The Social Security System (SSS) in the Philippines is a vital government-mandated institution that ensures financial security for its members through various benefits and loan programs.

As members, staying informed about the latest contribution table is essential to ensure accurate payments, maximize benefits, and maintain an active membership.

In this article, we will guide you through the updated SSS contribution rates and other key details to help you manage your contributions effectively.

Table of contents

What is the SSS Contribution?

SSS contributions are monthly payments made by members and their employers to fund the social security system. These contributions are essential for providing members with a range of benefits, including:

- Sickness

- Maternity

- Disability

- Retirement

- Death

- Funeral; and

- Unemployment

Paying SSS contributions ensures that members have financial protection against life’s uncertainties, making it a critical component of financial planning.

Learn More: SSS in the Philippines: How to Get Started and What to Expect

SSS Contribution Table 2025

As of January 2025, the SSS contribution rate has increased to 15%, with employers contributing 10% and employees contributing 5% of the monthly salary credit (MSC).

YEAR | CONTRIBUTION RATE | EMPLOYER SHARE | EMPLOYEE SHARE | MSC | |

| MIN. | MAX. | ||||

| 2025 | 15% | 10% | 5% | Php 5,000 | Php 35,000 |

| 2024 | 14% | 9.5% | 4.5% | Php 4,000 | Php 30,000 |

| 2023 | 14% | 9.5% | 4.5% | Php 4,000 | Php 30,000 |

| 2022 | 13% | 8.5% | 4.5% | Php 3,000 | Php 25,000 |

| 2021 | 13% | 8.5% | 4.5% | Php 3,000 | Php 25,000 |

The MSC ranges from a minimum of Php 5,000 to a maximum of Php 35,000, reflecting changes from previous years where the minimum was Php 4,000 and the maximum was Php 30,000.

SSS Contribution Tables for Member Types

Here are the 2025 SSS Contribution Tables for each member types:

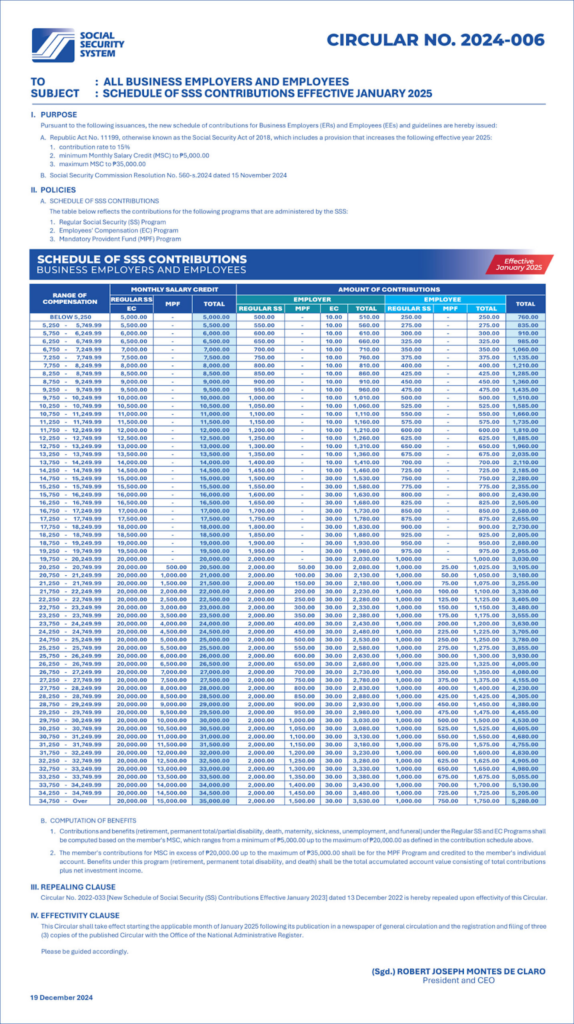

Employer (ER) and Employee (EE)

Employers and employees are mandatorily covered by the SSS. The 2025 SSS Contribution Table updates employers’ share is 10% and employees’ contribution is 5% of the total contribution.

Employers must remit the full contribution by the last day of the month following the applicable period. Employers are responsible for processing the contribution payment monthly.

For example, if an employee’s SSS contribution for March 2025 is due, the employer must remit the total contribution (including both employer and employee shares) by April 30, 2025.

