The rise of digital content creation as a lucrative profession, the Bureau of Internal Revenue (BIR) in the Philippines is reminding content creators that their earnings—whether from ad revenue, brand deals, or even free products—are subject to taxation.

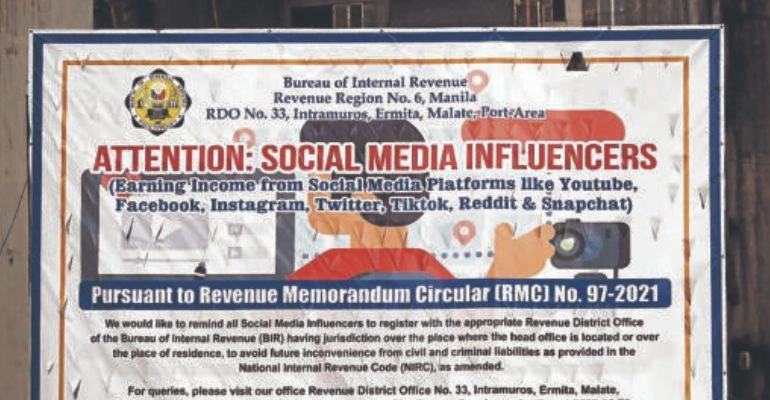

In 2021, the BIR issued Revenue Memorandum Circular No. 97-2021, explicitly stating that social media influencers must pay income tax and business tax, depending on their revenue.

This comes as the digital economy continues to boom, with many individuals generating significant income through platforms like YouTube, Facebook, Instagram, and TikTok.

Who Are Considered Social Media Influencers?

BIR defines social media influencers as self-employed individuals or those in trade or business who monetize their digital posts.

This includes creators earning through platforms such as YouTube, Facebook, Instagram, and TikTok.

As the digital economy continues to expand, the agency has emphasized the importance of proper tax compliance for individuals generating substantial income online.

Social Media Influencer Tax Deductions

To support influencers in properly reporting their income, the BIR allows tax deductions for business-related expenses. Eligible deductions include:

- Equipment costs (cameras, computers, lighting)

- Software subscriptions and editing tools

- Internet services and mobile data plans

- Payments to freelancers for video editing, marketing, or other professional services

To claim these deductions, content creators must maintain accurate records and secure official receipts or invoices as proof of expenses.

To improve compliance, the BIR has warned that it will issue Letters of Authority (LOA) to investigate influencers suspected of underreporting income.

Those found guilty of tax evasion could face penalties and legal action.

Adhering to tax regulations, content creators not only fulfill their legal obligations but also contribute to national economic growth.

If an influencer doesn’t pay their taxes, the BIR can investigate their earnings. They may receive a notice asking them to explain their income and tax payments. If they ignore this or are found guilty of not paying the correct taxes, they could face fines or even legal charges. In serious cases, tax evasion could lead to lawsuits and big penalties.

The BIR checks influencers’ income by looking at their online earnings from platforms like YouTube, Facebook, and TikTok. They can track financial transactions, sponsorships, and brand deals. If they suspect someone is not reporting their income correctly, they can issue a Letter of Authority (LOA) to review their records. This means the BIR has the right to investigate an influencer’s earnings and expenses to ensure they are paying the correct taxes.

Taxable income includes ad revenue (e.g., YouTube AdSense), brand sponsorships, affiliate marketing commissions, product sales, and even free products received in exchange for promotions.

Keep Reading: GUIDE: Real Property Tax (RPT) in the Philippines

Leave a Reply