If you’re a Pag-IBIG member looking to enjoy exclusive perks, discounts, and banking features, getting a Pag-IBIG Loyalty Card Plus is a great option.

This upgraded card, powered by Asia United Bank (AUB), serves as both an ID and a financial tool that makes everyday transactions more convenient.

Here’s a quick guide on how to apply for a Pag-IBIG Loyalty Card and the requirements you need!

Requirements for Pag-IBIG Loyalty Card

Before applying, make sure you meet these simple requirements:

- Active Pag-IBIG Member – You need to have at least one contribution in the past six months.

- Valid Government-Issued ID – Required to verify your identity.

- Completed Application Form – Available at Pag-IBIG branches or downloadable from their website.

- Application Fee – A one-time fee of PHP 125.00 for card issuance.

For a detailed guide on Pag-IBIG membership and how to apply, check out this step-by-step guide.

Step-by-Step Guide to Getting Your Card

Step 1: Visit a Pag-IBIG Branch

Locate a Pag-IBIG branch that offers the Loyalty Card Plus service. You can check the list of participating branches on the AUB website.

Step 2: Membership Verification

Approach the Pag-IBIG staff to confirm your membership status and get an application form.

Step 3: Fill Out the Application Form

Provide accurate details. If you don’t have a middle name, enter a dash (“-”).

Step 4: Submit Your Requirements and Payment

Hand in your completed form, a valid ID, and the PHP 125.00 fee to the designated personnel.

Step 5: Receive Your Card

In most cases, the Pag-IBIG Loyalty Card Plus is issued on the same day, so you can start using it immediately!

