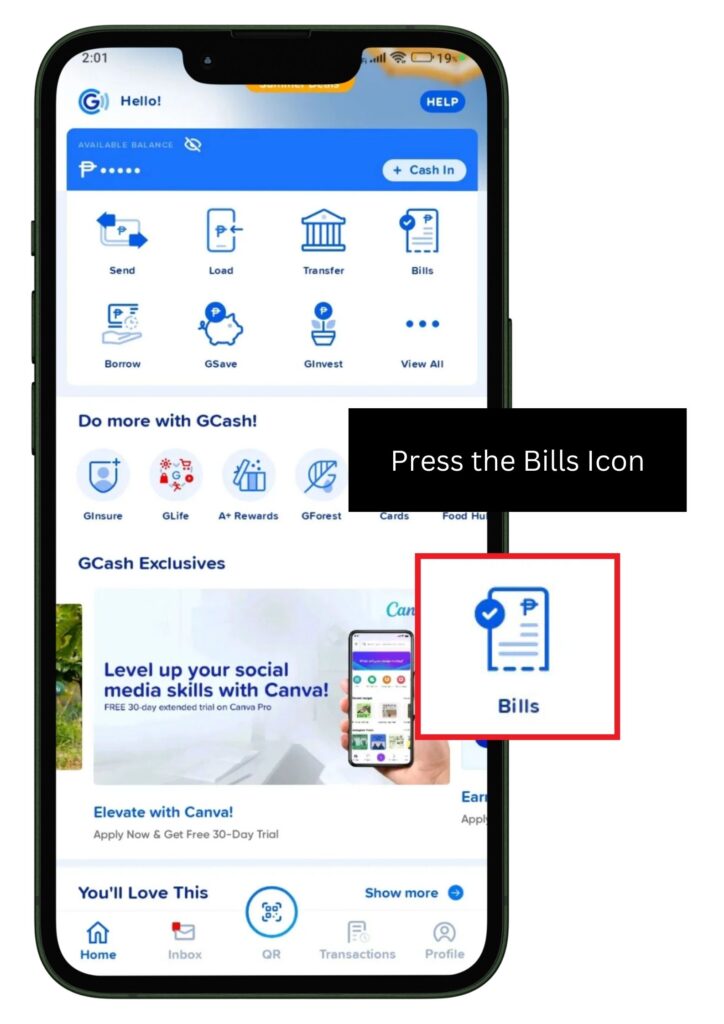

STEP 2: Go to “Bills”

From the home screen, tap “Bills icon.”