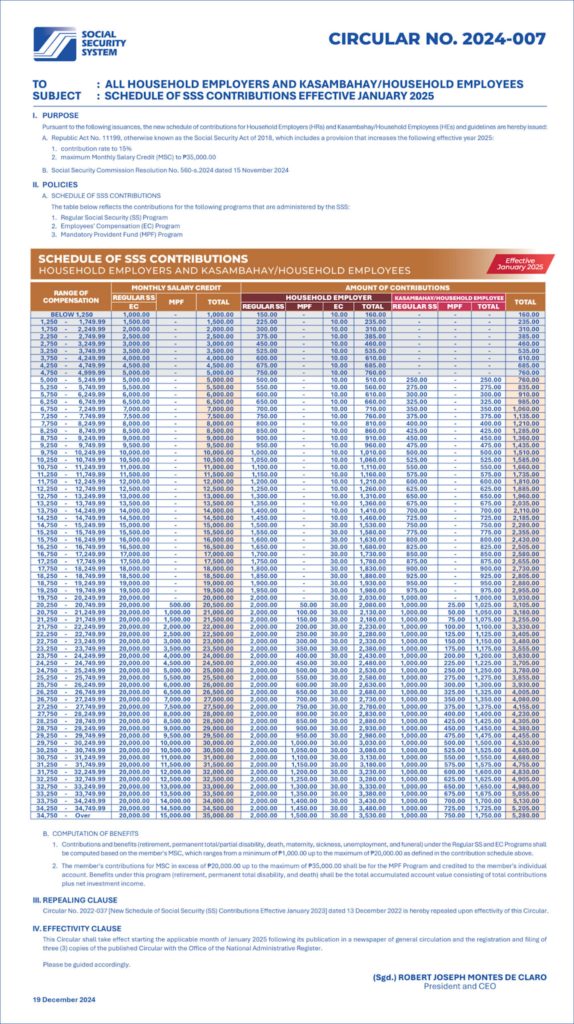

Household Employer (HR) and Household Employee (HE)

Household employers and household employees (kasambahays) are also under the compulsory coverage of SSS.

They follow the same SSS contribution rates as regular employers and employees, with slight differences, particularly in the payment schedule.

Household employers have the option to remit contributions either monthly or quarterly, with the latter being the more common choice. For example, if a household employer chooses the quarterly option, contributions for January to March must be paid on or before April 30.

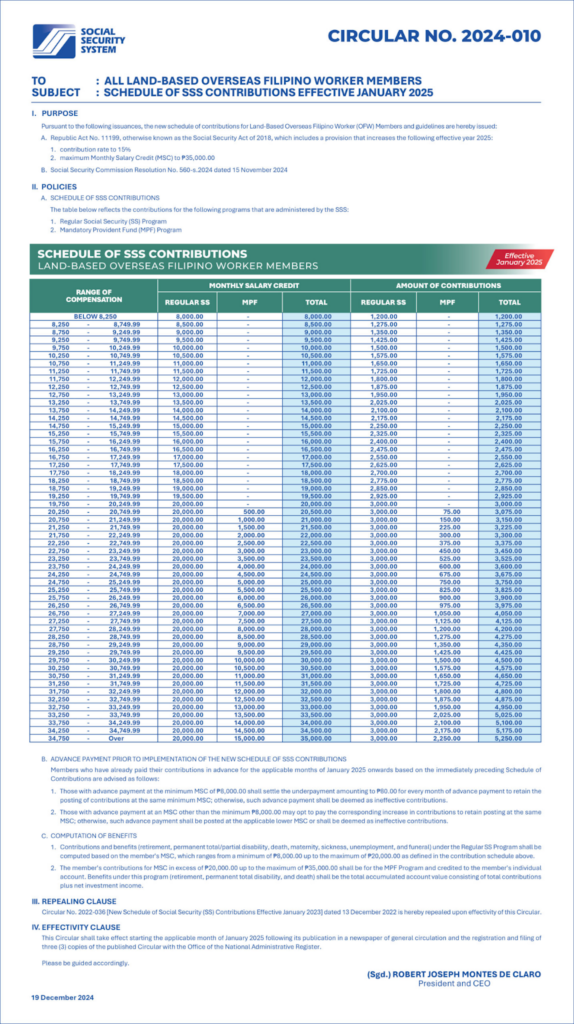

Land-based OFW Member

Overseas Filipino Workers (OFWs) are under the compulsory coverage of SSS.