Activating and Using Your Card

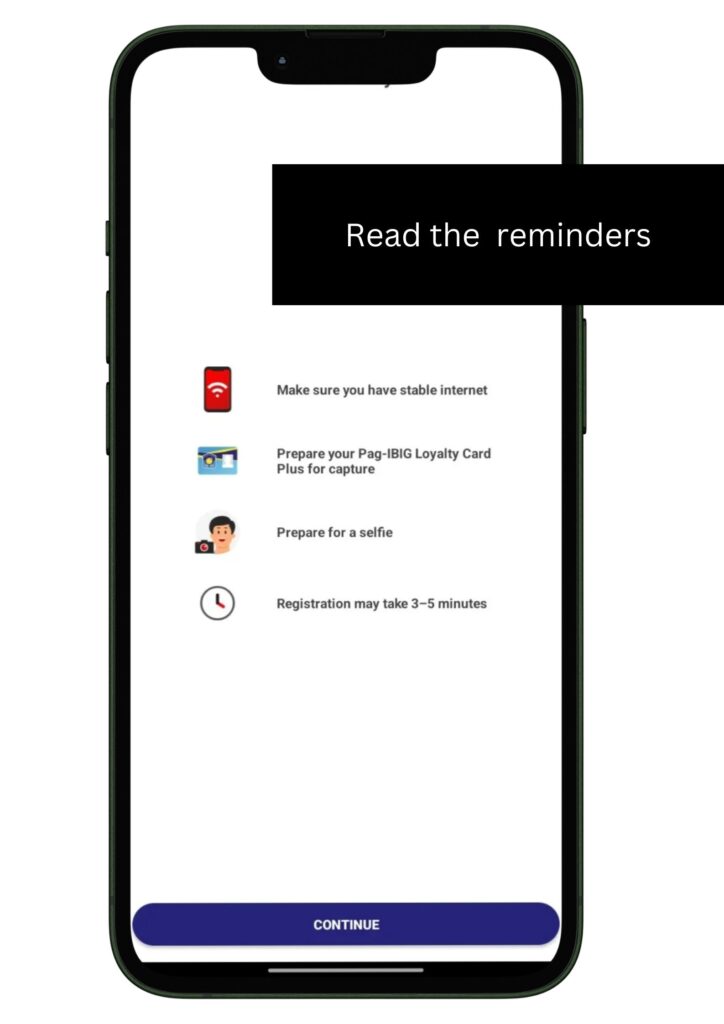

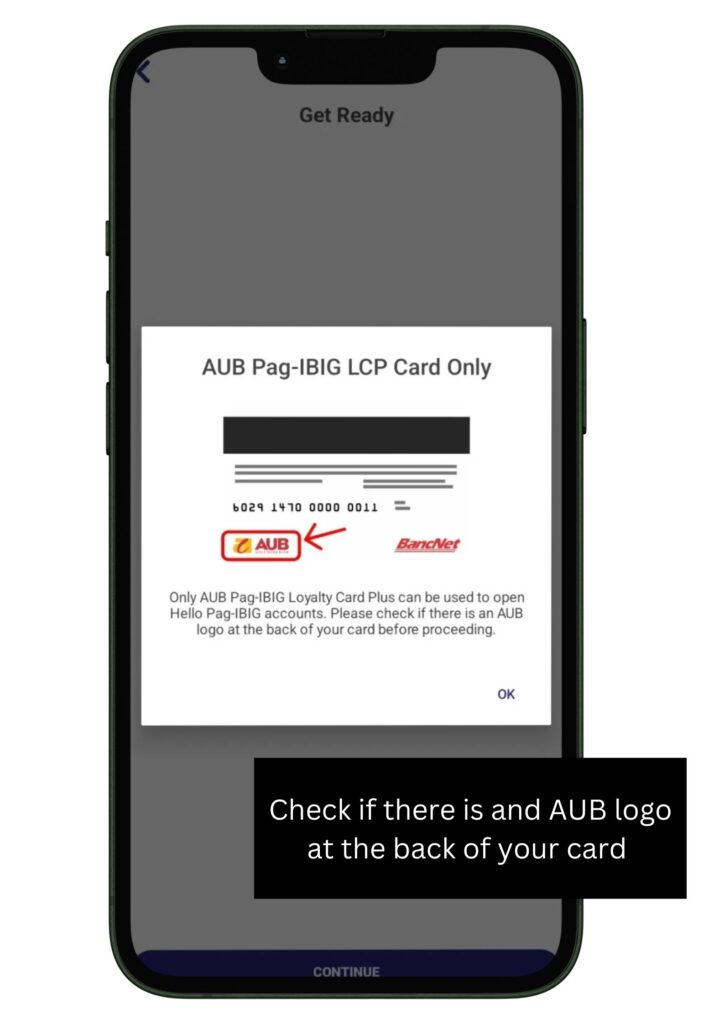

Once you have your card, follow these steps to activate it:

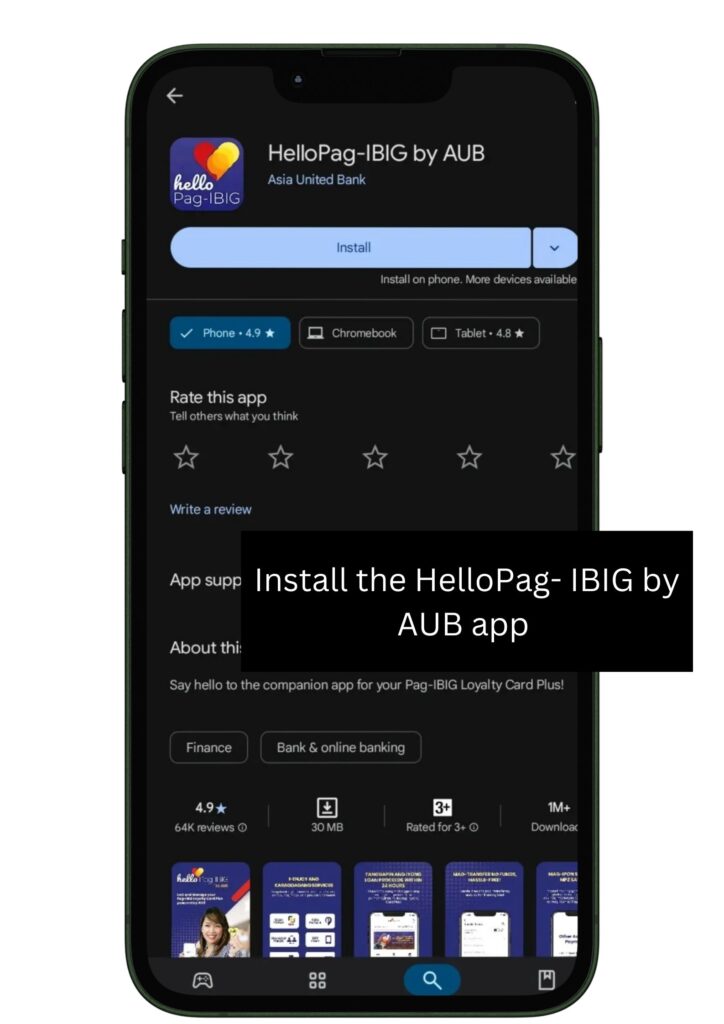

- Download the Hello Pag-IBIG Mobile App – Available on Google Play, the App Store, and Huawei App Gallery.

- Change Your PIN – Set a secure PIN via any AUB ATM or the Hello Pag-IBIG app.

- Start Using Your Card! – Receive loan proceeds, deposit savings, withdraw cash, and shop anywhere that accepts BancNet cards.

Perks and Benefits of the Pag-IBIG Loyalty Card Plus

Owning a Pag-IBIG Loyalty Card Plus comes with a variety of exclusive perks and benefits that enhance your financial and shopping experience:

- Fast & Easy Loan Disbursement – Get your loan proceeds credited directly to your card, often within 24 hours.

- Hassle-Free Withdrawals & Purchases – Withdraw cash from over 20,000 ATMs and shop at 200,000+ POS terminals.

- Exclusive Discounts & Rewards – Enjoy amazing deals on groceries, dining, travel, wellness, and more! Get special discounts at partner establishments like supermarkets, restaurants, pharmacies, and hotels.

- Safe & Secure Transactions – Manage your card, block or unblock it, and change your PIN via the Hello Pag-IBIG mobile app.

- Long-Term Validity – Your banking features last for 10 years, while your discounts & perks are valid for 3 years.

Check out the list of partner merchants offering exclusive deals for Loyalty Card Plus holders on the Pag-IBIG Fund website.

For any assistance, visit any AUB branch or use the Hello Pag-IBIG app for account management and support.

For fresh graduates and job seekers looking to understand Pag-IBIG benefits, this guide provides a helpful overview.

With the Pag-IBIG Loyalty Card Plus, you’re not just getting an ID.

You’re unlocking a powerful financial tool that makes transactions seamless, saves you money, and enhances your everyday lifestyle.

Apply today and start enjoying the benefits!

Currently, application for the Pag-IBIG Loyalty Card Plus must be done in person at a Pag-IBIG branch.

No, the Pag-IBIG Loyalty Card Plus serves as an ID but also functions as a cash card where loan proceeds can be credited.

You can check your balance through AUB ATMs or via the Hello Pag-IBIG mobile app.

Keep Reading: Pag-IBIG Fund 2024 Dividends Credited: How to Check and Withdraw Your Earnings

Leave a Reply