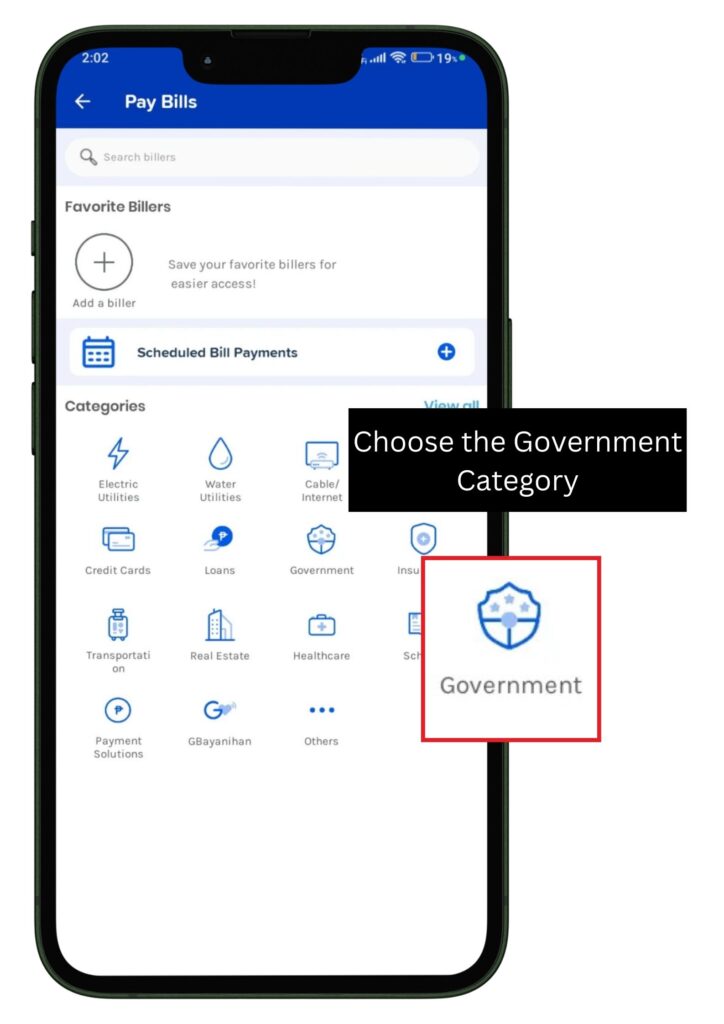

STEP 3: Select “Government”

Scroll down and find the “Government” category.

