Estimated reading time: 5 minutes

Pag-IBIG has officially announced that it has garnered the endorsement of the Federation of Free Workers (FFW), a prominent labor organization, for the initiative to raise mandatory monthly savings. Commencing this month, January, Pag-IBIG will begin the phased implementation of the deferred increase in its members’ contributions.

Recent changes have occurred within the Pag-IBIG Contribution of 2024 in implementing the latest changes.

Table of contents

Exploring The Latest Change In Pag-IBIG Contribution In 2024

In recent updates, the Pag-IBIG Fund has finally gained the green light to implement the deferred increase in members’ contributions. What’s more, these updates were originally planned for 2023. However, Pag-IBIG released that the hike was continually deferred in recognition of the continuing effects of the pandemic. Hence, the long-awaited updates have now been implemented.

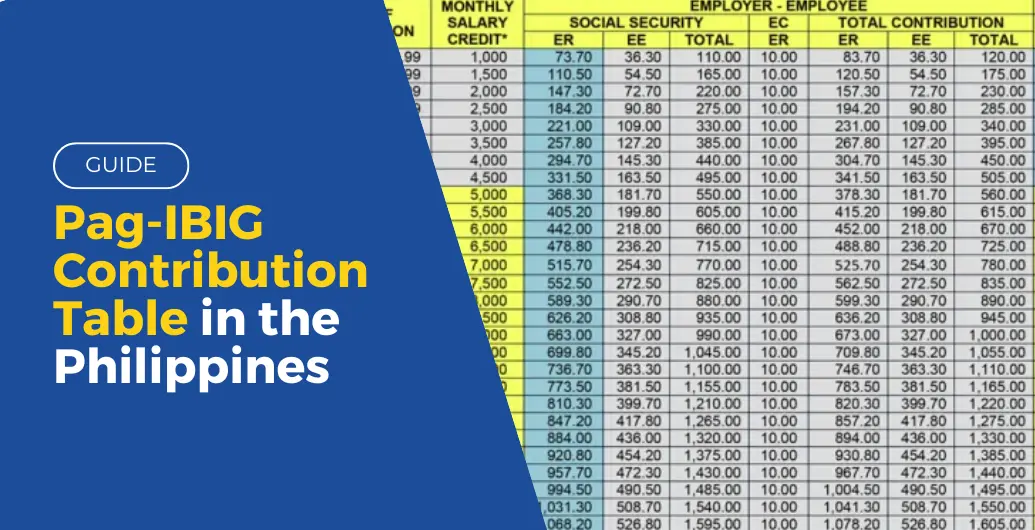

PAG-IBIG Contribution Table Lists

The following table displays the latest Pag-IBIG contributions for individuals under the company. The displayed table is for the employees and employers to share for this particular benefit.

Pag-IBIG Contribution Table for Employees and Employers

| Monthly Salary | Employer’s Contribution Rate | Employee’s Contribution Rate | Total |

| ₱1,000 to ₱1,500 | 2% | 1% | 3% |

| ₱1,500 and Above | 2% | 2% | 4% |

The employer’s share, at 2%, remains constant throughout the year, respective to the employee’s salary. In addition, these contributions are deducted directly from the employee’s salary and are allocated to support diverse programs offered by the Pag-IBIG Fund.

Additionally, the maximum monthly salary to complete the employee contributions remains at PHP 5,000 this year. However, the maximum contributions for both employee and employer will change from PHP 100 to PHP 200.

How to Compute Your Pag-IBIG Contribution

You can calculate your monthly contributions through the following formula: Monthly Salary x Employee or Employer Share.

For example, if an employee earns PHP6,000 per month, the formula will be 6,000 x 0.02 = 120, and you and your employer will contribute PHP 120 each.

