If you’re starting a business in the Philippines, one of the most important steps to take is obtaining a BIR permit. The Bureau of Internal Revenue (BIR) issues permits to businesses to ensure that they comply with tax regulations and operate legally. If you’re not sure how to get a BIR permit, this guide will take you through the steps to get a BIR permit for your business.

What is a BIR permit?

A BIR permit refers to a permit issued by the Bureau of Internal Revenue (BIR) in the Philippines. The BIR is the government agency responsible for collecting taxes and enforcing tax laws in the country.

A BIR permit is necessary for businesses to operate legally in the Philippines. There are different types of BIR permits depending on the nature of the business and its tax obligations.

These permits include:

- Certificate of Registration (COR) – This is the primary permit issued by the BIR to businesses and individuals engaged in trade or business in the Philippines.

- Taxpayer Identification Number (TIN) – This is a unique identification number assigned by the BIR to taxpayers for tax purposes.

- Authority to Print (ATP) – This permit is required for businesses that issue official receipts, invoices, or other similar documents to their customers.

- Book of Accounts – This permit is required for businesses to maintain proper accounting records and books of accounts.

- Tax Clearance – This is a certificate issued by the BIR indicating that a taxpayer has settled all tax liabilities and obligations.

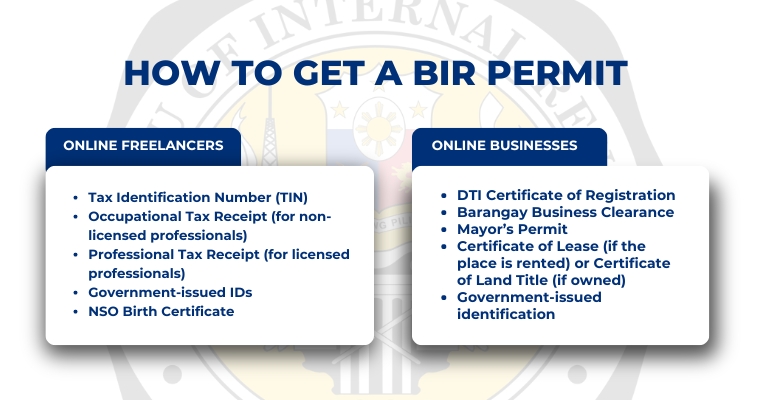

BIR Permit Requirements

For online businesses such as online shops (single proprietor):

- DTI Certificate of Registration

- Barangay Business Clearance

- Mayor’s Permit

- Certificate of Lease (if the place is rented) or Certificate of Land Title (if owned)

- Government-issued identification (Passport, Driver’s License, Birth Certificate, etc.

For online freelancers:

- Tax Identification Number (TIN)

- Occupational Tax Receipt (for non-licensed professionals)

- Professional Tax Receipt (for licensed professionals)

- Government-issued IDs

- NSO Birth Certificate

How to obtain an Application Form

If you’re looking to obtain an application form from the Bureau of Internal Revenue (BIR) in the Philippines, there are a few ways you can do so:

Download the form from the BIR website: You can visit the BIR website at www.bir.gov.ph and search for the form you need. Once you find it, you can download and print it out.

Visit a BIR office: You can also visit a BIR office in person and request for an application form. The staff will provide you with the necessary form that you need to fill out.

Request a form via mail or email: If you’re unable to visit a BIR office, you can also request for a form via mail or email. You can email the BIR at contact_us@bir.gov.ph or send a letter to their office requesting for the necessary form. Make sure to include your contact details so that they can get back to you.

Where to Submit the BIR Application

You can submit your application at any BIR Revenue District Office (RDO) that has jurisdiction over your tax filing. The BIR has multiple RDOs located throughout the Philippines, and you can find the RDO that covers your area by checking the BIR website or by contacting their hotline.

Proceed to the Revenue District Office where you are registered and present the duly accomplished BIR Form 1704, together with the required attachments. Receive your copy of the duly stamped and validated form from the RDO representative.

Alternatively, you may also submit your BIR application online through the BIR’s Electronic Filing and Payment System (eFPS) or through the BIR’s Online eRegistration System (OeRS) if the application is for registration.

Wait for the release of the BIR permit

After completing all the requirements, you’ll need to wait for the BIR permit to be released. Processing time may vary depending on the volume of applications received. Once your permit is ready, you can claim it from the BIR office where you submitted your application.

For Online Applicants

Prepare all the required documentary requirements in scanned PDF copy not exceeding 4MB total file size of all attachments per email.

Click the following link to view complete documentary requirements:

- For Sole Proprietors, Professionals, Mixed Income Earners

- For Corporations, Partnerships

- For Cooperatives, Associations and other Non-individuals

- For Branch

Determine filing and payment obligations.

Download and answer the tax type questionnaire to determine your applicable tax liabilities. Then, scan the accomplished tax type questionnaire and include it as attachment to your email application.

Pay for the registration fee

Via the ePayment Channels of the BIR, a taxpayer-applicant who already has a Taxpayer Identification Number (TIN) can pay the P500.00 Registration Fee and the P30.00 loose DST online via ePayment Channels.

While picking up the Certificate of Registration, the Taxpayer-Applicant who lacks an existing TIN must wait for an email with instructions on when to pay the P500.00 Registration Fee and P30.00 loose DST at the New Business Registrant Counter at the Revenue District Office (RDO).

Where to Submit the Application

- Go to the BIR website and access the Newbizreg portal.

- Select the applicable registration form and fill out the required fields.

- Attach the required supporting documents.

- Click the submit button ‘Email your Application’ to submit your application.

- Receive an email for the scheduled pick-up of Certificate of Registration and buying of BIR Printed Receipts/Invoices or Authority to Print, if applicable.

Tips to Remember

Obtaining a BIR permit in the Philippines can be a complex process that requires careful preparation and attention to detail. It is crucial to take the time to determine the correct type of permit you need and to prepare all the necessary documents accurately to avoid delays or rejection of your application.

Additionally, submitting your application to the correct BIR office or online platform and paying the necessary fees on time will help ensure a smoother application process.

Lastly, following up on your application and providing any additional information or documents requested by the BIR can also help speed up the processing time. – WhatALife!/Jayve

Leave a Reply