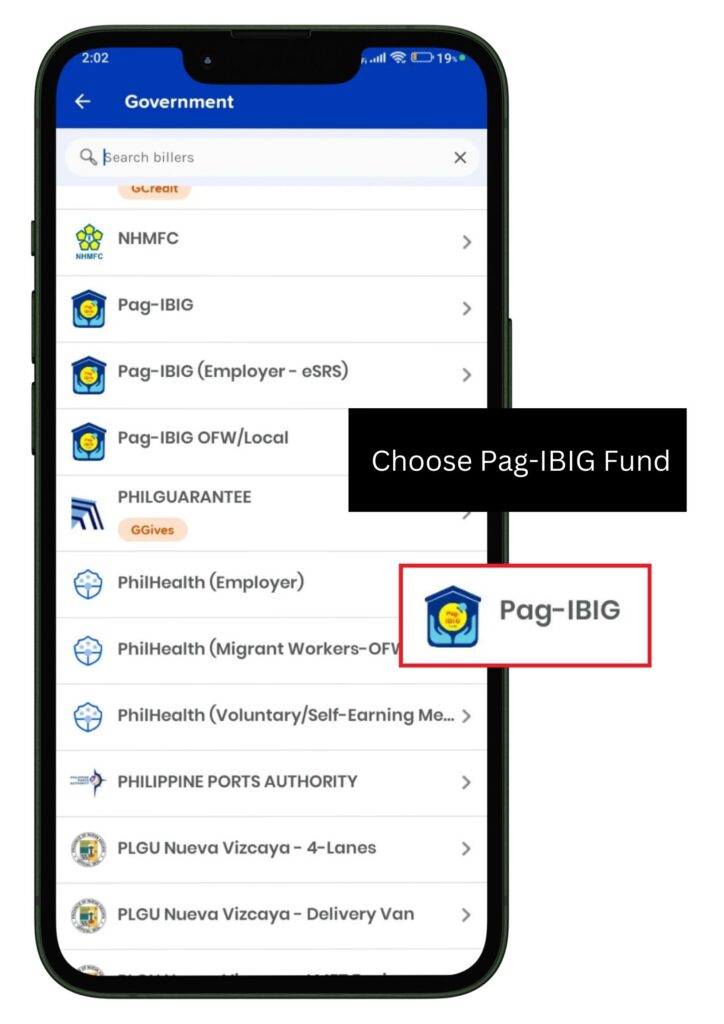

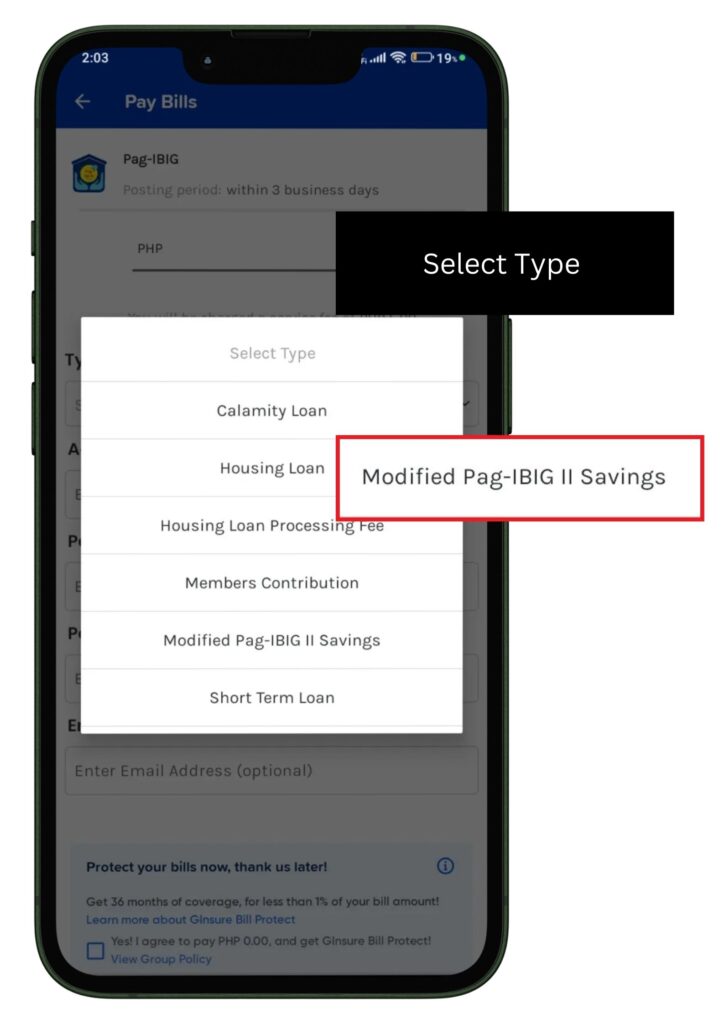

STEP 4: Choose “Pag-IBIG Fund”

Look for Pag-IBIG Fund in the list of government agencies.

STEP 5: Enter Your Payment Details

Now, it’s time to input your details:

- Account Number – Enter your 12-digit MP2 account number.

- Amount – Type in how much you want to contribute (minimum ₱500).

- Period Covered – Input the year and month you’re paying for (e.g., 202503 for March 2025).

STEP 6:Review Your Details

Double-check everything to avoid mistakes. Once you’re sure, tap “Confirm.”

STEP 7:Payment Confirmation

You’ll receive a text message from GCash confirming your payment.

Alternative Payment Method via Virtual Pag-IBIG

If you don’t have GCash, you can also pay your MP2 savings through the Virtual Pag-IBIG website:

- Go to Virtual Pag-IBIG

- Select “MP2 Savings” as your payment option

- Enter your details (MP2 account number, amount, and period covered)

- Choose GCash or other payment methods

- Confirm and pay!

Quick Tips & Reminders

- Make sure your GCash wallet has enough balance before making the payment.

- Keep a screenshot of your payment confirmation as proof.

- Payments usually post in real-time, but always check your Virtual Pag-IBIG account to confirm.

If you’re looking for a simple way to save and invest, Pag-IBIG MP2 is a great option!

And with GCash, paying your contributions has never been this easy.

So start saving today and watch your money grow over time.

Got any questions? Feel free to drop them in the comments!

No, MP2 is voluntary, so there’s no penalty if you skip a payment. However, you might earn fewer dividends if you contribute irregularly.

The minimum monthly savings is ₱500, but you can save as much as you want. There is no maximum limit for MP2 contributions.

You can pay monthly, quarterly, or make a one-time lump sum payment—it’s up to you!

Sources: (1)

Keep Reading: How to Get Your Pag-IBIG Loyalty Card Plus: Unlock Benefits

Leave a Reply