As of January 2025, the Philippine Health Insurance Corporation (PhilHealth) has maintained its premium contribution rate at 5.0% of an employee’s monthly basic salary.

This rate applies to all Direct Contributors, including employees, employers, self-employed individuals, and Overseas Filipino Workers (OFWs).

The income floor is set at ₱10,000, while the income ceiling is ₱100,000.

Also Read: How PhilHealth Works: A Guide for Fresh Graduates and First-Time Employees

Table of contents

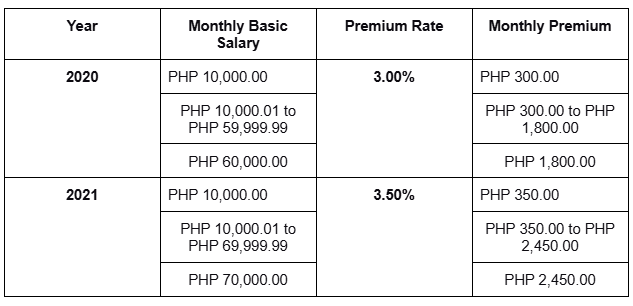

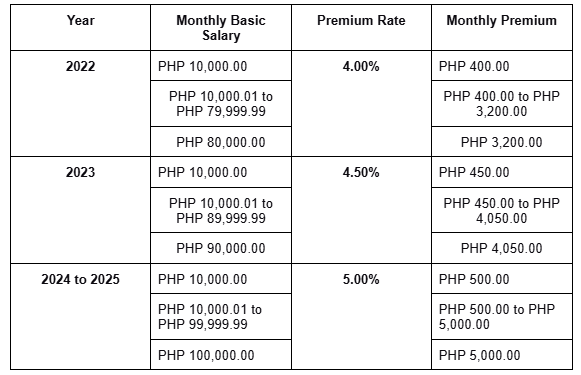

PhilHealth Contribution Breakdown (2020–2025)

To help members track the progressive increase in PhilHealth contributions, here’s a detailed breakdown of how much is the PhilHealth contribution from 2020 to 2025, highlighting the annual changes in rates and premium amounts:

Also Read: SSS CONTRIBUTION TABLE 2024 MONTHLY

How to Compute Your PhilHealth Contribution in 2025

To calculate your monthly contribution, follow this formula:

Monthly Salary X 5% = Total Monthly Premium

For employed individuals, the coset is equally shared between the employer and employee:

Total monthly Premium 2=Employee Share = Employer Share

Here’s the sample computations:

Example 1: Employee earning ₱12,000 per month

- Total Contribution: 12,000 × 5% = ₱600

- Employee Share: ₱300

- Employer Share: ₱300

Example 2: Employee earning ₱25,000 per month

- Total Contribution: 25,000 × 5% = ₱1,250

- Employee Share: ₱625

- Employer Share: ₱625

Example 3: Employee earning ₱110,000 per month (above ceiling)

- Total Contribution (capped at ₱100,000): 100,000 × 5% = ₱5,000

- Employee Share: ₱2,500

- Employer Share: ₱2,500

Here’s a step-by-step guide on how you can register.

How Much is the PhilHealth Contribution for Voluntary and Unemployed Members?

For Self-Employed and Voluntary Members, the PhilHealth contribution is fully shouldered by the member and must be paid monthly, quarterly, or annually.

To know how much is PhilHealth contribution for voluntary members, here’s a breakdown:

- Minimum Contribution: ₱500 per month (based on the ₱10,000 income floor)

- Maximum Contribution: ₱5,000 per month (for incomes at ₱100,000 and above)

For those wondering how much is PhilHealth contribution for unemployed individuals, the rates are the same as those for voluntary members.

What are the benefits of being a PhilHealth Member?

The benefits for PhilHealth Members and their dependents are the following:

In-patient hospital care and Out-patient care, specifically:

- Room and Board (for In-patients)

- Health Care Professional Services

- Laboratory, Diagnostic, and Other Medical Fees

- Usage of Medical or Surgical Equipment and Facilities

- Personal Preventive Services (for outpatients)

- Prescription Drugs and Biologicals

- Health Education and Seminar Packages

- Emergency and Transfer Services

- Other healthcare services that the corporation determines to be appropriate and cost-effective.

Also Read: GUIDE: PhilHealth Hospitalization Coverage and Benefits

Z Benefit Packages

As part of its mandate, PhilHealth also has a financial security program that helps outpatients with specific medical conditions. These medical conditions are animal bites, malaria, tuberculosis, HIV-AIDS, and Voluntary Surgical Contraception.

Malaria Z Benefit

Malaria outpatients will receive a Php 600 benefit, including diagnostic malaria smears, laboratory procedures, drugs and medicine, and consultation services. Members who have been diagnosed with malaria will be able to claim this benefit.

Voluntary Surgical Contraception Z Benefit

Members who wish to do voluntary surgical contraception will have a Php 4,000 benefit covering the surgery’s medical expenses and family planning.

Animal Bite Z Benefit

Animal bite outpatients will receive a Php 3,000 treatment package with rabies vaccines, rabies immune globulin, local wound care, anti-tetanus, and antibiotics. In addition, the package will cover the medical costs for rabies exposure, animal bites, and post-exposure prophylaxis.

Tuberculosis Z Benefit

For members diagnosed with Tuberculosis, PhilHealth will give a benefits package of Php 4,000 for their diagnostic exams, consultation, medicine, and counseling.

HIV-AIDS Z Benefit

Members diagnosed with HIV-AIDS will receive Php 30,000 annually for their medical expenses related to HIV-AIDS.

Important Reminders

- Late Payment Penalties: Failure to pay PhilHealth contributions on time may result in penalties and possible gaps in coverage. Ensure that payments are made before the deadlines to maintain uninterrupted access to PhilHealth benefits.

- Retain Proof of Payment: Always keep official receipts or electronic transaction records as proof of contribution payments for future reference.

- Claim Eligibility: Ensure that you have met the minimum contribution requirements before hospitalization to qualify for benefits.

Final Thoughts

Now that you understand the 5% PhilHealth contribution rate for 2025, it’s important to stay on top of your payments to keep your healthcare benefits active.

Missing deadlines can lead to penalties and lapses in coverage, so make sure to pay on time and check your contribution status regularly.

Taking charge of your PhilHealth contributions not only secures your access to medical benefits but also ensures peace of mind in case of unexpected healthcare expenses.

Whether you’re employed, self-employed, or voluntarily contributing, staying informed about your responsibilities is key.

Don’t wait until you need it—stay updated, pay on time, and make the most of your PhilHealth coverage today!

PhilHealth Contribution Table and Computation: FAQs

Yes, PhilHealth contributions have increased over time as shown in the table above. The premium rate has gradually increased from 3.0% in 2020 to 5.0% in 2025. Future adjustments will depend on government policies and healthcare funding needs.

PhilHealth covers up to 100% of your hospital bill, depending on your illness and the type of healthcare facility. Coverage varies based on the case rate system, which assigns a fixed amount per illness or procedure. For minor cases, PhilHealth may cover a portion, while for major illnesses, coverage can be higher. Always check with your hospital to know how much PhilHealth will shoulder for your treatment.

Yes, Overseas Filipino Workers (OFWs) are classified as Direct Contributors and are required to continue their PhilHealth contributions. They can pay through PhilHealth-accredited collection partners, including banks and remittance centers.

Keep Reading: PhilHealth Membership Registration: How to Get Your PhilHealth ID Number

Leave a Reply