For Land-based OFWs, the monthly salary credit is based on the monthly earnings declared by the member at the time of the registration unless they make another declaration of their monthly earnings. Land-based OFWs are required to pay 15%, unlike sea-based OFWs whose share is divided with their employers.

The deadline for payment of contribution are as follows:

| APPLICABLE MONTHS | DEADLINE |

| January – September | December 31 of the same year |

| October – December | January 31 of the following year |

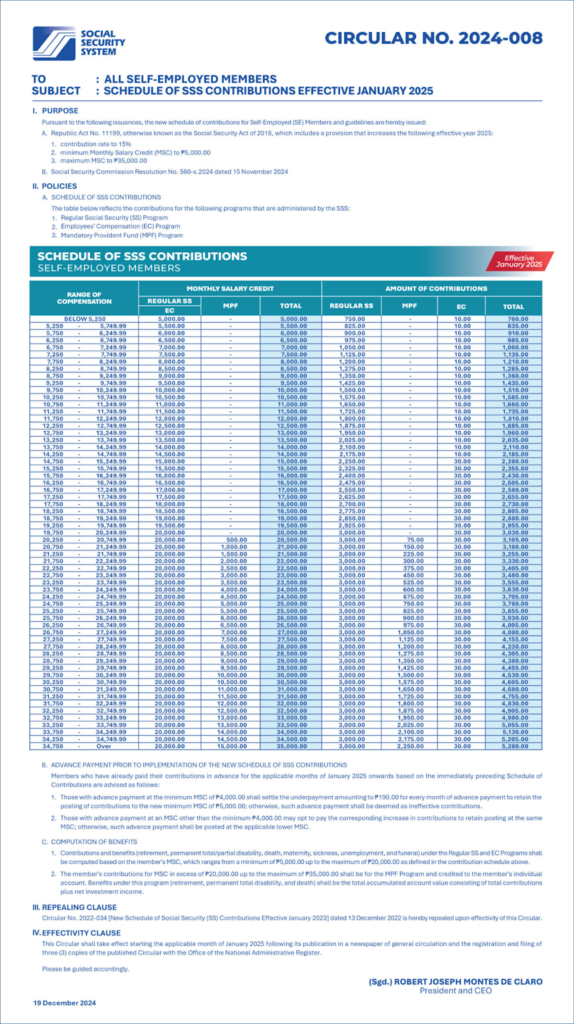

Self-employed Member

Similar to household employers, self-employed SSS members can choose to pay their contributions either monthly or quarterly. Their declared monthly earnings determine the Monthly Salary Credit (MSC), which is subject to a 15% contribution rate as updated in the SSS Contribution 2025.

Self-employed members must settle their payments on or before the last day of the month following the applicable period.

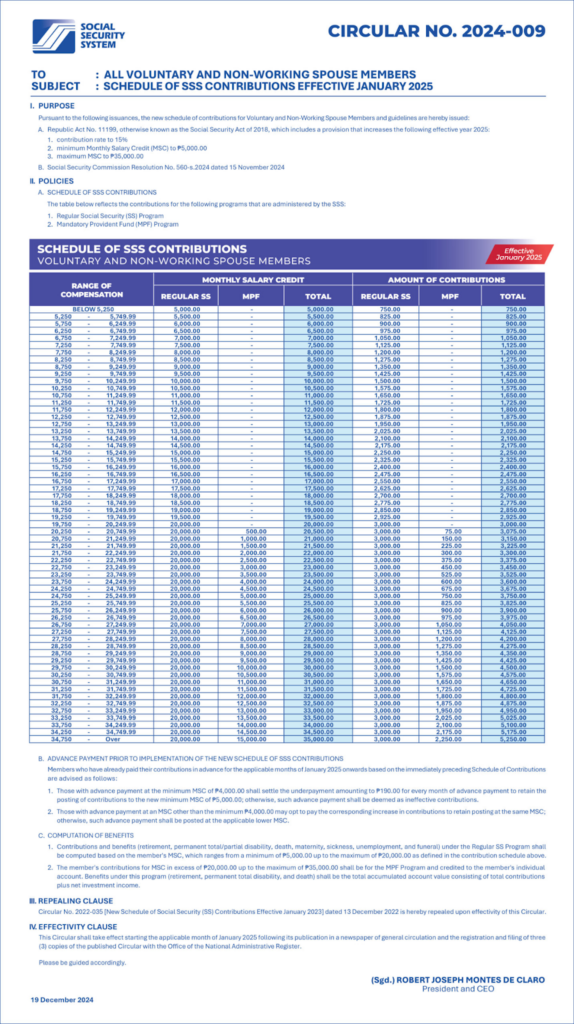

Voluntary Member and Non-working Spouse

Voluntary members and non-working spouses fall under the voluntary coverage of SSS.