Pag-IBIG Contribution Table for Self-Employed Members

| Monthly Income | Contribution Rate |

| At least ₱1,000 to ₱1,500 | 1% |

| ₱ 1,500 to ₱ 4,999 | 2% |

| ₱ 5000 and above | 3% |

The Pag-Ibig Contribution Table of 2024 has been recently updated. For members who are self-employed or voluntary in positions:

- If the monthly income ranges from at least PHP 1,000 up to exactly PHP 1,500, the contribution rate is set by 1%.

- If the monthly incomes range from more than PHP 1,500 up to exactly PHP 4,999.99, the member contribution rate is up to 2%.

- Lastly, if the monthly income is PHP 5,000 and above, the contribution rate is up to 3%.

Pag-IBIG Contribution Table for Overseas Filipino Workers

| Monthly Salary | Employment Status | Country | Contribution Rate |

| ₱1,500 and above | Land-based | All countries | 2% of the basic salary |

| ₱1,500 and above | Sea-based | All countries | 2% of the basic salary |

Overseas Filipino workers (OFWs) who are not covered under the mandatory Pag-IBIG contributions must pay 2% of their monthly income to Pag-IBIG. This detail is specified under HDMF Circular No. 391. OFWs may also choose to pay the employer’s 2% contribution.

The maximum amount of the monthly salary for OFW’s monthly contribution is up to PHP 5,000.

Pag-IBIG Contribution Table for a Non-Working Spouse

| Half of the Spouse’s Monthly Salary | Contribution Rate |

| ₱1,500 and below | 1% |

| Over ₱1,500 | 2% |

The Pag-IBIG Contribution Table 2024 for Non-Working Spouses remains the same for this year. For working spouses’ contributions, the rate is up to 1% for monthly compensation of PHP 1,500 or less.

For compensations up to more than PHP 1,500, the rate is up to 2%. Non-working spouses can contribute up to 50% of the working spouse’s contribution rate.

Pag-IBIG Contribution Table for Kasambahays

| Monthly Salary | Employer’s Contribution Rate | Kasambahay’s Contribution Rate | Total |

| ₱1,500 and below | 3% | 0% | 3% |

| ₱1,500 to ₱4.999 | 4% | 0% | 4% |

| ₱5000 and above | 2% | 2% | 4% |

The Pag-IBIG Contribution Table in 2024 for Kasambahay’s position, the Pag-Ibig contributions still require the employer to contribute on the member’s behalf. The requirements are as follows:

- If the monthly salary is PHP 1,500 or below, the employer must pay 3% of the total monthly salary on the member’s behalf.

- If the monthly salary is over PHP 1,500 but no more than PHP 4,999, the employer is responsible for paying 4% as a Pag-IBIG contribution on the member’s behalf.

- If the monthly salary is up to PHP 5,000 and above, the employer is responsible for paying 2% as a Pag-IBIG contribution on the member’s behalf.

Some Tips For Your Pag-IBIG Contributions

Here are some important tips you can use in making the most out of your Pag-IBIG contributions and benefits:

- Make contributions consistently in taking advantage of the saving and loan programs;

- While there are minimum contribution requirements, you can choose to contribute more if it is affordable;

- Take advantage of the employer matching and

- Keep track of your contribution and explore other programs and services that are offered.

Frequently Asked Questions

Here are some common questions citizens ask regarding the Pag-IBIG Contribution of 2024:

How much should I contribute to Pag-IBIG?

Your contribution amount is based on the percentage of your monthly salary. For regular employees and employers, both of their current contribution state is 1%, making a total of 2% of the employee’s salary. Self-employed individuals or voluntary contributors are 2% of the declared monthly income.

Can I withdraw my Pag-IBIG contribution after 4 years?

You can claim your contributions at the end of 5, 10, 15, or 20 years, depending on your selected option during your membership registration.

What will happen if I stop paying my Pag-IBIG contribution?

Self-employed members must pay their Pag-IBIG contribution directly to the HDMF. Failure to remit contributions will subject the employer to a 3% penalty per month.

Keep reading: Everything You Need to Know About CSC Careers in the Philippines

Leave a Reply