Estimated reading time: 6 minutes

The Bureau of Internal Revenue (BIR) requires individuals and businesses to register for taxation purposes. This registration ensures that businesses and individuals comply with Philippine tax laws and regulations. So, if you are starting a business or earning income in the Philippines, here’s what you need to know about BIR registration, such as the application and more.

What is BIR Registration?

BIR registration is the process of registering with the Bureau of Internal Revenue (BIR) for taxation purposes. It is an essential requirement for businesses and individuals earning income in the Philippines.

Additionally, it is a requirement for businesses and individuals in the Philippines to comply with tax laws and regulations and to obtain permits and licenses. It provides access to government services and benefits and is crucial for achieving financial stability and growth. Failure to register can result in penalties, fines, and legal issues.

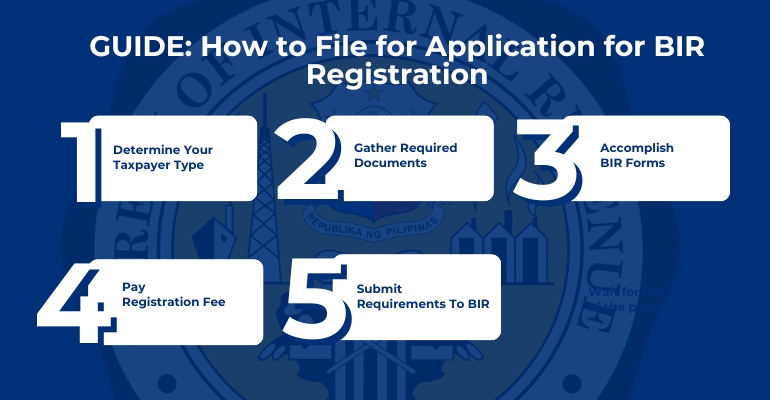

BIR Registration – The Process

Determine Your Taxpayer Type

Before starting the registration process, it is essential to determine your taxpayer type. The taxpayer type determines the requirements and documents needed for registration. The types of taxpayers are as follows:

- Self-employed

- Professionals

- Mixed-Income

- Employees (aka Purely Compensation Earner)

- Under EO 98

Gather Required Documents: Essential Steps for BIR Registration

The following documents must be submitted with your completed application form:

Companies:

- Original & copy of the Certificate of Incorporation / Registration

- Name & File Numbers of Directors

- Original & Copy of Notice of Directors

- Original and Copy of Notice of Addresses

- Outstanding returns (if applicable)

Self-Employed Individuals and Sole Traders:

- Original & copy of Certificate of Registration (if applicable)

- Original and copy of national identification (ID card, passport or driver’s permit)

- Outstanding returns (if applicable)

Individual Employees:

- Original and copy of national identification (ID card, passport, or driver’s permit)

- Letter from employer indicating the effective date of employment and salary, or TD4 Certificate (this is issued by your employer) for prior years

- Outstanding returns (if applicable)

Partnerships:

- Name and addresses of each partner

- Evidence of BIR numbers for each partner – Original and Copy of Certificate of Registration and/or Partnership agreement

- Outstanding returns (if applicable)

Accomplish BIR Forms: A Step-by-Step Guide for BIR Registration

Different Types of BIR Forms

- Account Information Forms

- Application Forms

- Certificates

- Documentary Stamp Tax Return

- Excise Tax Return

- Income Tax Return

- Legal Forms

- Other Forms

- Payment/Remittance Forms

- Transfer Tax Return

- VAT/Percentage Tax Returns

Tips for filling out the forms accurately

Here are some tips for filling out BIR registration forms accurately:

Double-check all information

Make sure that all information provided is accurate and up-to-date. Any mistake in the registration process can lead to delays, fines, or legal issues.

Use the correct tax code

Ensure that the correct tax code is used for the type of business or activity being registered. Using the wrong code can result in incorrect tax calculations and penalties.

Fill out all required fields

All required fields in the forms should be filled out completely. Leaving a field blank may result in delays or rejection of the application.

Be consistent with information

The information provided in the forms should be consistent with other documents, such as business permits, licenses, and other registration documents.

Seek professional advice

If unsure about any aspect of the registration process or the forms, seek the advice of a tax professional or a BIR representative. This can help ensure that the forms are filled out accurately and in compliance with tax laws and regulations.

How do I pay my BIR registration fee?

The amount of the registration fee depends on the taxpayer type and registered activity. The registration fee can be paid through banks, accredited payment centers, and other authorized payment channels. Some banks offer online payment options for added convenience.

When making the payment, it is important to bring the completed registration form and necessary supporting documents. Necessary supporting documents may include proof of identity, residence, and income, among others. By ensuring that all necessary documents are provided, and the fee is paid on time, individuals and businesses can complete the BIR registration process smoothly and efficiently.

Methods of Payment

Here are some methods of payment for the BIR registration fee:

Over-the-counter (OTC) Payment

This can be made at authorized banks and other accredited payment centers. Payment can be in cash or check, depending on the bank’s policy.

Online Payment

Some banks offer online payment options for added convenience. Taxpayers can access the bank’s website or mobile app and follow the instructions to complete the payment process.

Electronic Payment

This can be made through the Electronic Filing and Payment System (EFPS). This web-based system allows taxpayers to file and pay taxes online. To use the EFPS, taxpayers must enroll in the system and have a valid Taxpayer Identification Number (TIN).

Submit Requirements to BIR

The requirements for submission may vary depending on the specific type of document you need to submit. However, some general requirements that may apply include:

Accomplished form or document

Make sure that you have properly filled out and completed the form or document that you need to submit. Ensure that all necessary fields are filled out correctly and completely.

Supporting documents

Prepare any supporting documents that are required for your submission. These may include receipts, invoices, financial statements, contracts, and other relevant documents.

Identification documents

You may need to provide a valid ID card or any government-issued identification document to verify your identity.

Payment of fees

Some submissions may require payment of fees or taxes. Make sure that you have enough funds to cover the fees or taxes and that you have paid them before submitting your documents.

Submission deadline

Be aware of the deadline for submission of your documents. Late submissions may result in penalties or other consequences.

Tips to Remember

To ensure a smooth and hassle-free registration process, it is important to follow the steps outlined in this guide:

- Determine the type of registration you need based on your business or individual status.

- Prepare all the required documents and supporting documents.

- Submit your application and supporting documents to the appropriate BIR office.

- Wait for the BIR to process your application and follow up as necessary.

- Once your registration is approved, make sure to comply with all the tax obligations and requirements.

Remember, failure to register with the BIR can result in penalties, fines, and legal consequences. By following these steps and seeking professional advice when needed, you can ensure that your registration process is successful and your business or individual tax obligations are met. – WhatALife!/Jayve

Leave a Reply