Like members under compulsory coverage, they contribute at the same rate of 15%. However, their Monthly Salary Credit (MSC) is determined differently.

For voluntary members, the MSC is based on their declared monthly income at the time of registration. For non-working spouses, it is set at 50% of their working spouse’s MSC.

Members under voluntary coverage can choose to pay their contributions either monthly or quarterly. Payments must be made on or before the last day of the month following the applicable period.

How to Compute Your SSS Contribution

Step 1: Determine Your Monthly Salary Credit (MSC)

Identify the salary range that applies to you within the MSC brackets.

Step 2: Calculate the Total Contribution

Multiply the MSC by 15% to get the total contribution.

Step 3: Split the Contribution

For employed members, the employer pays 10% and the employee pays 5%. For self-employed and OFWs, they pay the full 15%.

Sample Calculation

Scenario 1: Maria is a self-employed freelance writer who earns around Php 25,000 monthly, and she wants to compute her SSS contribution for January 2025. How much is her contribution?

Here are the steps:

Step 1: Determine the Monthly Salary Credit (MSC)

Maria’s monthly salary credit is Php 25,000.

Step 2: Calculate the Total Contribution

The formula to find the total contribution is:

Total Contribution = MSC x 15% or 0.15

If Maria’s MSC is Php 25,000, then:

Total Contribution = Php 25,000 x 0.15

= Php 3,750

Step 3: Split the Contribution

Since Maria is self-employed, she pays the full 15% or Php 3,750.

Also Read: How to Apply for SSS Membership: A Beginner’s Step-by-Step Guide

Scenario 2: Juan, an employed office worker, earns ₱18,000 monthly. His employer deducts his SSS contribution. How much is Juan’s share of the contribution? How much is his employers’ share?

Here are the steps:

Step 1: Determine the Monthly Salary Credit (MSC)

Juan’s monthly salary credit is Php 18,000.

Step 2: Calculate the Total Contribution

The formula to find the total contribution is:

Total Contribution = MSC x 15% or 0.15

If Juan’s MSC is Php 18,000, then:

Total Contribution = Php 18,000 x 0.15

= Php 2,700

Step 3: Split the Contribution

Since Juan is an employed office worker, he contributes 5% of the Total Contribution while his employer contributes 10%.

Employer Share: Php 18,000 x 0.10 = Php 1,800

Employee Share: Php 18,000 x 0.05 = Php 900

Total Contribution = Php 2,700

Reminders

Stay Updated on Contribution Rates and Monthly Salary Credit (MSC) Adjustments:

Check the SSS contribution table annually for you to stay informed and updated on contribution rates. This ensures your payroll systems reflect these changes to avoid discrepancies.

Refer to Official Sources

Staying informed is important, but it’s also important to verify that the information comes from official sources. To ensure the 2025 SSS Contribution Table is from the legit source, check out the official website.

Compliance for Employers and Employees, Household Employers and Kasambahay

Employers have the responsibility to deduct the employee’s share and remit the total contribution by the last day of the month. Non-compliance results to penalties.

On the other hand, household employers have similar responsibility with employers but can opt to make payments monthly or quarterly.

Self-Employed and Voluntary Members

Self-employed and voluntary members pay the full total contribution. Payment can be made monthly or quarterly, depending on preference.

Land-based OFWs

OFWs are required to pay the full contribution. Payments can be made monthly, quarterly, or annually to maintain active membership.

Non-Working Spouses

Contributions for non-working spouses are based on 50% of the working spouse’s MSC. Ensure accurate computation to avoid underpayment.

Monitor Payment Deadlines

Late payments may result in penalties or inactive membership status. Set reminders to ensure timely remittance of contributions.

Conclusion

Staying updated with the latest SSS contribution table is essential for ensuring compliance and maximizing benefits. The updated contribution rate reflects a commitment to enhancing the system’s long-term viability and improving benefits for members.

For official updates and detailed contribution tables, members can visit the SSS website or contact their local SSS office.

Keep Reading: How to Pay and Check Your SSS Contributions: A Step-by-Step Guide

Leave a Reply